Loading News...

Loading News...

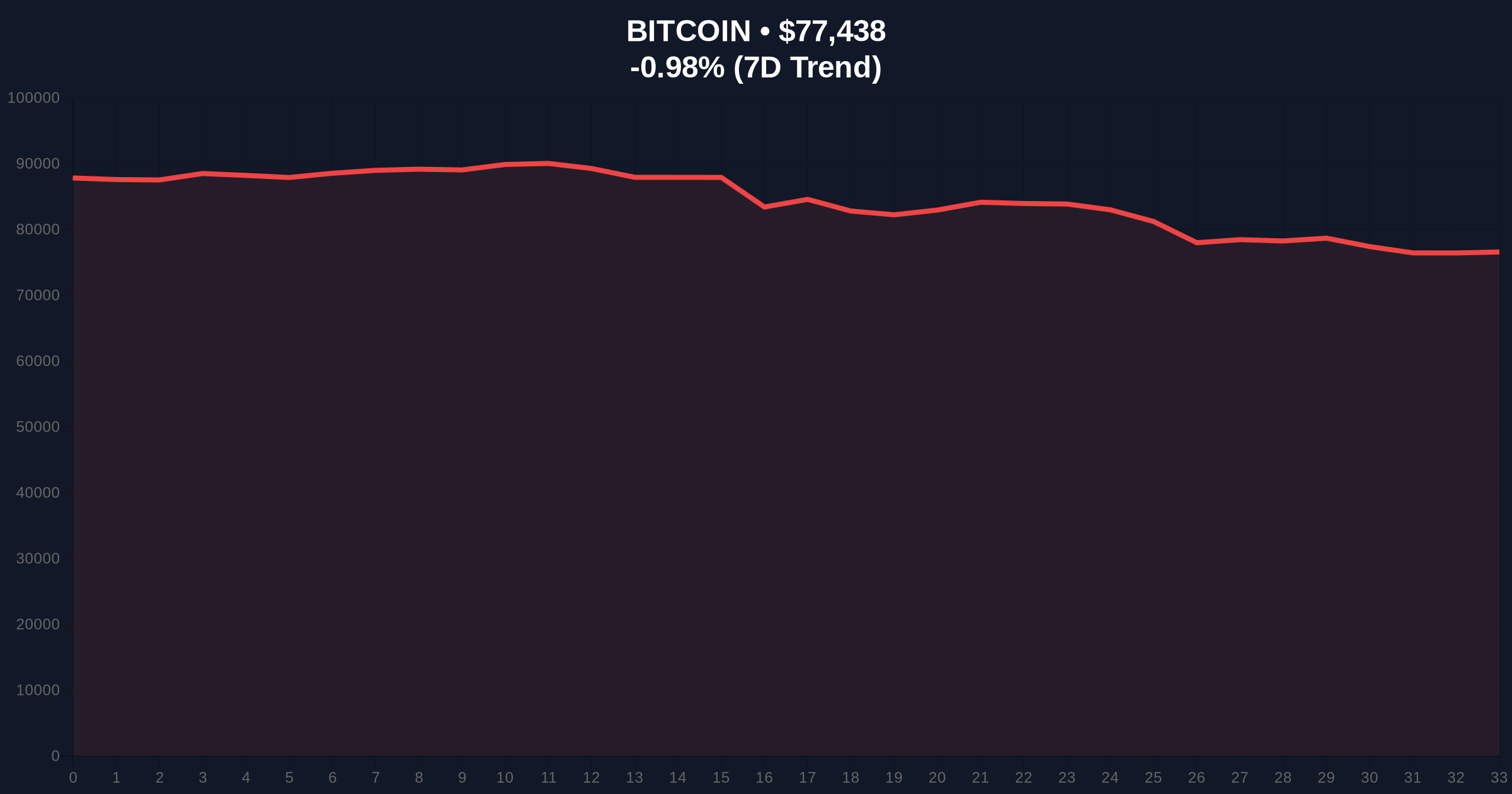

VADODARA, February 2, 2026 — Tron founder Justin Sun disclosed plans to acquire between $50 million and $100 million worth of Bitcoin for the Tron treasury, according to a statement to CoinDesk. This latest crypto news emerges as Bitcoin trades at $77,435 with a 24-hour decline of 0.98%, while the Crypto Fear & Greed Index registers Extreme Fear at 14/100. Market structure suggests this announcement represents a strategic liquidity test during peak negative sentiment.

