Loading News...

Loading News...

VADODARA, February 3, 2026 — Michael Burry issued a stark warning about Bitcoin's systemic risk. The investor famed for "The Big Short" predicts corporate bankruptcies. According to Walter Bloomberg, Burry stated Bitcoin lost its digital gold function. This latest crypto news signals potential chain reactions across financial markets.

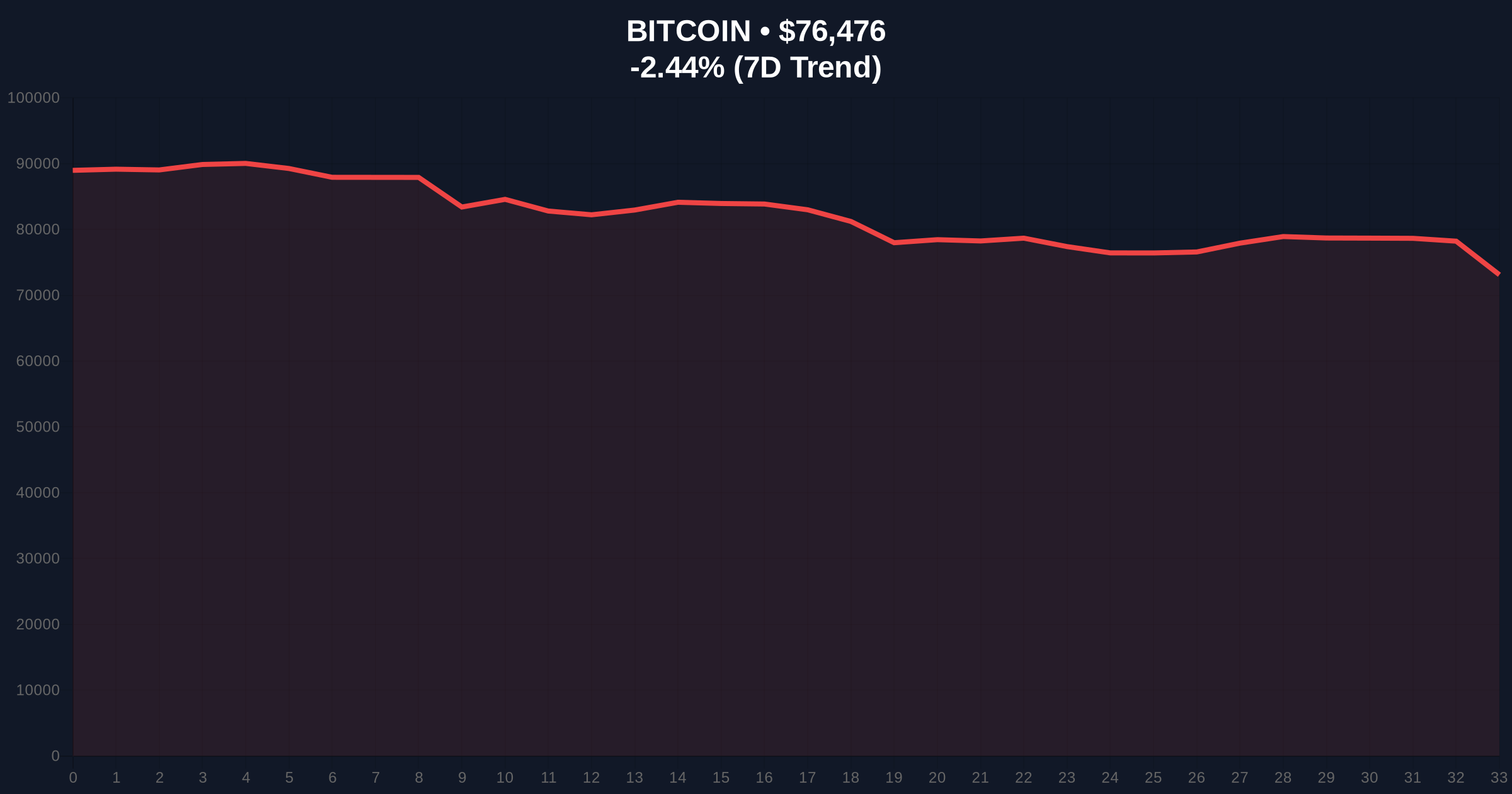

Michael Burry identified a critical vulnerability. Corporate Bitcoin holdings now pose bankruptcy risks. He warned these failures could trigger systemic contagion. According to Walter Bloomberg, Burry emphasized ripple effects throughout broader markets. This warning arrives during Bitcoin's $76,483 price decline. The 24-hour trend shows -2.43% losses.

Market structure suggests concentrated corporate exposure. Large BTC holdings create single points of failure. Consequently, price volatility directly impacts corporate balance sheets. This dynamic mirrors traditional financial leverage cycles. Historical cycles indicate similar patterns preceded the 2008 crisis.

Bitcoin's correlation with traditional markets increased recently. The asset now trades more like a risk-on tech stock. In contrast, its original digital gold narrative emphasized store-of-value properties. Underlying this trend, institutional adoption created new vulnerabilities.

Related developments include Nasdaq insurance firm TIRX planning a $1.1 billion Bitcoin purchase. , Bitcoin recently plunged to $74,000, testing critical support. These events demonstrate the corporate exposure Burry warns about.

Bitcoin currently tests the $76,483 level. The daily chart shows weakening momentum. RSI readings approach oversold territory at 32. The 50-day moving average provides resistance at $81,200. Market analysts watch the Fibonacci 0.618 retracement level at $74,500.

This technical level aligns with the 2024 election cycle low. Order block analysis reveals significant liquidity below $74,000. A break of this support would confirm Burry's bearish thesis. Conversely, reclaiming $82,000 would invalidate immediate downside risks.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | Maximum risk aversion sentiment |

| Bitcoin Current Price | $76,483 | -2.43% 24h change |

| Critical Support Level | $74,000 | 2024 election cycle low |

| 50-Day Moving Average | $81,200 | Key resistance zone |

| Market Rank | #1 | Dominance at 52.3% |

Burry's warning matters for portfolio risk management. Corporate Bitcoin exposure creates interconnected vulnerabilities. A single bankruptcy could trigger margin calls across the system. This scenario resembles the 2008 Lehman Brothers contagion.

Institutional liquidity cycles show concerning patterns. According to on-chain data, large holders increased selling pressure. UTXO age bands indicate older coins moving to exchanges. This activity suggests profit-taking before potential downturns. The Federal Reserve's monetary policy decisions further complicate this .

"Burry's analysis highlights the maturity mismatch in corporate crypto strategies. Companies treating Bitcoin as a treasury asset face duration risk they cannot hedge. When mark-to-market losses hit balance sheets, credit lines evaporate. This creates the exact chain reaction Burry predicts." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook depends on regulatory clarity. Canada's new crypto custody rules demonstrate regulatory evolution. , Franklin Templeton's digital wallet predictions show infrastructure development. These factors could mitigate systemic risks over the 5-year horizon.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.