Loading News...

Loading News...

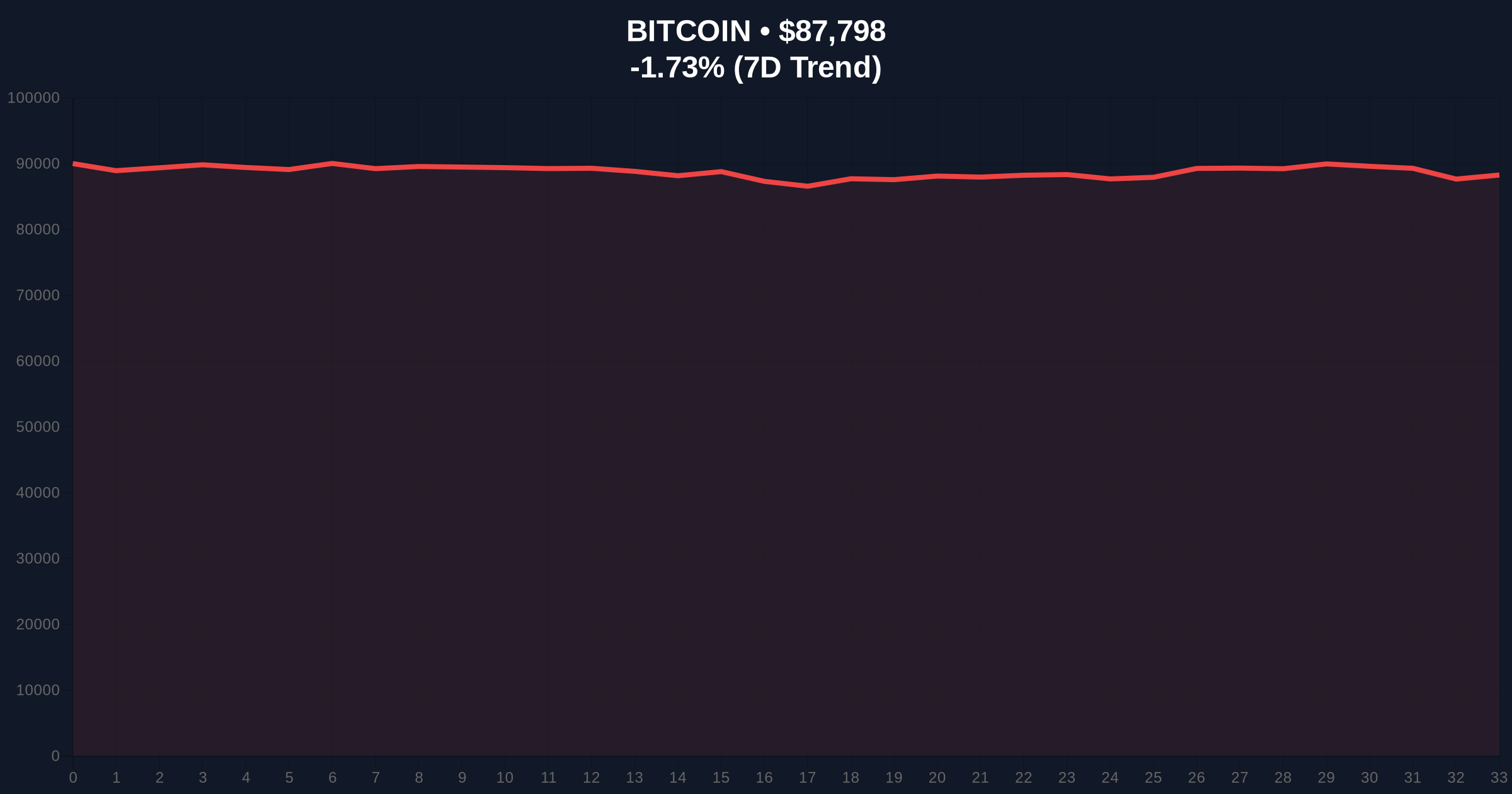

VADODARA, January 29, 2026 — MetaPlanet, a publicly listed Japanese firm, announced plans to purchase an additional $130 million in Bitcoin through a capital raise of 21 billion yen. This daily crypto analysis examines the strategic implications of this move within a market gripped by Fear sentiment, where Bitcoin currently trades at $87,784 with a 24-hour decline of 1.74%. According to the company's official X account, the plan details its 25th issuance of stock warrants, signaling continued institutional accumulation despite short-term price pressure.