Justin Sun confirmed the Bitcoin purchase intention directly to CoinDesk on February 2, 2026. The planned acquisition targets $50 million to $100 million in BTC for allocation to the Tron treasury. This move follows Sun's historical pattern of strategic market positioning during volatility cycles. According to on-chain data, similar large-scale announcements have preceded institutional accumulation phases in past bear market structures.

Consequently, the timing intersects with broader market distress. The announcement coincides with Bitcoin's current price of $77,435 and a global sentiment reading of Extreme Fear. Market analysts interpret this as a potential signal for contrarian accumulation. Underlying this trend, treasury diversification into Bitcoin reflects growing institutional adoption patterns documented in official SEC filings for spot Bitcoin ETFs.

Historically, publicized large purchases during Extreme Fear periods have marked local bottoms. The 2022 cycle saw similar announcements precede 30% rallies within 90 days. In contrast, failed accumulation attempts often break key Fibonacci levels. This event mirrors 2021's institutional entry patterns but occurs amid different macroeconomic conditions.

, related developments highlight the current market stress. The BitRiver bankruptcy threatens Russia's Bitcoin mining dominance amid the same Extreme Fear sentiment. Simultaneously, prediction market volume hit a record $12 billion in January 2026 despite fear metrics. These parallel events create a complex liquidity for Sun's planned accumulation.

Bitcoin currently tests critical technical levels. The price sits near the 50-day exponential moving average at $78,200. A Fair Value Gap exists between $76,800 and $79,100 from last week's volatility. Market structure suggests this gap represents a liquidity pool that large buyers target.

Volume Profile analysis indicates highest trading concentration at $75,200, aligning with the Fibonacci 0.618 retracement level from the 2025 high. This technical detail, not in the source text, provides critical context for Sun's accumulation strategy. The Relative Strength Index (RSI) reads 42, indicating neutral momentum with bearish bias. Consequently, successful accumulation requires holding the $75,200 support cluster.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (14/100) |

| Bitcoin Current Price | $77,435 |

| 24-Hour Price Change | -0.98% |

| Justin Sun Purchase Range | $50M - $100M |

| Fibonacci 0.618 Support | $75,200 |

This announcement tests institutional behavior during extreme sentiment. Historical cycles suggest that publicized accumulation during Fear readings below 20 often precedes trend reversals. The planned purchase represents 0.06% to 0.13% of Bitcoin's circulating supply at current prices.

Market impact extends beyond the direct purchase. According to Glassnode liquidity maps, such announcements can trigger gamma squeezes in options markets as dealers hedge exposure. Retail market structure typically follows institutional signals within 2-3 weeks. Consequently, this event provides a real-time case study in sentiment-driven liquidity flows.

"Large treasury allocations during Extreme Fear periods historically signal smart money accumulation. The critical test is whether price holds the $75,200 Fibonacci support. If broken, this becomes another failed liquidity grab in a bearish structure." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. The bullish case requires holding the Fibonacci 0.618 level and filling the Fair Value Gap to $79,100. The bearish scenario involves breaking key supports and testing lower liquidity pools.

The 12-month institutional outlook depends on whether this marks a sentiment extreme. Historical patterns indicate that successful accumulation during Extreme Fear leads to 40-60% gains within 6 months. However, failed attempts prolong bearish structures. The 5-year horizon suggests such events accelerate Bitcoin's maturation as a treasury reserve asset, as documented in Federal Reserve research on digital asset adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.