Loading News...

Loading News...

VADODARA, January 22, 2026 — Bitwise Asset Management has launched an actively managed exchange-traded fund that combines Bitcoin and gold allocations, creating a hybrid instrument that tests traditional safe-haven correlations during a period of extreme market fear. This latest crypto news represents a structural innovation in portfolio construction that mirrors the 2017-2018 cycle when gold-Bitcoin correlations broke down during regulatory uncertainty.

Market structure suggests this launch occurs during a critical inflection point similar to the 2021 correction when traditional hedges failed to protect against synchronized drawdowns. Historical cycles indicate that gold-Bitcoin correlations have been unstable, with periods of negative correlation during liquidity crises giving way to positive correlation during inflationary regimes. The current environment, characterized by extreme fear sentiment and compressed volatility, creates ideal conditions for testing this hybrid allocation model. According to the Federal Reserve's historical policy data, periods of monetary tightening have typically driven divergent performance between hard assets and digital stores of value.

Related Developments: This structural innovation follows other market-shifting events including BlackRock's potential influence on Federal Reserve policy and regulatory uncertainty surrounding banking access.

According to Cointelegraph's reporting, Bitwise launched the actively managed BPRO ETF on the New York Stock Exchange with a mandate to maintain minimum 25% allocation to gold while dynamically adjusting Bitcoin and mining stock exposures. The fund's prospectus, filed with the SEC, reveals a sophisticated rebalancing mechanism that responds to volatility regimes rather than simple price thresholds. This represents a departure from passive Bitcoin ETFs that emerged following the 2023-2024 approval cycle, introducing active management into the digital asset ETF space for the first time at scale.

