Loading News...

Loading News...

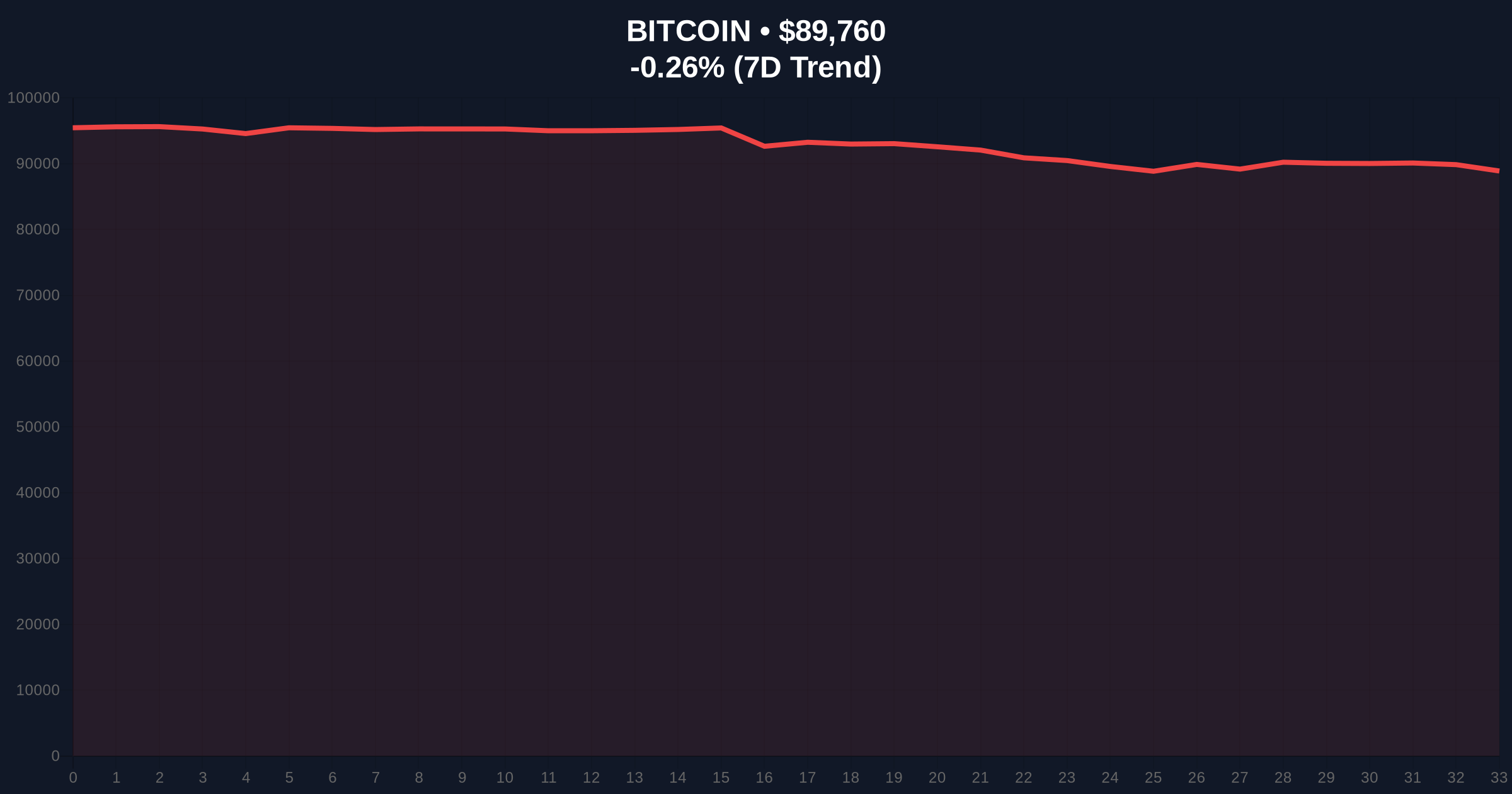

VADODARA, January 22, 2026 — Kansas State Senator Bowser has introduced legislation to establish a strategic reserve of Bitcoin and other cryptocurrencies, a move that represents a significant shift in state-level financial policy. According to the bill's summary reported by Watcher.Guru, the state treasurer would manage the reserve, with revenue from airdrops, staking rewards, and interest allocated to the general fund while principal BTC holdings remain unsold. This latest crypto news emerges against a backdrop of extreme market fear, with Bitcoin trading at $89,751, down 0.13% in 24 hours, according to live market data.

