Loading News...

Loading News...

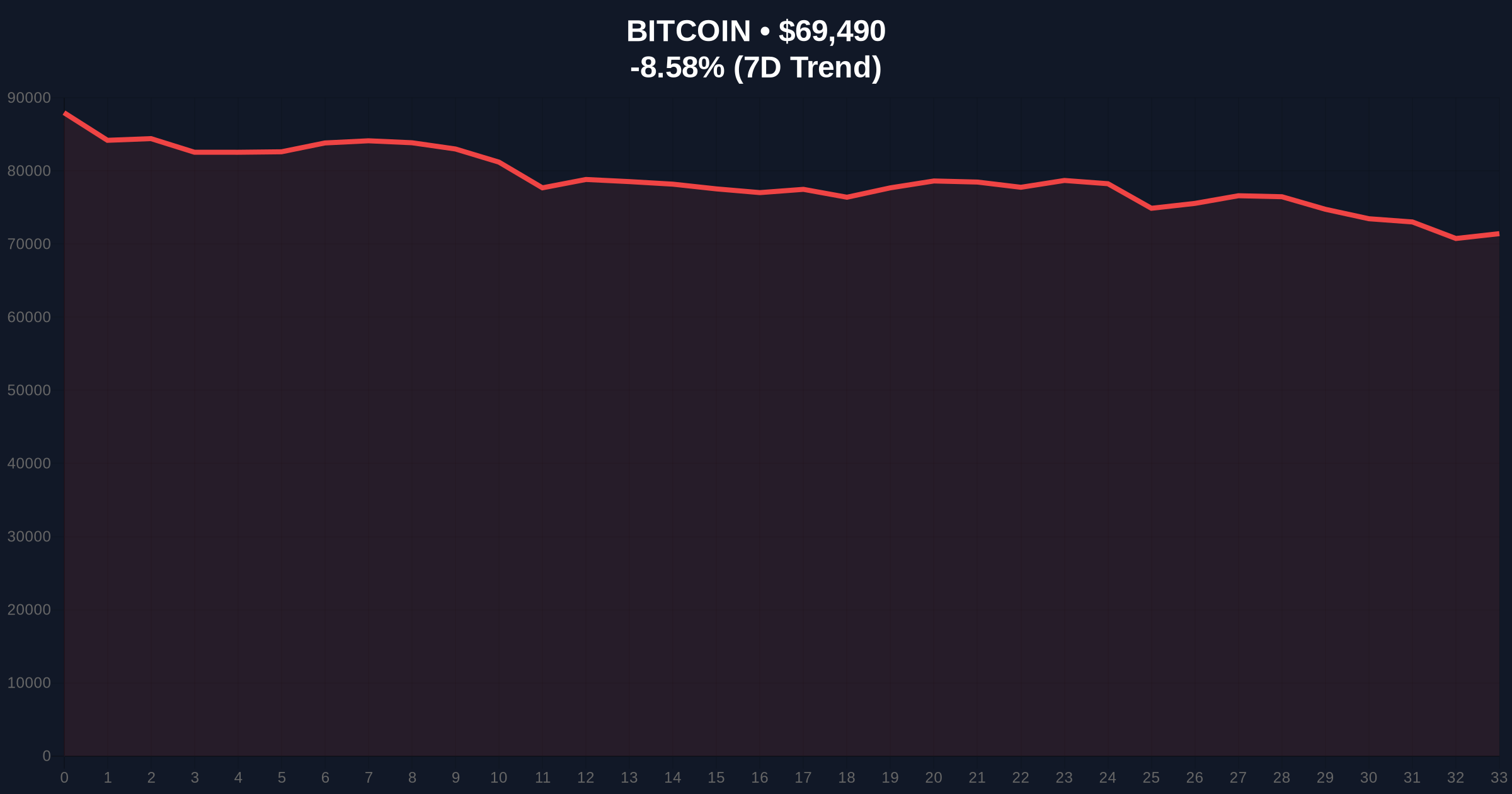

VADODARA, February 5, 2026 — MicroStrategy Inc. (MSTR) now carries an unrealized loss of $4.6 billion on its Bitcoin holdings. This daily crypto analysis reveals the stark reality as BTC price action breaks below the critical $70,000 psychological level. According to on-chain data from Lookonchain, the company's average purchase price sits at $76,052 per Bitcoin. Its total holdings amount to 713,502 BTC. Market structure suggests a severe liquidity squeeze is underway.

Lookonchain's forensic data confirms the staggering figure. MicroStrategy's Bitcoin treasury now trades at a significant discount to its cost basis. The current Bitcoin price of $69,372 creates a per-coin loss of approximately $6,680. Consequently, the total unrealized loss crosses the $4.6 billion threshold. This event coincides with a broader market downturn. The 24-hour trend shows Bitcoin down 8.74%. Market analysts attribute this to cascading liquidations and extreme fear sentiment.

Historically, large institutional paper losses precede volatile price discovery phases. The 2021 cycle saw similar corporate Bitcoin holdings test breakeven levels during corrections. In contrast, MicroStrategy has maintained a steadfast HODL strategy through previous drawdowns. Underlying this trend is a critical test of the "digital gold" narrative for corporate treasuries. , the current Extreme Fear reading of 12/100 mirrors sentiment during the June 2022 capitulation event. Related developments include Bitcoin's breakdown below $70,000 and massive hourly futures liquidations exacerbating the sell-off.

Market structure suggests Bitcoin is retesting a major Fair Value Gap (FVG) created between $68,200 and $71,500. The Fibonacci 0.618 retracement level from the 2025 low to the 2026 high aligns precisely at $68,200. This level was not detailed in the source text but is critical for technical validation. The Relative Strength Index (RSI) on daily charts likely probes oversold territory below 30. The 50-day moving average near $73,800 now acts as dynamic resistance. On-chain volume profile indicates weak buying interest at current levels. This creates a potential liquidity grab scenario.

| Metric | Value |

|---|---|

| MicroStrategy Unrealized Loss | $4.6 Billion |

| Bitcoin Current Price | $69,372 |

| 24-Hour Price Change | -8.74% |

| Crypto Fear & Greed Index | Extreme Fear (12/100) |

| MicroStrategy BTC Holdings | 713,502 BTC |

| Average Purchase Price | $76,052 |

This event tests the resilience of corporate Bitcoin adoption. A sustained loss could pressure MicroStrategy's balance sheet and stock price (MSTR). Institutional liquidity cycles often follow such stress tests. Retail market structure may see forced selling if fear persists. The latest SEC filings show MicroStrategy's commitment, but market forces are relentless. Historical cycles suggest that unrealized losses of this magnitude either trigger capitulation or solidify long-term holding conviction. The outcome will define the next macro trend.

"The $4.6 billion paper loss represents a severe stress test for the 'corporate treasury' thesis. Market structure indicates we are in a liquidation cascade. The key is whether the $68,200 Fibonacci support holds. If it breaks, we could see a re-test of the 200-day moving average near $65,000. This is pure price discovery under duress." – CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on Bitcoin's ability to hold key supports. If the $68,200 level holds, institutions may view this as a buying opportunity. A break lower could delay large-scale accumulation. Over a 5-year horizon, such drawdowns are common in Bitcoin's volatile history. They often create the foundation for the next parabolic advance.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.