Loading News...

Loading News...

VADODARA, January 29, 2026 — JPMorgan's latest macro strategy report delivers a stark assessment. Bitcoin has declined 13% over the past year. The U.S. Dollar Index (DXY) fell 10%. This concurrent drop shatters the narrative of Bitcoin as a reliable dollar hedge. According to the report, the cryptocurrency market is primarily driven by short-term capital flows and investor sentiment. This is the latest crypto news shaking institutional assumptions.

Yuxuan Tang, JPMorgan's head of Asia macro strategy, authored the critical analysis. CoinDesk reported the findings. Tang noted the atypical correlation. A weaker DXY typically favors risk assets like Bitcoin. The opposite occurred. Bitcoin's sharper decline suggests a different market perception. The asset is sensitive to liquidity conditions, not a dollar hedge. Many investors seeking dollar diversification now prefer gold or emerging market stocks. The report concluded Bitcoin faces difficulty matching traditional safe-haven rallies without a clear monetary policy shift.

Historically, Bitcoin bulls touted its inverse correlation with the dollar. The 2021-2023 cycle often showed this pattern. In contrast, the past year reveals a breakdown. Underlying this trend is a shift in market structure. Short-term capital flows dominate. This mirrors behavior seen in 2018's bear market liquidity crunch. The current environment echoes that period's sentiment-driven price action. , regulatory uncertainty amplifies the effect. For instance, recent U.S. Senate probes into DOJ conflicts contribute to market fear. Related developments include high-profile security breaches and sudden DeFi liquidations, highlighting systemic fragility.

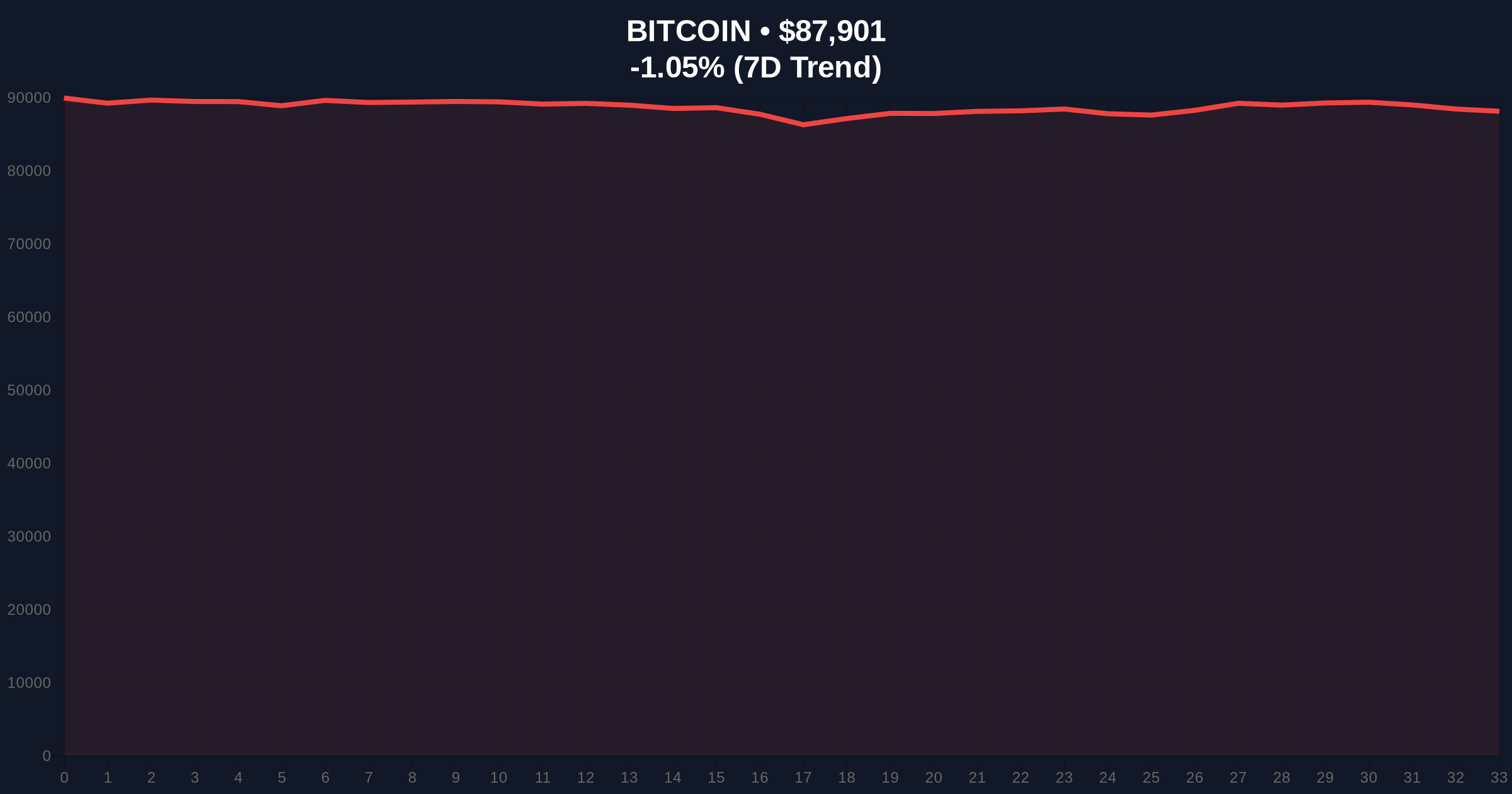

Market structure suggests critical levels. Bitcoin currently trades at $87,893. The 24-hour trend shows a -1.06% decline. Key support sits at the $85,000 level, aligning with the 0.618 Fibonacci retracement from the 2025 high. A break below this invalidates the current consolidation phase. Resistance forms near $92,000, a previous order block. The RSI reads 42, indicating neutral momentum with bearish bias. Volume profile analysis shows thinning liquidity at higher prices. This technical setup confirms JPMorgan's liquidity-driven thesis. The market lacks sustained bid depth.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (26/100) |

| Bitcoin Current Price | $87,893 |

| Bitcoin 24h Change | -1.06% |

| Bitcoin Market Rank | #1 |

| DXY 1-Year Decline | 10% |

| Bitcoin 1-Year Decline | 13% |

This analysis impacts institutional allocation. Pension funds and ETFs often justify Bitcoin exposure as a dollar hedge. JPMorgan's data undermines that thesis. Consequently, capital may flow toward gold or other alternatives. Retail market structure also shifts. Short-term traders now dominate liquidity cycles. This increases volatility during Federal Reserve policy announcements. The Federal Reserve's monetary policy dashboard shows tightening conditions, exacerbating the liquidity sensitivity Tang identified.

"The correlation breakdown is significant. It suggests Bitcoin's price action is more aligned with global liquidity metrics than currency depreciation narratives. Until monetary policy provides clearer direction, expect continued sentiment-driven volatility." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge. First, a bearish continuation if liquidity tightens further. Second, a bullish reversal requires a structural shift in monetary policy.

The 12-month outlook hinges on monetary policy clarity. Historical cycles suggest that without a Fed easing cycle, Bitcoin struggles to decouple from liquidity flows. Over a 5-year horizon, adoption and regulatory maturation could restore hedge characteristics, but short-term dynamics dominate.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.