MetaPlanet disclosed its Bitcoin purchase strategy in an official document regarding its 25th issuance of stock warrants. The firm aims to raise up to 21 billion yen, equivalent to approximately $130 million, specifically for Bitcoin acquisition. This move follows a pattern of corporate treasury adoption pioneered by MicroStrategy, but with distinct Japanese regulatory nuances. The company shared this document on its official X account, providing transparency to investors and market participants.

Consequently, this announcement positions MetaPlanet among a growing cohort of Asian-listed firms leveraging Bitcoin as a balance sheet asset. The capital raise through stock warrants suggests a structured, long-term approach rather than speculative trading. Market structure indicates that such institutional flows create foundational support levels, often absorbing retail sell-side pressure during fear-driven corrections.

Historically, corporate Bitcoin accumulation has preceded major liquidity cycles. MicroStrategy's initial purchases in 2020 correlated with Bitcoin's breakout from the $10,000 resistance zone. In contrast, Asian firms like MetaPlanet entered later, reflecting regional adoption lags. Underlying this trend is a broader shift toward digital asset allocation, driven by currency debasement concerns and portfolio diversification needs.

, the current Fear sentiment, with a score of 26/100, mirrors the December 2022 market bottom when Bitcoin tested $16,000. During that period, institutional accumulation accelerated, setting the stage for the 2023-2025 bull run. MetaPlanet's move suggests similar contrarian positioning, where sophisticated capital enters during retail capitulation phases.

Related Developments:

Bitcoin's current price of $87,784 sits within a critical technical zone. The 24-hour decline of 1.74% has created a Fair Value Gap (FVG) between $89,200 and $90,500, which market makers may target for liquidity grabs. On-chain data from Glassnode indicates that the Realized Price, a key support metric, holds at $85,000, aligning with the Fibonacci 0.618 retracement level from the 2025 high of $98,000.

, the 200-day moving average provides dynamic support at $85,200, forming a confluence with the Fibonacci level. Volume Profile analysis reveals significant accumulation between $84,000 and $86,000, suggesting institutional buying interest. This technical setup creates a high-probability Order Block, where MetaPlanet's planned purchase could catalyze a reversal if price retests this zone.

| Metric | Value | Implication |

|---|---|---|

| MetaPlanet Purchase Amount | $130M (21B JPY) | Institutional accumulation signal |

| Bitcoin Current Price | $87,784 | -1.74% 24h trend |

| Crypto Fear & Greed Index | 26/100 (Fear) | Contrarian buying opportunity |

| Fibonacci 0.618 Support | $85,200 | Key technical level |

| 200-Day Moving Average | $85,200 | Long-term trend support |

MetaPlanet's announcement matters because it demonstrates institutional conviction during a fear-driven market. According to Ethereum.org's documentation on blockchain transparency, public disclosures like MetaPlanet's warrant issuance provide verifiable on-chain footprints, reducing information asymmetry. This move injects structural demand into Bitcoin's market microstructure, potentially offsetting retail outflows.

Additionally, the capital raise through stock warrants indicates shareholder approval for Bitcoin allocation, a governance milestone. Historically, such corporate actions have preceded regulatory clarity phases, as seen with U.S. spot Bitcoin ETF approvals in 2024. Consequently, MetaPlanet's strategy may encourage other Asian firms to follow, amplifying regional adoption.

"MetaPlanet's planned purchase reflects a sophisticated response to market inefficiencies. When retail sentiment hits Fear extremes, institutional capital identifies liquidity gaps. This $130 million allocation, though modest relative to global liquidity, signals a broader trend of balance sheet diversification into hard-capped digital assets."

Market structure suggests two primary scenarios based on current technicals and institutional flows.

The 12-month institutional outlook remains positive, as corporate accumulation like MetaPlanet's provides non-speculative demand. Over a 5-year horizon, such flows could reduce Bitcoin's volatility, enhancing its store-of-value narrative. However, macroeconomic factors, including Federal Reserve policy shifts, will remain primary drivers.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.