Loading News...

Loading News...

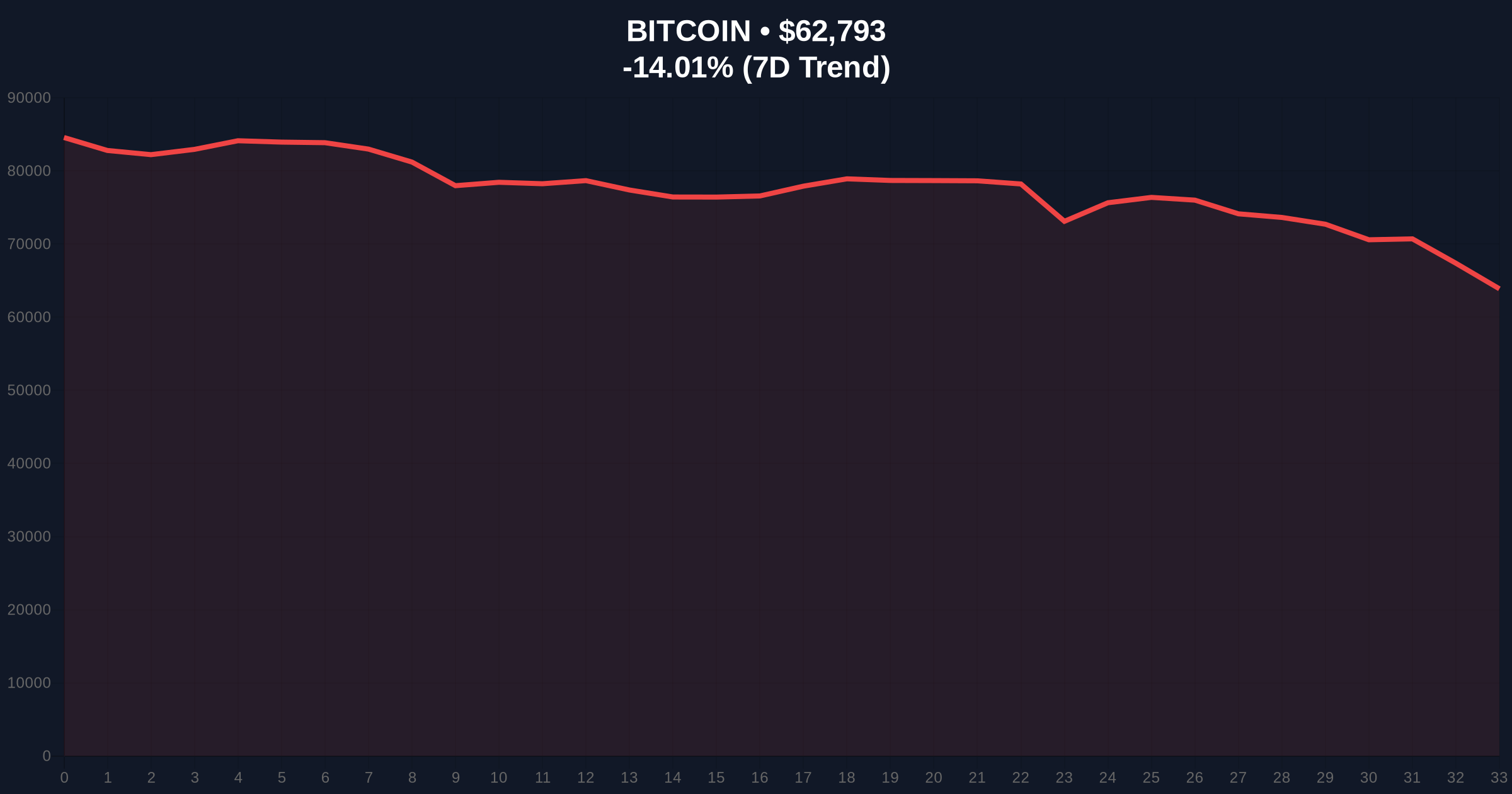

VADODARA, February 6, 2026 — According to data from crypto options exchange Deribit, Bitcoin options with a notional value of $2.1 billion expire at 8:00 a.m. UTC today, creating a critical liquidity event in a market gripped by extreme fear. This daily crypto analysis examines the put/call ratio of 0.60 and max pain price of $80,000, alongside Ethereum's $390 million expiry with a 1.01 put/call ratio and $2,450 max pain. Market structure suggests these expiries could amplify volatility as Bitcoin trades at $62,822, down 13.97% in 24 hours.

