Loading News...

Loading News...

VADODARA, January 30, 2026 — JPMorgan Chase & Co. has released a report indicating Bitcoin futures are in an oversold condition, driven by a capital rotation from cryptocurrencies to precious metals. This daily crypto analysis reveals a significant shift in investor behavior, with both retail and institutional players favoring gold and silver ETFs over Bitcoin. According to The Block, the report highlights a stagnation in Bitcoin ETF inflows since Q4 2025, contrasting with surging gold ETF investments.

JPMorgan's analysis, sourced from market data and ETF flow trackers, shows a clear divergence starting in August 2025. Individual investors previously engaged in a 'debasement trade,' buying both Bitcoin and gold ETFs to hedge against currency devaluation. However, by Q4 2025, cumulative inflows into Bitcoin ETFs declined, while gold ETF inflows spiked. Institutional investors amplified this trend, moving capital more aggressively into precious metals. Market structure suggests this rotation reflects a reevaluation of Bitcoin's role as a risk-off asset.

Historically, Bitcoin and gold have shown periods of correlation during macroeconomic uncertainty, such as the 2020-2021 inflation surge. In contrast, the current decoupling indicates a potential breakdown in Bitcoin's 'digital gold' thesis. Underlying this trend is a broader risk-aversion cycle, mirrored in the Extreme Fear sentiment gripping crypto markets. Related developments include Bitwise's long-term Bitcoin prediction and WisdomTree's AUM growth, highlighting conflicting signals in a fearful market.

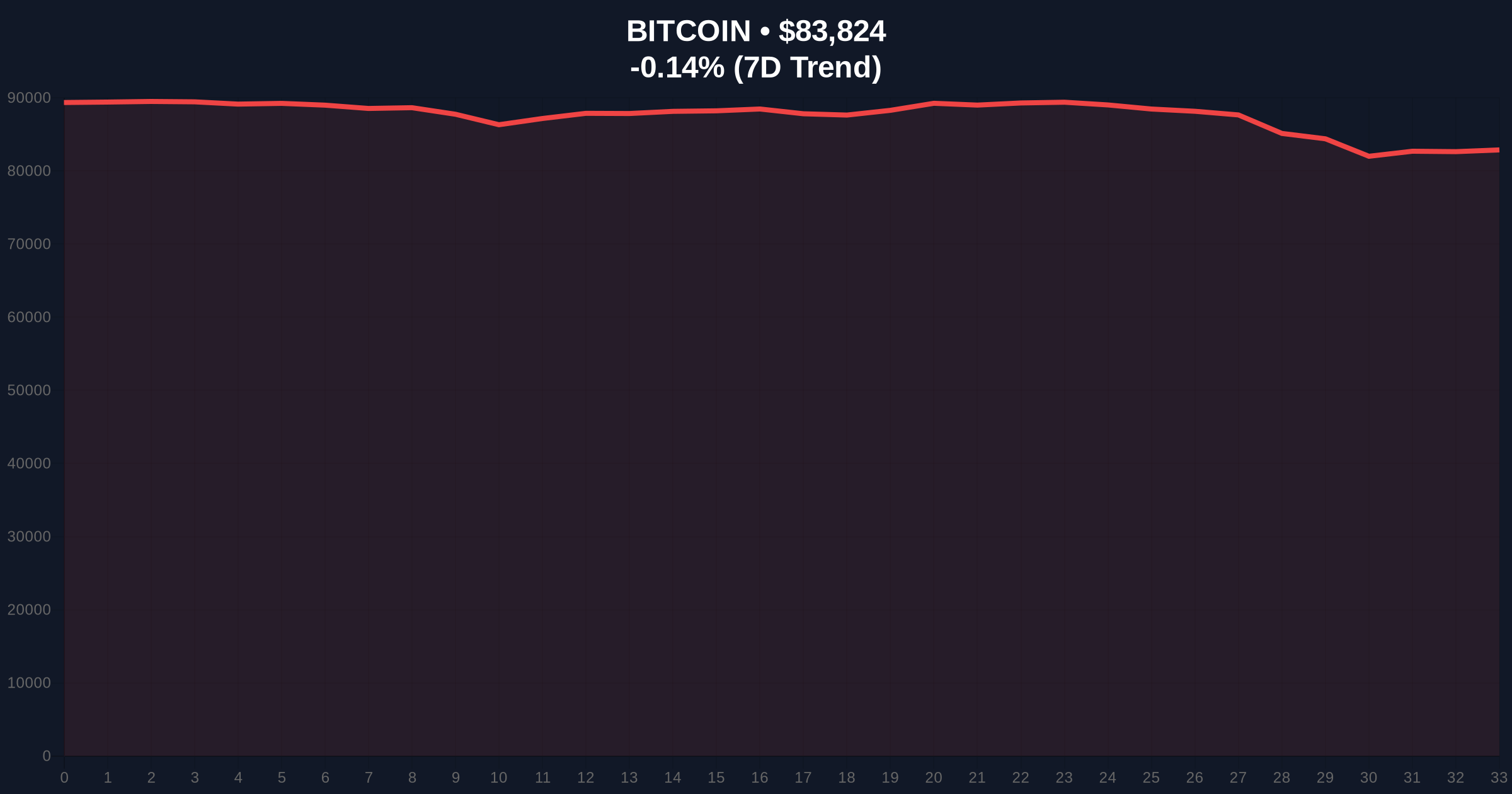

Bitcoin's current price of $83,815 sits near critical technical levels. On-chain data indicates a Fair Value Gap (FVG) between $85,000 and $88,000, a zone where liquidity was previously grabbed. The oversold futures condition, per JPMorgan, aligns with a Relative Strength Index (RSI) dipping below 30 on daily charts. , Fibonacci retracement levels from the 2025 high show support at $82,000 (0.618 level), a key invalidation point. If this support fails, it could trigger a cascade of stop-loss orders, exacerbating the sell-off.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | High risk-aversion, potential buying opportunity if reversed |

| Bitcoin Current Price | $83,815 | Testing key support levels |

| 24-Hour Trend | -0.15% | Minor decline, but oversold futures suggest underlying weakness |

| Gold ETF Inflows (Q4 2025) | Surged vs. Bitcoin | Capital rotation confirmed by flow data |

| Bitcoin Futures Position | Oversold | Contrarian signal; could precede a short squeeze |

This shift matters because it challenges Bitcoin's institutional adoption narrative. If capital exits Bitcoin for gold, it undermines the asset's store-of-value proposition. Real-world evidence includes stagnating Bitcoin ETF inflows, which contrast with record gold ETF purchases. Institutional liquidity cycles now favor traditional havens, potentially reshaping market structure for years. Retail sentiment, as seen in the Extreme Fear index, may follow suit, leading to further outflows.

"The data indicates a tactical rotation, not a structural abandonment. However, if Bitcoin fails to hold the $82k support, we could see a prolonged reallocation phase. Market participants should monitor UTXO age bands for signs of long-term holder distribution," said the CoinMarketBuzz Intelligence Desk.

Two data-backed scenarios emerge from current market structure. First, a bullish reversal if Bitcoin holds support and futures oversold conditions trigger a short-covering rally. Second, a bearish continuation if the rotation to gold accelerates, breaking key technical levels.

Over the next 12 months, institutional outlook hinges on macroeconomic factors like interest rates and inflation. If gold continues to outperform, Bitcoin may struggle to regain its hedge status. For a 5-year horizon, this event could signal a maturation phase where Bitcoin's correlation with risk assets increases, diverging from gold.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.