Loading News...

Loading News...

VADODARA, January 21, 2026 — A high-net-worth investor known as 'pension-usdt.eth' has executed a significant portfolio rotation, closing a 10x leveraged Bitcoin long position at a $4.09 million loss and opening a 3x leveraged Ethereum short valued at $73.54 million, according to on-chain data from Onchainlens. This daily crypto analysis examines the structural implications of this whale activity within a market exhibiting extreme fear, mirroring the deleveraging events of Q4 2021.

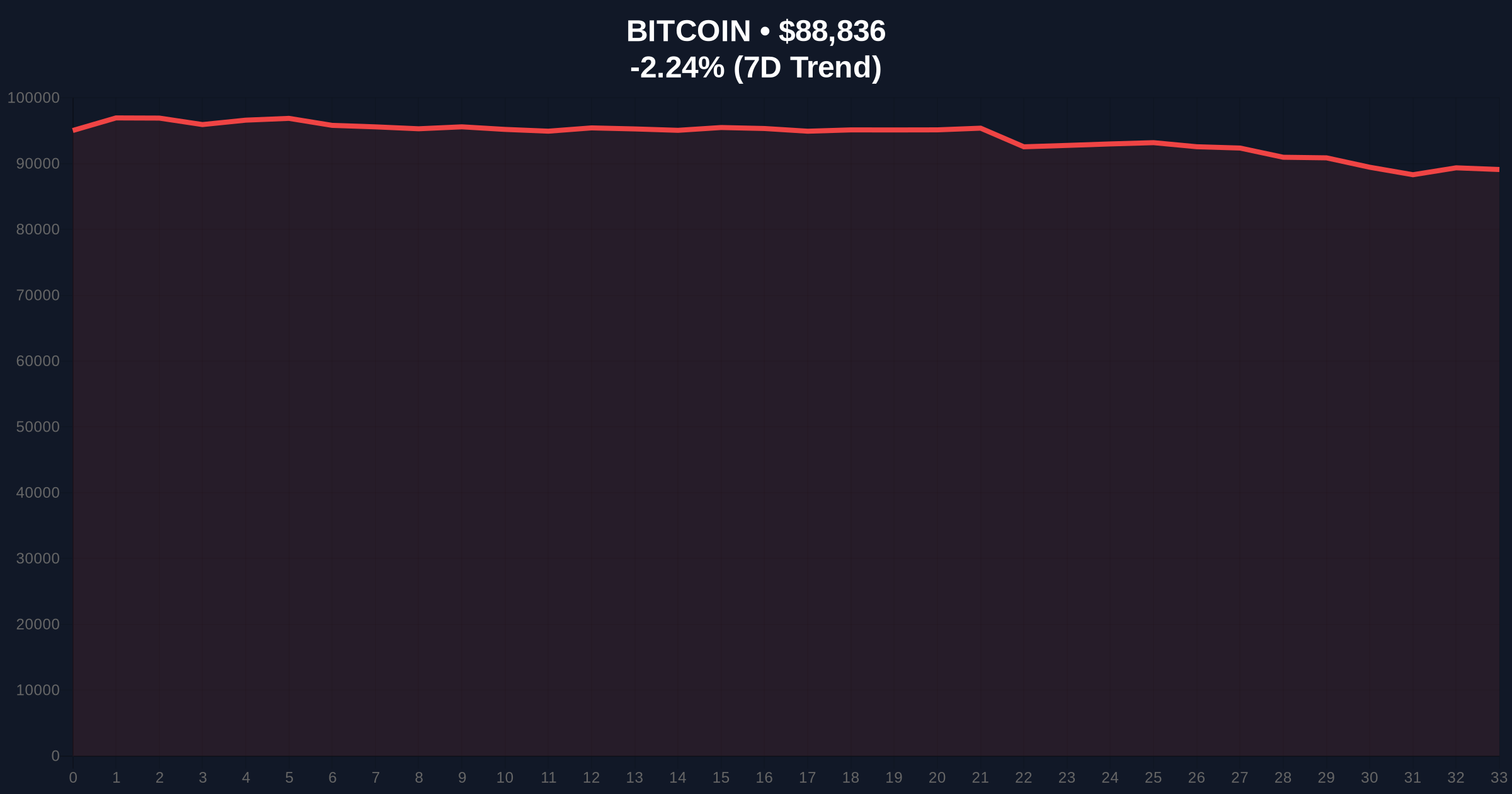

Market structure suggests the current environment parallels the 2021 correction, where leveraged long liquidations preceded a multi-month consolidation phase. According to Glassnode liquidity maps, the $88,000-$92,000 zone represents a high-density volume profile, historically acting as a magnet for price action. The whale's pivot from Bitcoin to Ethereum short exposure indicates a tactical shift rather than outright capitulation, similar to institutional rotations observed during the March 2020 volatility spike. This activity occurs amid broader regulatory scrutiny, as detailed in our analysis of the SEC's recent appointments and their market impact.

Onchainlens forensic data confirms that the entity 'pension-usdt.eth' closed a 10x leveraged Bitcoin long position, realizing a loss of $4.09 million. The investor subsequently opened a 3x leveraged short on Ethereum for 25,000 ETH, with an entry price of $2,927.33 and a liquidation price of $3,990.63. The total notional value of the Ethereum short is $73.54 million. This sequence represents a classic risk-reallocation pattern, where losses on one asset are hedged with directional exposure on another, often targeting perceived relative weakness.

Bitcoin's current price of $88,817 sits within a critical Fair Value Gap (FVG) between $86,500 and $90,200. The 200-day moving average at $85,750 provides confluence support. Ethereum's entry price of $2,927.33 aligns with a previous order block from December 2025, now acting as resistance. The RSI on both assets hovers near 40, indicating neutral momentum but with bearish divergence on higher timeframes. Bullish invalidation for Bitcoin is set at $86,500; a break below would target the $82,000 Fibonacci support. Bearish invalidation for Ethereum is at $3,050, which would negate the short thesis and potentially trigger a gamma squeeze toward $3,200.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Alternative.me |