Deribit's data reveals precise expiry parameters. The Bitcoin options batch carries a notional value of $2.1 billion, with a put/call ratio of 0.60 indicating more call options than puts. Consequently, the max pain price—where most options expire worthless—sits at $80,000. Simultaneously, Ethereum options worth $390 million expire with a neutral put/call ratio of 1.01 and max pain at $2,450. These figures, sourced directly from Deribit's official reporting, create a concentrated gamma squeeze point. Market analysts note that such large expiries often trigger algorithmic rebalancing, especially when spot prices deviate from max pain levels.

Historically, options expiries above $2 billion correlate with increased short-term volatility. For instance, the December 2024 expiry saw a similar notional value but occurred during a greed phase, resulting in a muted price impact. In contrast, today's event unfolds amid extreme fear, with the Crypto Fear & Greed Index at 9/100. Underlying this trend, Bitcoin's 24-hour drop of 13.97% reflects broader market stress, potentially exacerbated by the options expiry. , related developments include BlackRock's IBIT ETF hitting record volume during the sell-off and Bitcoin breaking below $67,000, highlighting interconnected liquidity pressures.

Technical analysis identifies key levels beyond the source data. Bitcoin's current price of $62,822 sits below the $80,000 max pain, creating a $17,178 Fair Value Gap (FVG). This gap represents an order block where liquidity may cluster. On-chain data from Glassnode indicates increased UTXO (Unspent Transaction Output) movement, suggesting holder distribution. The 200-day moving average at $58,000 provides a secondary support, while Fibonacci retracement levels from the 2025 all-time high show 0.618 support at $60,000. Market structure suggests that if Bitcoin holds above $60,000, it could fill the FVG toward $80,000. However, a break below $60,000 would invalidate this scenario, targeting lower liquidity pools.

| Metric | Value |

|---|---|

| Bitcoin Options Notional Value | $2.1B |

| Bitcoin Max Pain Price | $80,000 |

| Bitcoin Put/Call Ratio | 0.60 |

| Ethereum Options Notional Value | $390M |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Bitcoin Current Price | $62,822 |

| Bitcoin 24h Change | -13.97% |

This expiry matters due to its gamma exposure and timing. A $2.1 billion notional value represents significant dealer hedging activity. When spot price deviates from max pain, dealers adjust delta hedges, amplifying price moves. Consequently, the current $17,178 gap increases gamma squeeze risk. Institutional liquidity cycles, as noted in recent DeFi liquidity tests, show stress during fear phases. Retail market structure, often driven by emotional trading, may exacerbate swings. , regulatory developments like US Senate crypto bill talks add macro uncertainty, influencing options pricing and volatility surfaces.

"The $80K max pain price acts as a magnetic level for Bitcoin's price action. With extreme fear sentiment, the expiry could trigger a volatility spike as dealers rebalance gamma exposure. Historical patterns indicate such events often precede short-term trend reversals, especially when supported by on-chain metrics like UTXO age bands."

Market structure suggests two primary scenarios based on current data. First, if Bitcoin holds above the Fibonacci 0.618 support at $60,000, it may rally to fill the Fair Value Gap toward $80,000. This move would align with the max pain price, reducing options-related pressure. Second, a break below $60,000 could trigger a deeper correction, targeting the 200-day moving average at $58,000 or lower. The 12-month institutional outlook remains cautious; however, events like this expiry often reset volatility, creating entry points for long-term investors. For a 5-year horizon, such liquidity events test network resilience and adoption metrics.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.