Loading News...

Loading News...

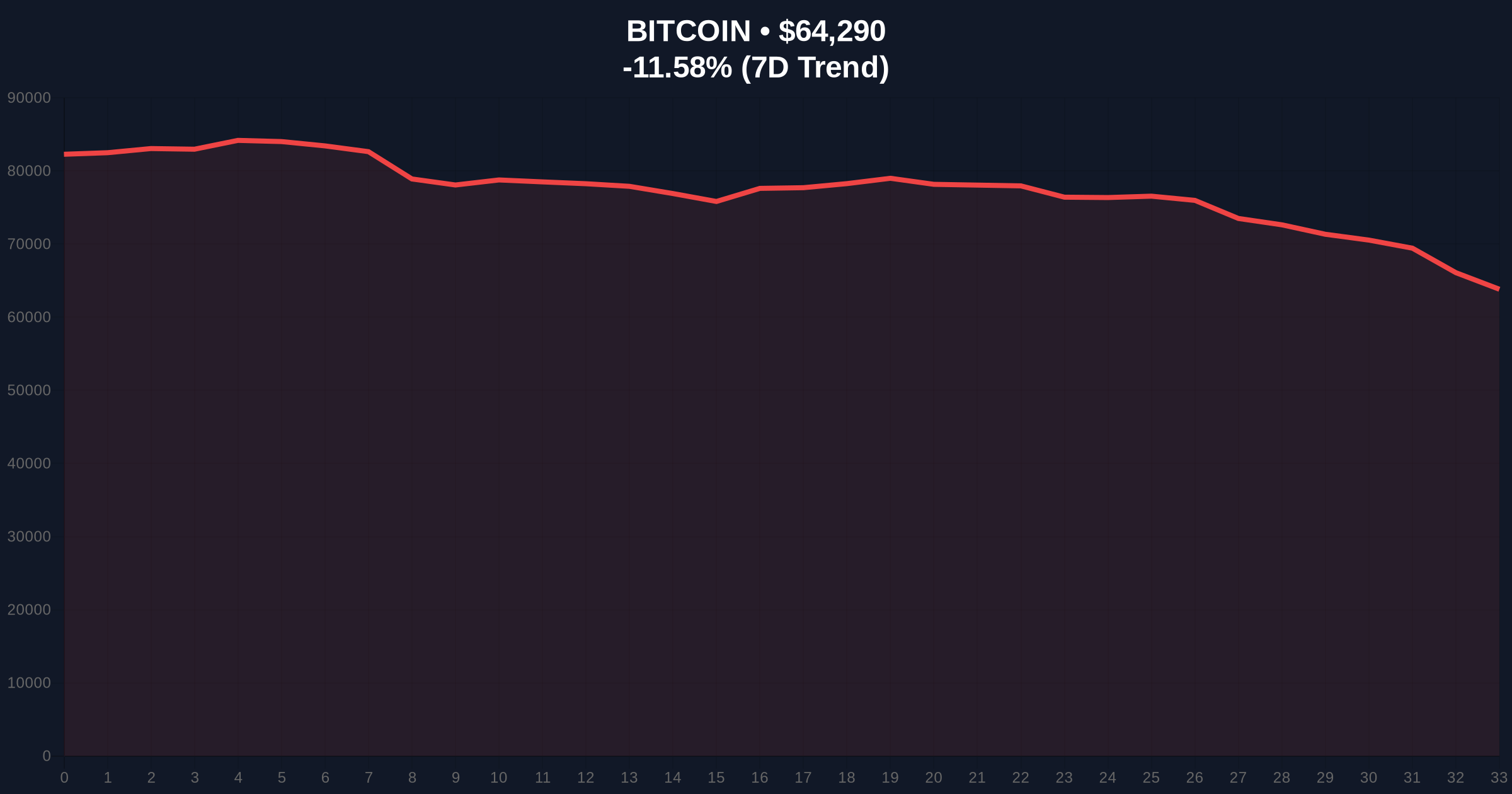

VADODARA, February 6, 2026 — Mara Holdings (MARA), the Bitcoin mining entity formerly known as Marathon Digital, executed a significant capital movement today. According to on-chain intelligence firm Lookonchain, the company transferred 1,318 BTC, valued at approximately $86.89 million, to institutional counterparties Two Prime, BitGo, and Galaxy Digital within a 10-hour window. This Daily crypto analysis examines the transaction's context against a backdrop of severe market stress, where Bitcoin's price has declined 11.60% in 24 hours.

Lookonchain's blockchain surveillance data provides the primary source for this event. Mara Holdings moved a substantial portion of its Bitcoin treasury to three established institutional players. Two Prime operates as a digital asset investment firm, BitGo serves as a regulated custodian, and Galaxy Digital functions as a diversified financial services firm. The transaction's timing coincides with a sharp market correction. Market structure suggests this is not a routine operational move but a strategic liquidity event. The transfer represents a direct shift of assets from a producer (miner) to financial intermediaries.

Historically, large miner outflows during price declines have preceded capitulation events. Similar to the 2021 correction, where miner selling pressure exacerbated the drawdown, current on-chain flows indicate a stress test for Bitcoin's institutional support layers. In contrast to the 2023 cycle, where miner reserves accumulated, the 2026 shows increased treasury management activity. Underlying this trend is the maturation of Bitcoin's financial infrastructure, allowing entities like Mara to execute complex transactions swiftly.

Related developments in the current market environment include significant liquidation events, as detailed in our coverage of crypto futures liquidations exceeding $400 million and Bitcoin breaking below key support levels.

Bitcoin currently trades at $64,274, having broken below the psychologically significant $66,000 level. The Relative Strength Index (RSI) on daily timeframes sits near oversold territory, typically below 30. A critical technical level not mentioned in the source is the Fibonacci 0.618 retracement at $63,200, drawn from the 2024 cycle low. This level often acts as a major support zone in bull market corrections. The 200-day moving average, a key institutional benchmark, provides dynamic support near $61,500. Volume profile analysis shows increased selling volume, confirming the bearish momentum.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $64,274 |

| 24-Hour Price Change | -11.60% |

| Crypto Fear & Greed Index | Extreme Fear (Score: 9/100) |

| Mara Holdings Transfer Value | $86.89 Million |

| Bitcoin Transferred | 1,318 BTC |

This transaction matters because it provides a real-time case study in institutional behavior during volatility. Mara Holdings, as a publicly-traded miner, operates under different capital constraints than private entities. Moving assets to custodians like BitGo and Galaxy Digital may indicate preparation for collateralized financing, OTC trading, or structured product creation. According to the U.S. Securities and Exchange Commission, public companies must maintain rigorous treasury management policies. This move could reflect compliance with those standards amid market stress. The shift impacts Bitcoin's available supply on exchanges, potentially reducing immediate sell-side pressure if the coins move into cold storage.

"Large-scale miner transfers during downturns often signal a rebalancing of operational risk. The involvement of regulated entities like BitGo suggests a move toward enhanced security and financial optionality, rather than panic selling. Market participants should monitor whether this represents an isolated event or the start of a broader miner treasury management trend." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish scenario requires Bitcoin to reclaim and hold above the $66,000 level, which would invalidate the immediate bearish structure. The bearish scenario involves a continued test of lower supports, potentially targeting the $61,500 200-day moving average. On-chain data indicates that miner outflow events like this one have historically marked local bottoms when accompanied by extreme fear sentiment.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles, such as 2021, show that corrections of this magnitude within a bull market often create long-term buying opportunities. The maturation of Bitcoin's institutional infrastructure, evidenced by transactions like Mara's, supports a positive 5-year horizon despite near-term volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.