Loading News...

Loading News...

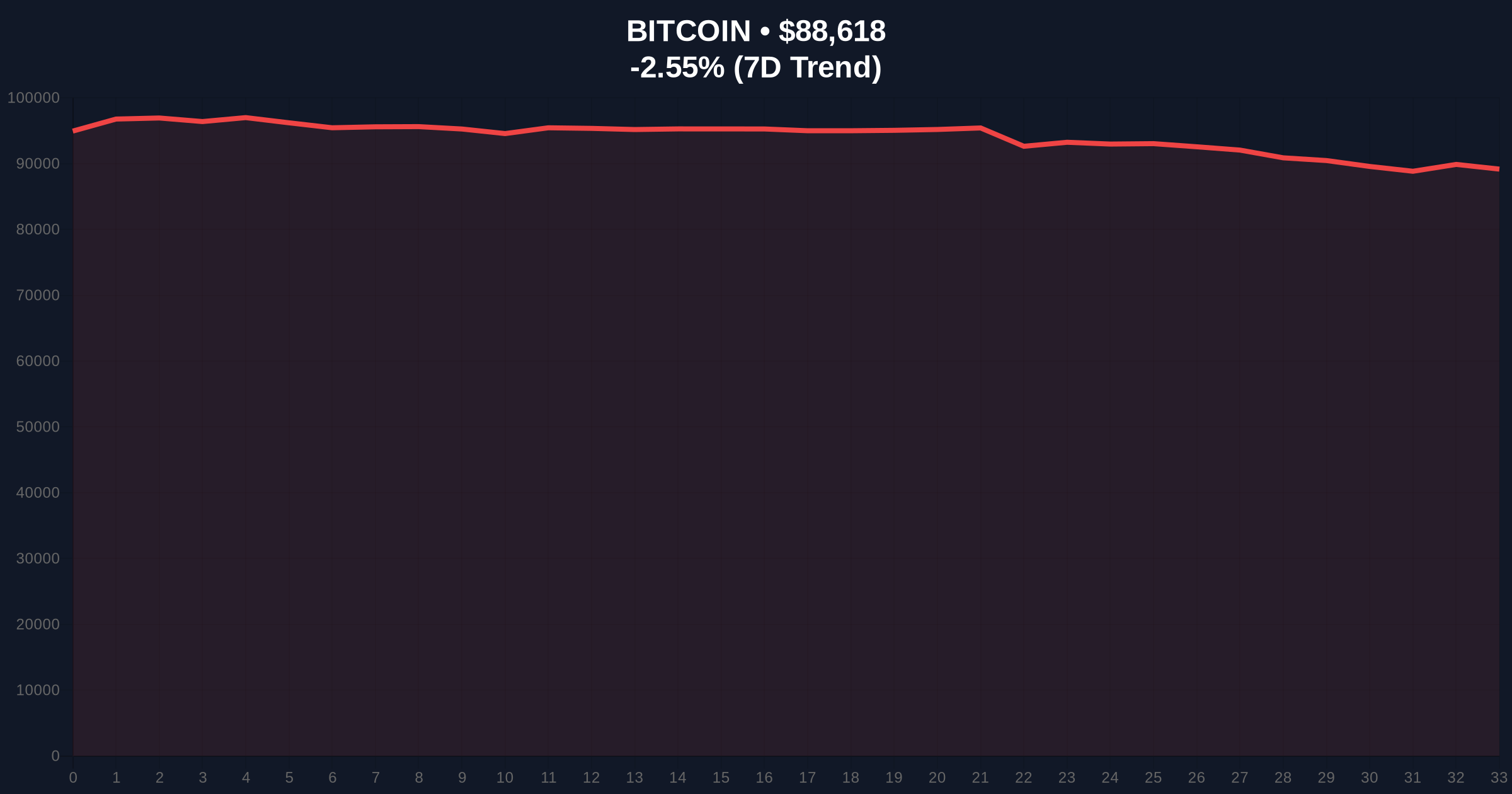

VADODARA, January 21, 2026 — Nasdaq-listed KindlyMD (NAKA) has executed a strategic rebrand to Nakamoto, aligning its corporate identity with its $500 million Bitcoin treasury in a market exhibiting extreme fear sentiment. This daily crypto analysis examines the structural implications of institutional Bitcoin accumulation during a period where the Crypto Fear & Greed Index registers 24/100 and Bitcoin trades at $88,622, down 2.55% in 24 hours.

