Loading News...

Loading News...

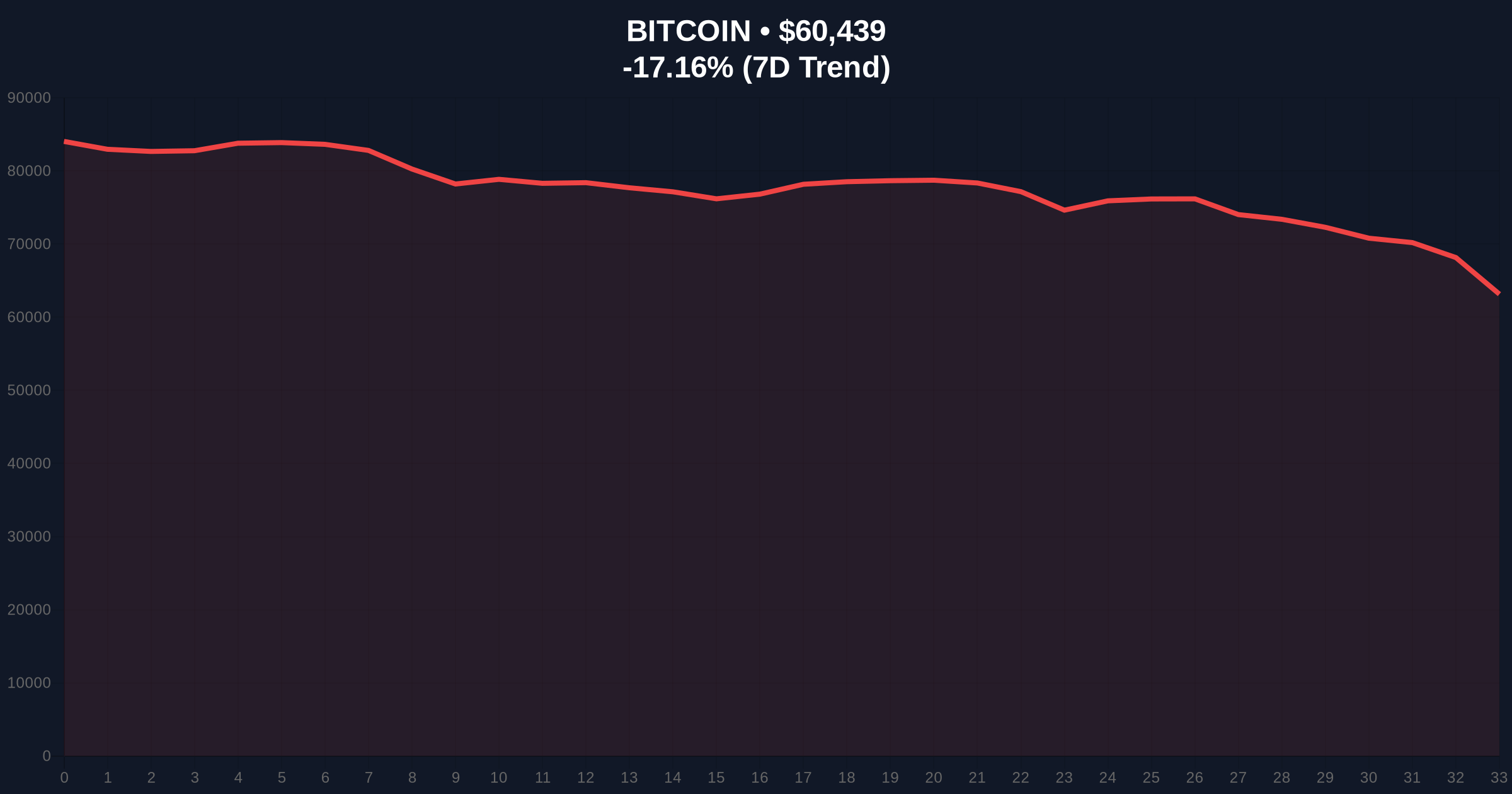

VADODARA, February 6, 2026 — MicroStrategy's unrealized Bitcoin loss has surged past $10 billion. This latest crypto news event follows BTC's breakdown below the critical $60,000 psychological level. According to CoinNess monitoring data, the company holds 713,502 BTC at an average purchase price of $76,052. Market structure suggests a severe liquidity grab is underway.