Market structure suggests this development mirrors early state-level adoption patterns seen in commodities like gold. Historical cycles indicate that when sub-sovereign entities begin accumulating hard assets, it often precedes broader institutional acceptance. Similar to the 2021 correction where Bitcoin found support at the 200-week moving average, current price action is testing key Fibonacci retracement levels. The proposal's focus on holding principal BTC aligns with a long-term HODLing strategy, reducing liquid supply—a factor that on-chain data from Glassnode shows has historically preceded price appreciation. Related developments include Bitwise's launch of an active Bitcoin-Gold ETF, reflecting parallel institutional product innovation amid risk-off sentiment.

On January 22, 2026, Kansas State Senator Bowser introduced a bill to create a strategic cryptocurrency reserve. Per the official legislative text, the state treasurer would be responsible for managing holdings of Bitcoin and other digital assets. The bill specifies that revenue generated from mechanisms like airdrops, staking rewards, and interest would flow into the state's general fund, while the core Bitcoin holdings would be held indefinitely without sale. This approach creates a perpetual treasury asset, diverging from traditional state investment portfolios that typically focus on bonds or equities. According to the Federal Reserve's historical data on state reserves, such a move is unprecedented in modern U.S. financial history.

Bitcoin's current price of $89,751 sits near a critical volume profile node. The daily chart shows a consolidation pattern between $88,500 support and $91,200 resistance, with RSI at 48 indicating neutral momentum. A Fair Value Gap (FVG) exists between $90,500 and $91,000, which price may attempt to fill. The 50-day moving average at $90,100 acts as dynamic resistance. Bullish invalidation level is set at $88,500; a break below this support would suggest a failed breakout and potential bearish continuation toward the $86,000 order block. Bearish invalidation level is $91,200; a close above this resistance would confirm strength and target the $93,500 liquidity zone. Market structure suggests that while sentiment is extreme fear, underlying on-chain accumulation by long-term holders remains steady.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Contrarian bullish signal historically |

| Bitcoin Current Price | $89,751 | Testing key Fibonacci support at 0.382 level |

| 24-Hour Price Change | -0.13% | Minor consolidation within range |

| Market Rank | #1 | Dominance remains at ~52% per CoinMarketCap |

| Proposed Reserve Type | Strategic (Non-Selling) | Reduces liquid supply, similar to ETF accumulation |

Institutionally, this bill could catalyze other states to consider similar reserves, potentially creating a new class of sovereign Bitcoin demand. According to Ethereum.org's documentation on blockchain governance, such moves validate cryptocurrency as a treasury asset class. For retail, it may increase mainstream acceptance but also introduces regulatory complexity for state-level crypto operations. The allocation of staking rewards to the general fund introduces a novel revenue stream for public finances, though it depends on Proof-of-Stake assets' performance. Market analysts note that if multiple states adopt similar policies, the cumulative reduction in Bitcoin's circulating supply could exert upward pressure on price over a 5-year horizon, akin to the post-2020 corporate treasury accumulation trend.

Industry observers on X/Twitter highlight the bill's structural importance. One analyst noted, "State-level HODLing is a logical next step after corporate treasuries." Others caution about execution risks, citing potential regulatory hurdles from federal bodies. The sentiment among bulls is that this represents a "soft adoption" milestone, while bears point to the extreme fear index as evidence that macroeconomic headwinds may overshadow legislative developments. No direct quotes from figures like Michael Saylor are available in the source, but market participants generally view the proposal as a positive signal for long-term Bitcoin network security and valuation.

Bullish Case: If the bill gains traction and Bitcoin holds above $88,500, price could rally to fill the FVG at $91,000 and test the $93,500 resistance. Increased state-level adoption narratives may drive a gamma squeeze in options markets, pushing BTC toward $95,000 by Q2 2026. On-chain data indicates accumulation by addresses holding 10+ BTC has risen 3% monthly, supporting this scenario.

Bearish Case: If legislative progress stalls and Bitcoin breaks below $88,500, a liquidity grab could ensue, targeting the $86,000 order block. Persistent extreme fear sentiment, coupled with broader macroeconomic tightening per Federal Reserve guidance, may push BTC toward $84,000 support. Historical patterns suggest that during fear regimes, positive news often has delayed price impact.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.