| Bitcoin Current Price | $88,817 | CoinMarketCap |

| Bitcoin 24h Change | -2.33% | CoinMarketCap |

| Whale BTC Loss | $4.09 million | Onchainlens |

| Whale ETH Short Value | $73.54 million | Onchainlens |

For institutions, this whale activity signals a shift toward defensive positioning, leveraging Ethereum's upcoming Pectra upgrade uncertainty as a catalyst. Retail traders face increased volatility risk, as large leveraged positions can exacerbate liquidations during thin liquidity periods. The move highlights the growing sophistication of on-chain derivatives strategies, where entities use perpetual swaps to express macro views without spot market impact. This aligns with broader trends of platforms expanding traditional asset access amid crypto fear.

Market analysts on X/Twitter note the whale's timing coincides with Bitcoin's rejection at the $92,000 resistance level. One quant trader stated, "The $73M ETH short is a liquidity grab targeting the $3,000 psychological level." Bulls argue the loss is isolated, pointing to stablecoin inflows on exchanges as a counter-indicator. However, the prevailing sentiment remains cautious, with many referencing the 2021 cycle where similar whale rotations preceded a 30% drawdown.

Bullish Case: If Bitcoin holds the $86,500 support and Ethereum breaks above $3,050, the whale's short could face liquidation, fueling a short squeeze toward $95,000 for BTC and $3,300 for ETH. This scenario requires a reduction in extreme fear sentiment, possibly driven by positive regulatory clarity from entities like the Federal Reserve.

Bearish Case: A break below Bitcoin's $86,500 invalidation level could trigger cascading liquidations, targeting the $82,000 Fibonacci support. Ethereum dropping below its $2,850 order block would validate the whale's short, pushing prices toward $2,700. This mirrors the 2021 correction where leveraged positions unwound over several weeks.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.