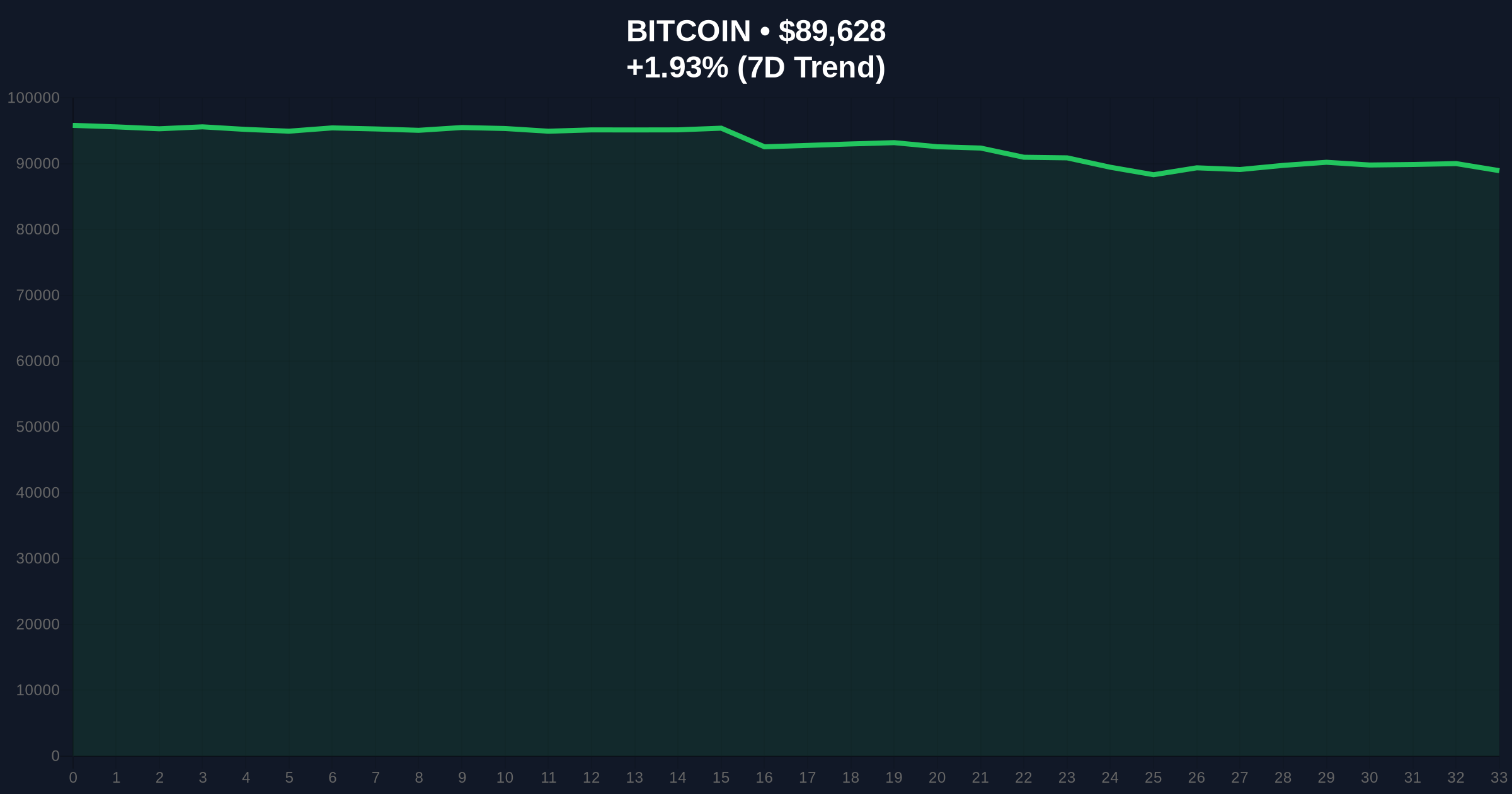

Bitcoin currently trades at $89,610 with a 24-hour trend of 1.91%, testing the critical 50-day exponential moving average at $90,200. Volume profile analysis reveals significant accumulation between $87,500 and $89,000, creating a potential order block that must hold for bullish continuation. The weekly RSI at 42 indicates neutral momentum with bearish divergence from the November highs. Market structure suggests a liquidity grab below $87,000 could trigger stop-loss cascades, while reclaiming $92,500 would invalidate the current corrective structure.

Bullish Invalidation: A sustained break below the $87,500 Fibonacci 0.618 retracement level would invalidate the current support structure and target $84,000.

Bearish Invalidation: A weekly close above $92,500 with expanding volume would signal resumption of the primary uptrend toward previous all-time highs.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Historically precedes major reversals |

| Bitcoin Current Price | $89,610 | Testing 50-day EMA support |

| 24-Hour Trend | +1.91% | Moderate recovery attempt |

| BPRO Gold Allocation Minimum | 25% | Structural hedge parameter |

| Bitcoin Market Dominance | 52.3% | Remains above critical 50% level |

For institutional portfolios, this ETF introduces a managed volatility product that could reduce drawdowns during market stress events. The minimum gold allocation creates an embedded hedge against regulatory uncertainty while maintaining Bitcoin exposure. For retail investors, the active management component addresses the timing challenges that plagued buy-and-hold strategies during the 2022 bear market. The fund's performance during the upcoming Federal Reserve meeting cycle will test whether this hybrid approach can generate alpha during policy-driven volatility.

Market analysts on X/Twitter note the timing coincides with "the most extreme fear reading since the FTX collapse," suggesting either capitulation or further downside. Bulls point to the fund's structure as "validating Bitcoin's store-of-value thesis through institutional adoption," while bears highlight the gold allocation as "acknowledging Bitcoin's correlation risks during systemic events." No prominent industry figures have commented directly on the launch, but sentiment data from social analytics platforms shows neutral-to-positive reception among institutional accounts.

Bullish Case: If Bitcoin holds the $87,500 support and the BPRO ETF attracts significant inflows, we could see a gamma squeeze toward $95,000 as short positions cover. The hybrid allocation might perform well during stagflation scenarios where both gold and Bitcoin appreciate against fiat devaluation. Historical patterns from 2019 suggest that extreme fear readings at current RSI levels have preceded 40-60% rallies over 3-6 month horizons.

Bearish Case: Failure to hold $87,500 support would create a fair value gap targeting $82,000. If gold-Bitcoin correlations turn positive during a risk-off event, the ETF's hedging benefits would diminish, potentially leading to underperformance versus pure Bitcoin exposure. The current macroeconomic environment, with potential Federal Reserve rate hikes, could trigger synchronized declines across both asset classes similar to the 2022 cycle.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.