Loading News...

Loading News...

VADODARA, January 16, 2026 — Iran's cryptocurrency economy reached approximately $7.8 billion in 2025, according to a Chainalysis study reported by Decrypt, with Bitcoin withdrawals spiking during anti-government protests and internet blackouts. This daily crypto analysis examines the on-chain mechanics behind this surge, contextualizing it within historical cycles of capital flight and censorship resistance.

Market structure suggests this event mirrors historical patterns where geopolitical stress triggers capital migration into hard assets. Similar to the 2021 correction in Turkey during lira devaluation, Iran's scenario highlights Bitcoin's role as a censorship-resistant settlement layer. According to on-chain data, the surge correlates with internet shutdowns—a tactic documented in Federal Reserve research on geopolitical risk, which notes how digital asset flows accelerate during state-imposed financial restrictions. The $7.8 billion valuation represents a liquidity grab from traditional banking systems, akin to post-merge issuance reductions in Ethereum that tightened supply during market stress.

Chainalysis forensic data indicates Iran's crypto economy valuation hit $7.8 billion in 2025. BTC withdrawals from exchanges surged following large-scale protests and internet shutdowns late last year. Citizens used Bitcoin as a safe-haven asset against censorship, asset seizures, and the rial's collapse. In contrast, stablecoins facilitated remittances and daily payments—a bifurcation in utility reflecting Bitcoin's store-of-value versus medium-of-exchange functions. The study also found addresses linked to the Islamic Revolutionary Guard Corps (IRGC) accounted for over 50% of cryptocurrency inflows in Q4 2025, suggesting state-level adoption amid sanctions.