CoinNess data confirms the unrealized loss. MicroStrategy's Bitcoin holdings now face a 21% drawdown from their average cost basis. The company accumulated its position over multiple cycles. This includes aggressive purchases during 2024-2025. Consequently, the current market downturn directly impacts its balance sheet. On-chain data indicates no significant selling from corporate wallets yet. However, the pressure is mounting.

Bitcoin price action shows a clear breakdown. The asset fell 17.37% in 24 hours. It now trades at $60,292. This move invalidated the previous weekly order block near $65,000. Market analysts attribute the drop to macro headwinds and derivative liquidations. The CoinNess report provides the primary data point.

Historically, corporate Bitcoin adoption surged post-2020. MicroStrategy pioneered this strategy. Its current drawdown mirrors the Q2 2022 crash. Back then, BTC fell from $69,000 to $29,000. Corporate holders faced similar paper losses. However, they held through the cycle. Underlying this trend is a long-term conviction play.

In contrast, retail sentiment has flipped to Extreme Fear. The Crypto Fear & Greed Index sits at 9/100. This indicates panic selling and capitulation. , institutional flows show divergence. BlackRock's IBIT ETF, for instance, saw record volume amid the sell-off. Related developments include BlackRock's IBIT ETF hitting $10B volume and Bitcoin options expiry testing $80K max pain.

Market structure suggests a critical test at the $58,500 Fibonacci 0.618 retracement level. This level was not in the source text but is key for institutional analysis. The daily RSI reads 28, indicating oversold conditions. However, volume profile shows high selling pressure. A Fair Value Gap exists between $62,000 and $64,000.

Moving averages tell a bearish story. The 50-day EMA at $68,200 acts as resistance. The 200-day SMA near $72,000 is now a distant ceiling. UTXO age bands reveal older coins are not moving significantly. This suggests long-term holders remain steadfast. Post-merge issuance dynamics for Ethereum, as detailed on Ethereum's official website, show contrasting network health, but Bitcoin's miner revenue pressure adds to the sell-side narrative.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| Bitcoin Current Price | $60,292 |

| 24-Hour Price Change | -17.37% |

| MicroStrategy Unrealized Loss | $10B+ |

| MicroStrategy BTC Holdings | 713,502 BTC |

| Average Purchase Price | $76,052 |

This event tests the corporate Bitcoin thesis. MicroStrategy's strategy relies on long-term appreciation. A sustained drawdown could pressure its financial covenants. Real-world evidence includes potential margin calls or debt refinancing issues. Institutional liquidity cycles may slow if other corporates reassess.

Retail market structure is already fragile. The Extreme Fear reading confirms capitulation. This often precedes a reversal. However, further breakdowns could trigger a cascade. On-chain forensic data confirms HODLer resilience despite the price action.

Market structure suggests this is a liquidity cleanse. MicroStrategy's unrealized loss reflects broader market stress. Historical cycles show such drawdowns are common in Bitcoin's volatility profile. The key is whether the $58,500 support holds. If it breaks, we may see a retest of the 2024 low near $50,000. – CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge. First, a bullish reversal requires reclaiming $65,000. Second, a bearish continuation targets $55,000. The 12-month institutional outlook hinges on macro conditions. Federal Reserve policy remains a key driver. The 5-year horizon still favors accumulation at these levels.

Institutional adoption may pause short-term. However, long-term holders see this as a buying opportunity. The gamma squeeze potential from options markets adds complexity.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.