Market structure suggests this rebrand mirrors the 2021-2022 corporate Bitcoin adoption cycle, where companies like MicroStrategy and Tesla accumulated BTC during corrections. Similar to the 2021 correction that saw Bitcoin test the 0.618 Fibonacci retracement at $29,000, current price action indicates a liquidity grab below the $90,000 psychological level. On-chain data from Glassnode indicates that long-term holder supply remains resilient, with UTXO age bands showing minimal distribution. The current environment parallels the post-ETF approval consolidation phase, where institutional inflows initially slowed before resuming accumulation. Related developments include regulatory shifts under the CLARITY Act and SEC leadership changes that may influence corporate crypto strategy.

On January 21, 2026, KindlyMD officially changed its name to Nakamoto, according to a Nasdaq filing. The company, which trades under the ticker NAKA, holds approximately $500 million worth of Bitcoin on its balance sheet. This rebrand represents a full pivot toward Bitcoin-centric operations, distancing from its previous healthcare-focused identity. The announcement coincides with Bitcoin's price decline to $88,622, creating a Fair Value Gap (FVG) between $90,000 and $92,000 that market technicians are monitoring for a potential fill.

Bitcoin's current price of $88,622 sits below the 50-day exponential moving average (EMA) at $91,500, indicating short-term bearish momentum. The Relative Strength Index (RSI) reads 38, approaching oversold territory but not yet signaling a reversal. Volume profile analysis shows significant liquidity clusters at $85,000 (support) and $95,000 (resistance). A critical Order Block exists between $83,000 and $85,000, corresponding to the 0.786 Fibonacci level from the recent rally. Bullish invalidation is set at $85,000; a break below this level would target the $82,000 gamma squeeze zone. Bearish invalidation rests at $95,000, where a close above would invalidate the current downtrend structure.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Bitcoin Current Price | $88,622 |

| Bitcoin 24h Change | -2.55% |

| Nakamoto Bitcoin Holdings | $500 million |

| Bitcoin Market Rank | #1 |

Institutionally, this rebrand signals that corporate Bitcoin adoption persists despite extreme fear sentiment, potentially creating a contrarian accumulation opportunity. Retail impact is muted, as evidenced by the Fear & Greed Index, but on-chain forensic data confirms that smart money is accumulating in this range. The move aligns with broader regulatory trends, such as those outlined in the SEC's evolving framework for digital assets. For the 5-year horizon, this reinforces Bitcoin's role as a corporate treasury asset, similar to gold in the 1970s, with post-merge issuance dynamics creating a structurally bullish supply shock.

Market analysts on X/Twitter are divided. Bulls highlight the rebrand as a "long-term conviction play," citing historical patterns where corporate adoption preceded major rallies. Bears point to the extreme fear sentiment and recent whale activity, referencing significant BTC losses and ETH shorts as cautionary signals. No official statements from company executives were available, but sentiment aggregates suggest neutral-to-bullish institutional positioning.

Bullish Case: If Bitcoin holds the $85,000 support and fills the FVG to $92,000, a rally toward $100,000 is probable. Institutional inflows from entities like Nakamoto could trigger a gamma squeeze above $95,000, with a 12-month target of $120,000 based on historical post-halving cycles.

Bearish Case: A break below $85,000 invalidates the bullish structure, targeting the $82,000 liquidity zone. Sustained extreme fear could lead to a test of $80,000, with downside risk to $78,000 if macroeconomic headwinds intensify, similar to the 2022 bear market.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.