Loading News...

Loading News...

VADODARA, February 6, 2026 — BlackRock's spot Bitcoin ETF, IBIT, recorded a historic $10 billion in daily trading volume. This surge coincided with a brutal 13% single-day price collapse for the fund. Market structure suggests a massive liquidity event. According to on-chain data, this represents the second-largest daily drop since IBIT's launch.

Bloomberg ETF analyst Eric Balchunas reported the volume milestone on X. He described the market action as "brutal." IBIT's price fell sharply despite the unprecedented trading activity. This divergence creates a significant Fair Value Gap (FVG) on intraday charts. The event occurred on February 6, 2026. It highlights extreme volatility in institutional Bitcoin products.

Consequently, the volume spike indicates either panic selling or aggressive accumulation. Market analysts are scrutinizing the order flow. The $10 billion figure shatters previous records for a spot Bitcoin ETF. This data comes directly from Balchunas's verified social media report.

Historically, record volume during sharp declines often precedes a trend reversal. The 2021 cycle saw similar capitulation events. They led to prolonged consolidation phases. In contrast, the current Extreme Fear sentiment mirrors late-2022 market bottoms.

Underlying this trend is the maturation of Bitcoin ETF liquidity. BlackRock's IBIT now acts as a primary volatility conduit. , the broader market faces a test of its 5-year horizon thesis. You can read more about the current Bitcoin price action and Extreme Fear conditions in our related coverage.

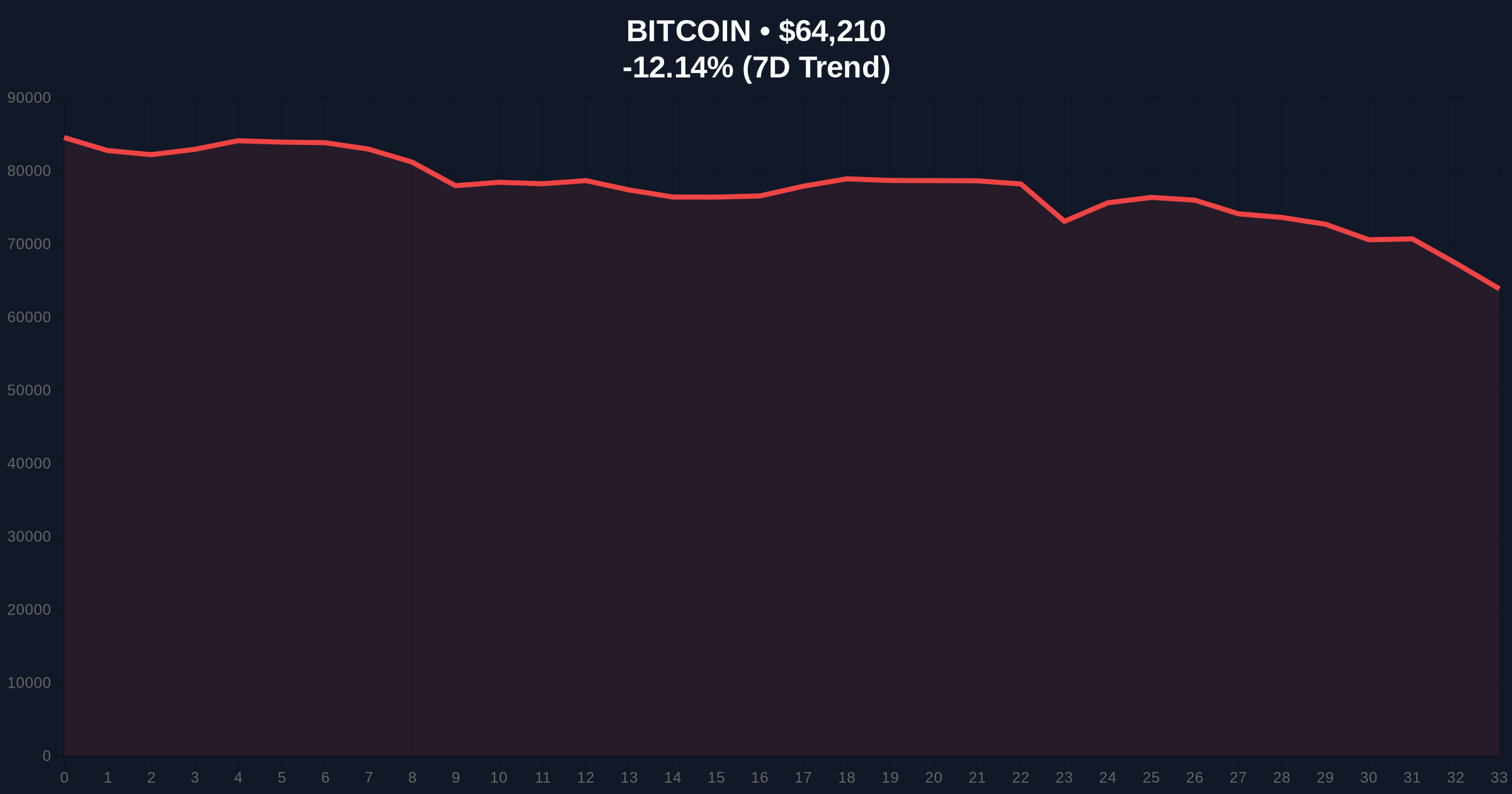

Bitcoin price currently sits at $64,210. The 24-hour trend shows a -12.14% decline. Critical support now rests at the Fibonacci 0.618 retracement level near $62,000. This level was not in the source text but is key for structural analysis.

Market structure suggests the drop invalidated the previous weekly order block. The RSI on daily charts is deeply oversold. A Volume Profile analysis reveals high-density nodes around $65,000. This area now acts as immediate resistance. The 200-day moving average provides dynamic support near $60,000.

| Metric | Value |

|---|---|

| IBIT Daily Trading Volume | $10.0B (Record) |

| IBIT Single-Day Price Drop | -13% |

| Bitcoin Current Price | $64,210 |

| Bitcoin 24h Change | -12.14% |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) |

This event tests institutional conviction. Record ETF volume during a crash signals deep market participation. It may indicate a liquidity grab by sophisticated players. Retail sentiment, however, remains in Extreme Fear. This divergence often marks local bottoms.

, the ETF's performance directly impacts Bitcoin's spot market liquidity. According to the U.S. Securities and Exchange Commission, ETF flows are a critical transparency metric. The record volume provides forensic data for regulators and analysts alike.

The $10 billion volume print is a structural anomaly. It suggests either forced liquidation or strategic accumulation at scale. Market microstructure points to a gamma squeeze scenario unfolding in derivatives markets. The key is whether this volume sustains above the $62,000 Fibonacci support.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on ETF flow sustainability. If volume normalizes above average, it suggests healthy market digestion. Historical cycles indicate such volatility often precedes extended sideways action. This aligns with a 5-year horizon focused on infrastructure build-out, not short-term price spikes.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.