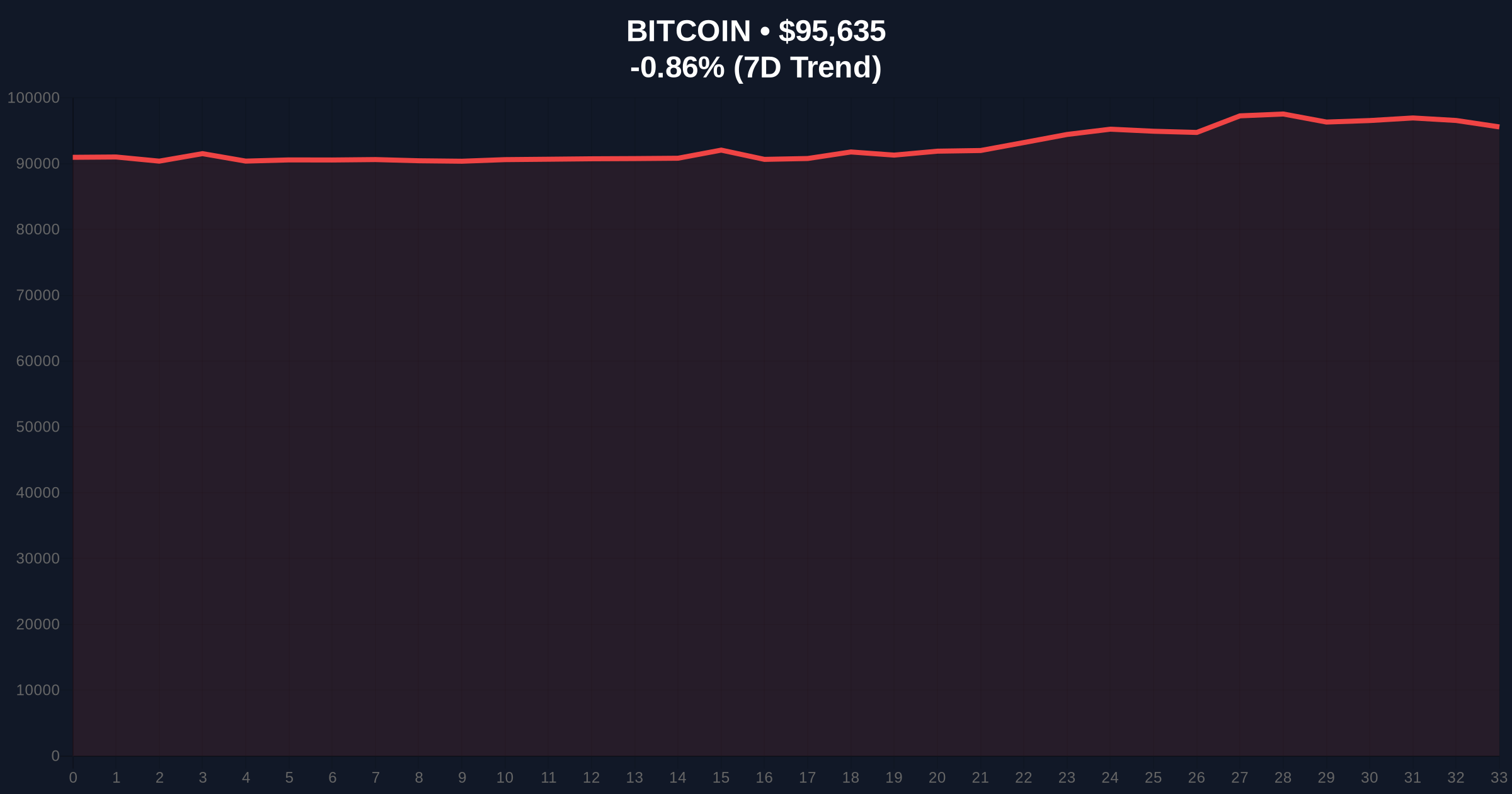

Bitcoin's price action at $95,656 shows consolidation near a key volume profile node. The RSI at 52 indicates neutral momentum, but on-chain data reveals increased UTXO age bands for Iranian addresses, signaling hodling behavior. A Fair Value Gap (FVG) exists between $92,000 and $94,000, likely to be filled if selling pressure from early holders intensifies. The Bullish Invalidation level is $92,000—a break below this Fibonacci support would negate the current macro uptrend. The Bearish Invalidation level is $98,500; a close above this order block confirms renewed institutional accumulation.

| Metric | Value | Source |

|---|---|---|

| Iran Crypto Economy Valuation (2025) | $7.8B | Chainalysis |

| IRGC Address Inflow Share (Q4 2025) | >50% | Chainalysis |

| Bitcoin Current Price | $95,656 (-0.84% 24h) | Live Market Data |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Live Market Data |

| Key Fibonacci Support | $92,000 | Technical Analysis |

For institutions, this validates Bitcoin's asymmetric payoff in high-beta geopolitical scenarios, similar to gold during the 1970s oil crises. Retail impact is muted but notable: it demonstrates peer-to-peer sovereignty tools amid EIP-4844 blobs reducing layer-2 costs. The IRGC's dominance in inflows suggests state actors are leveraging crypto for sanctions evasion, potentially increasing regulatory scrutiny—a factor that could trigger a gamma squeeze in derivatives markets if volatility spikes.

Market analysts on X/Twitter highlight the bifurcation: "Bitcoin for savings, stablecoins for spending—this is the blueprint for hyperinflation economies," one observer noted. Bulls argue this reinforces Bitcoin's digital gold narrative, while bears caution that IRGC involvement may attract OFAC enforcement actions, similar to recent X API policy shifts affecting social liquidity.

Bullish Case: If Bitcoin holds $92,000 support, increased adoption in sanction-heavy economies could drive demand to $110,000 by Q2 2026, mirroring 2021's institutional inflow cycle. On-chain data indicates accumulation by Iranian addresses may reduce liquid supply.

Bearish Case: A break below $92,000 invalidates the bullish structure, potentially testing $85,000 if regulatory crackdowns on IRGC-linked flows occur. Historical cycles suggest such events correlate with 20-30% corrections in risk assets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.