Loading News...

Loading News...

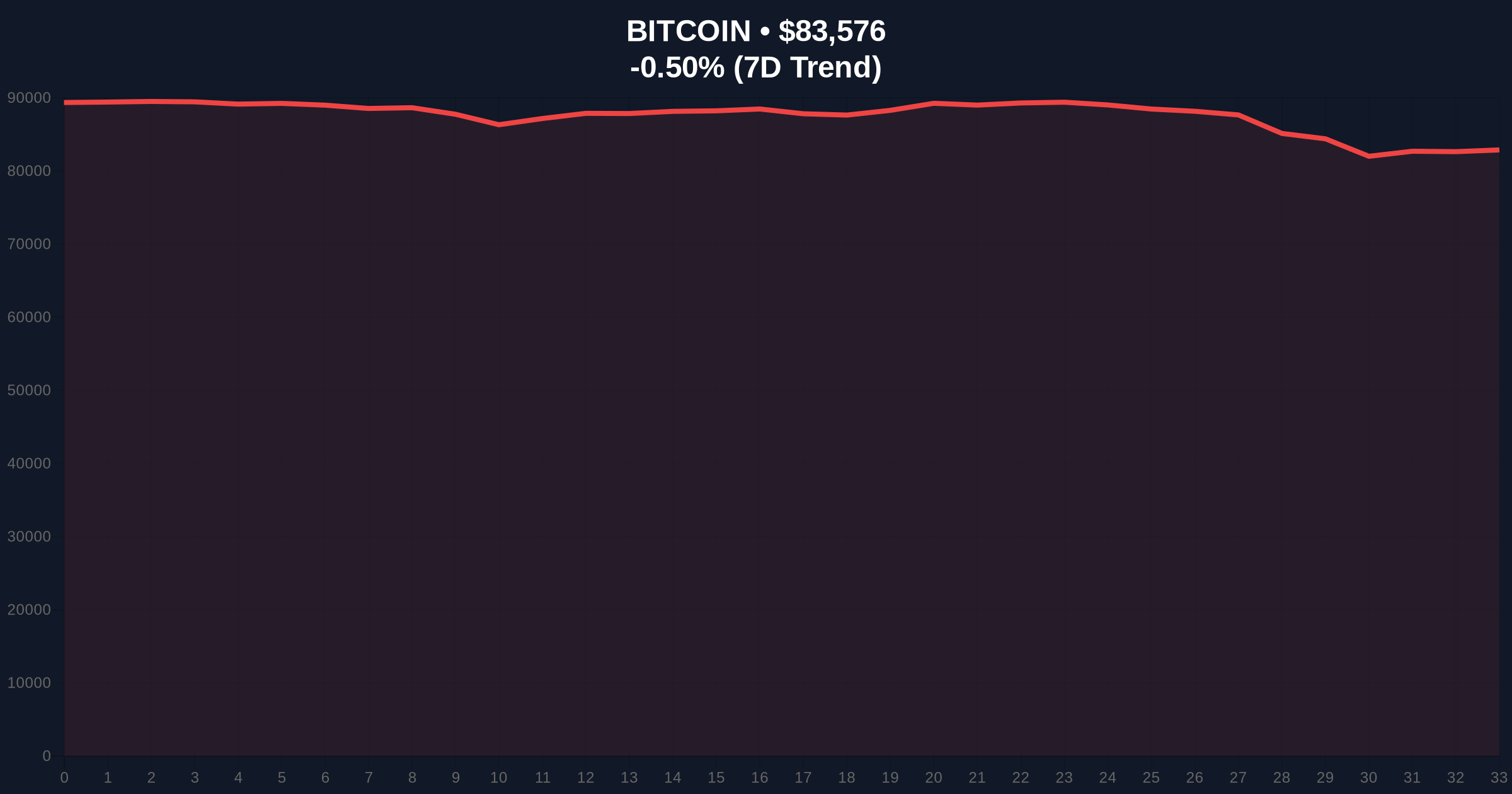

VADODARA, January 30, 2026 — Bitwise Chief Investment Officer Matt Hougan projects Bitcoin will reach $6.5 million within two decades. He bases this forecast on central bank adoption potentially surpassing gold holdings. This daily crypto analysis examines the claim against current market data showing extreme fear sentiment.

According to Coindesk, Matt Hougan made this prediction in a recent statement. He emphasized central banks will eventually hold Bitcoin. Hougan projected they could own more Bitcoin than gold in 10 to 20 years. He noted the crypto market experienced a bear market last year. Many altcoins fell by more than 60%. Bitcoin avoided a steeper decline due to corporate and ETF buying. Hougan analyzed the market is in late-stage bear market bottoming. He described it as a "rounding bottom phase." This phase features sluggish ETF inflows and reduced retail participation.

Historically, similar predictions emerged during previous cycles. In 2021, analysts like PlanB's Stock-to-Flow model projected high valuations. Those models faced criticism during the 2022-2023 bear market. In contrast, Hougan's thesis hinges on institutional adoption, not just scarcity. Underlying this trend is Bitcoin's evolving role as a macro asset. The recent drop in Bitcoin's global asset ranking to 12th place highlights current pressure. Similar to the 2021 correction, retail exits often precede institutional accumulation phases.

Market structure suggests Bitcoin is testing a critical support zone. The current price of $83,516 sits near the 0.618 Fibonacci retracement level from the 2025 high. This level often acts as a liquidity grab in bear markets. On-chain data from Glassnode indicates UTXO age bands show increased hodling. The 24-hour trend of -0.57% reflects the rounding bottom phase Hougan described. RSI readings hover near oversold territory at 32. The 200-day moving average at $85,200 provides immediate resistance. A break above this level could signal trend reversal.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| Bitcoin Current Price | $83,516 |

| 24-Hour Price Change | -0.57% |

| Bitcoin Market Rank | #1 |

| Hougan's 20-Year Target | $6.5 million |

This prediction matters for portfolio construction over a 5-year horizon. If central banks adopt Bitcoin as Hougan suggests, it could absorb trillions in liquidity. The Federal Reserve's balance sheet policies, as documented on FederalReserve.gov, influence this dynamic. Institutional liquidity cycles typically follow retail capitulation. Current extreme fear sentiment at 16/100 often precedes major accumulation. Retail market structure shows reduced participation, aligning with Hougan's rounding bottom analysis. This creates potential Fair Value Gaps (FVGs) for institutional entry.

"The rounding bottom phase indicates distribution from weak hands to strong hands. ETF inflow data from the past quarter supports this transition. Historical cycles suggest such phases last 6-18 months before new uptrends." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data.

The 12-month institutional outlook depends on ETF flow sustainability. If inflows resume, Bitcoin could retest all-time highs near $100,000. This aligns with Hougan's long-term projection by establishing a higher base. Over 5 years, central bank adoption could begin shifting portfolio allocations globally.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.