Loading News...

Loading News...

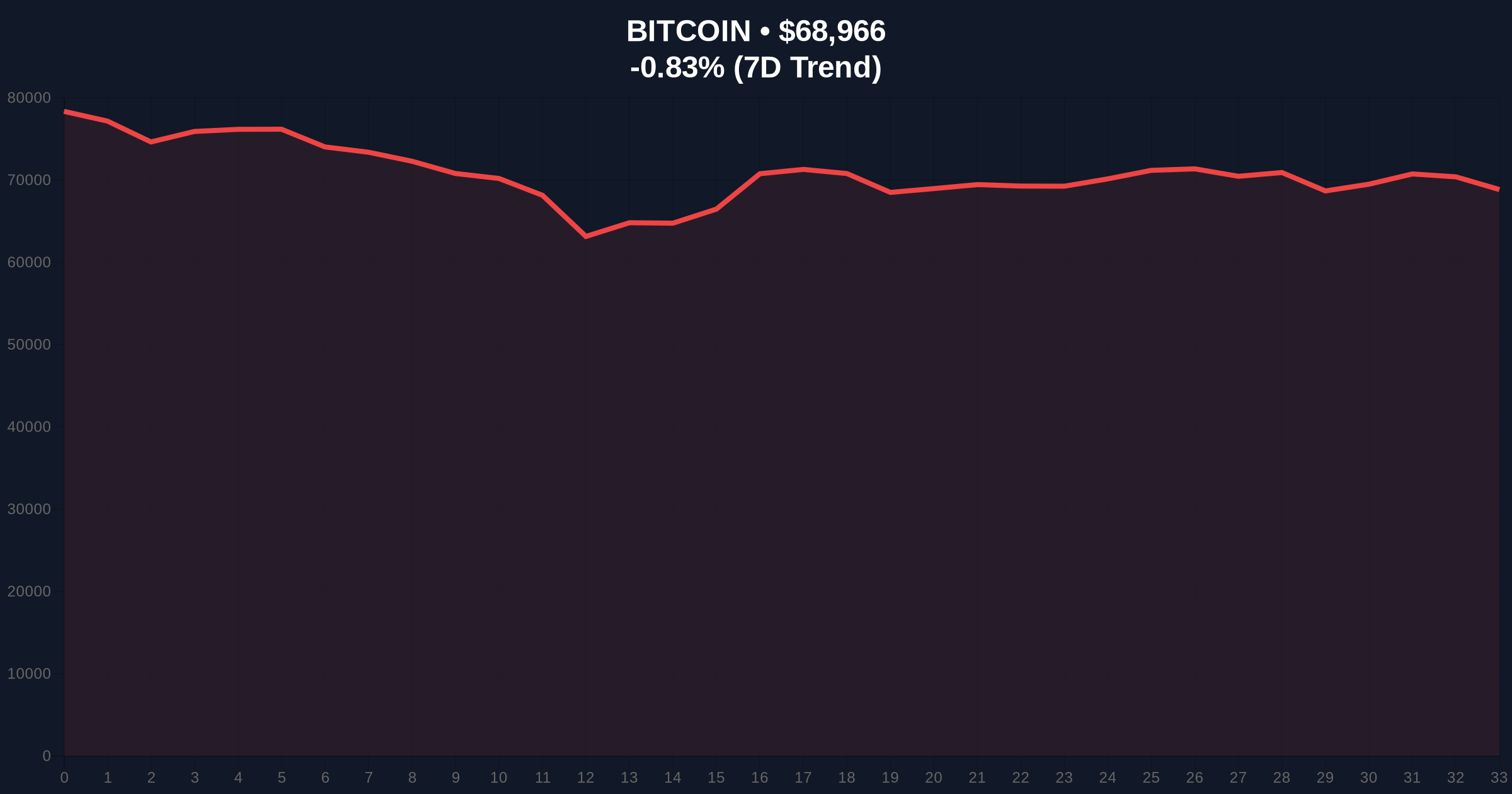

VADODARA, February 10, 2026 — Bitcoin has not yet entered its capitulation phase and faces potential further price declines, according to derivatives analysis from Amberdata. This latest crypto news highlights a critical divergence between current market conditions and historical bottoming patterns, with the 90-day futures basis holding at approximately 4%. Market structure suggests this level aligns too closely with risk-free yields, failing to signal the extreme pessimism typically required for a sustainable reversal.

Greg Magadini, Director of Derivatives at Amberdata, identifies the futures basis as a key indicator for Bitcoin market bottoms. According to his analysis, Bitcoin historically bottoms when the basis—the difference between futures and spot prices—widens significantly into negative territory. During the 2022 bear market, 90-day futures traded at a 9% discount to spot price. In contrast, current data shows no significant basis expansion. The 90-day basis remains around 4%, comparable to yields on risk-free government bonds like U.S. Treasuries. Consequently, Magadini warns that if futures traders begin liquidating positions, Bitcoin could experience additional downward pressure.

Historically, Bitcoin capitulation phases coincide with basis discounts exceeding 5%. The 2018-2019 cycle saw basis discounts reach 12% during the $3,200 bottom. Underlying this trend is the psychology of leveraged traders: extreme negative basis reflects forced selling and maximum pain. Currently, the 4% basis suggests complacency or structural hedging rather than panic. , this occurs amid a Global Crypto Fear & Greed Index reading of 9/100—Extreme Fear—creating a dissonance between sentiment surveys and derivatives pricing. In contrast, past bottoms aligned both metrics.

Related developments in decentralized finance highlight how market stress is driving innovation elsewhere. For instance, Reya Network recently launched an ultra-fast DEX on a Based rollup, optimizing for capital efficiency during volatile periods. Similarly, Ledger's integration with OKX DEX reflects a push for secure self-custody solutions as traders hedge counterparty risk.

Bitcoin currently trades at $69,021, down 0.99% in 24 hours. Technical analysis reveals a critical support cluster between $65,000 and $67,000, corresponding to the 0.618 Fibonacci retracement level from the 2025 high. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum without oversold extremes. Volume profile analysis shows weak accumulation at current levels, suggesting lack of institutional buying. Market structure suggests a break below $65,000 would invalidate the current consolidation and target the $60,000 psychological zone. On-chain data from Glassnode indicates UTXO (Unspent Transaction Output) age bands show increased movement from 3-6 month holders, signaling distribution rather than hodling.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Current Price | $69,021 | -0.99% 24h change |

| 90-Day Futures Basis | ~4% | No capitulation signal vs. historical 9%+ discounts |

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Sentiment disconnect from derivatives pricing |

| RSI (Daily) | 42 | Neutral, not oversold |

| Critical Support | $65,000 | 0.618 Fibonacci level |

This analysis matters because it challenges the narrative that current fear levels guarantee a bottom. The basis metric acts as a liquidity thermometer for institutional derivatives books. A 4% basis suggests futures traders still price in moderate forward premium, possibly due to structural arbitrage or hedging demand. Consequently, a sudden unwind could create a liquidity grab, exacerbating declines. Institutional cycles typically resolve when basis extremes flush out weak leverage. Without that flush, the market risks a prolonged distribution phase. Retail market structure, often driven by spot holdings, may decouple from derivatives-led moves, creating asymmetric volatility.

The absence of basis expansion is a red flag for anyone expecting an immediate V-shaped recovery. Historically, bottoms require futures traders to capitulate, which we haven't seen yet. The current 4% basis is essentially pricing in risk-free returns, not panic.

— CoinMarketBuzz Intelligence Desk synthesis of institutional derivatives analysis.

Market structure suggests two primary scenarios based on basis behavior and technical levels.

The 12-month institutional outlook hinges on macroeconomic factors like Federal Reserve policy, detailed in official Federal Reserve communications, and Bitcoin ETF flows. If basis remains compressed, the market may experience sideways action with lower highs. A resolution could come via a volatility spike that finally widens the basis, setting the stage for a new accumulation phase. Over a 5-year horizon, this period may be viewed as a necessary deleveraging event before the next halving-driven cycle.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.