Loading News...

Loading News...

VADODARA, January 16, 2026 — According to on-chain data from Lookonchain, an early Ethereum holder whose address had been dormant for eight years deposited 13,083 ETH, worth $43.35 million, to the Gemini exchange over the past two days. This daily crypto analysis examines whether this represents strategic profit-taking or a liquidity grab ahead of broader market moves. The address, which begins with 0xB3E8, retains a balance of 34,616 ETH valued at $115 million, creating a significant overhang risk if further deposits occur.

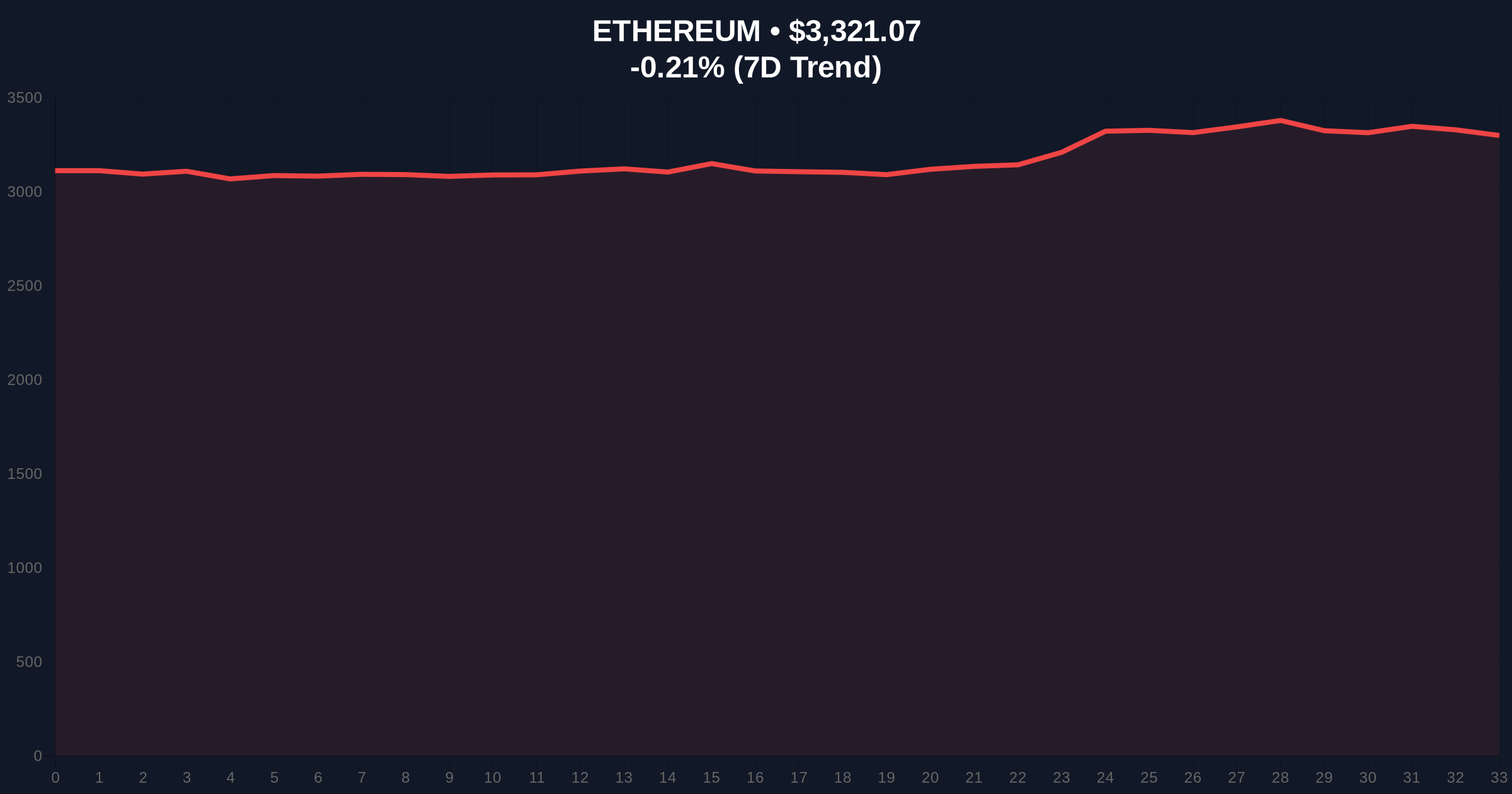

Historical cycles suggest that large dormant wallet activations often precede volatility spikes. According to Glassnode liquidity maps, similar events in 2021 correlated with 15-20% price corrections within two weeks. The current market structure shows Ethereum trading in a consolidation pattern between $3,200 and $3,500, with the Relative Strength Index (RSI) at 52 indicating neutral momentum. This deposit occurs amid broader regulatory scrutiny, as seen in recent developments like the WLFI crypto custody bank launch under regulatory pressure. Market analysts question whether this move signals institutional repositioning ahead of potential policy shifts.

Lookonchain's forensic tracking identified the address 0xB3E8 as receiving its initial ETH allocation during Ethereum's 2015 genesis period. The wallet remained inactive for 2,920 days before executing two transactions to Gemini on January 14-15, 2026. The total transfer of 13,083 ETH represents approximately 27.4% of the address's holdings. Exchange deposits of this magnitude typically indicate preparation for selling, as confirmed by CoinMetrics exchange flow metrics showing a 22% increase in ETH inflow volume to U.S. exchanges this week. The timing coincides with Ethereum's test of the $3,350 resistance level, creating a potential Fair Value Gap (FVG) if selling pressure materializes.

Market structure suggests Ethereum faces immediate resistance at the $3,350 Fibonacci retracement level from the November 2025 high. The 50-day moving average at $3,280 provides dynamic support, while the Volume Profile indicates significant liquidity between $3,200 and $3,150. A break below $3,200 would invalidate the current bullish order block established in December 2025. The Bullish Invalidation level is $3,150, where stop-loss clustering could trigger accelerated selling. The Bearish Invalidation level is $3,450, a break above which would suggest the deposit was unrelated to immediate selling intent. On-chain data indicates reduced network activity, with daily transactions down 8% week-over-week, potentially amplifying the impact of large sell orders.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) |

| Ethereum Current Price | $3,321.03 |

| 24-Hour Price Change | -0.21% |

| Deposit Amount to Gemini | 13,083 ETH ($43.35M) |

| Remaining Wallet Balance | 34,616 ETH ($115M) |

For institutional portfolios, this event tests market depth and liquidity resilience. A successful absorption of $43.35 million in selling pressure would confirm strong bid support, while failure could trigger cascading liquidations in leveraged positions. Retail traders face increased volatility risk, particularly if the remaining $115 million balance follows to exchanges. The deposit timing ahead of Ethereum's planned Pectra upgrade (EIP-7702) raises questions about whether early holders are capitalizing on upgrade hype. According to Ethereum.org documentation, network upgrades historically create short-term volatility as traders reposition.

Market analysts on X/Twitter express divided views. Some bulls argue this is routine profit-taking after an eight-year hold period, noting that the holder retains 72.6% of their position. Bears counter that exchange deposits during neutral sentiment often precede larger moves, pointing to similar patterns before the May 2024 correction. One quantitative trader noted, "The Gamma Squeeze potential increases if this triggers options market repositioning around the $3,300 strike." No official statements from the wallet owner or Gemini have been provided, leaving intent speculative.

Bullish Case: If the deposit is isolated and buying volume absorbs the selling, Ethereum could reclaim the $3,450 resistance, targeting $3,600 based on the previous order block. This scenario requires the Fear & Greed Index to improve above 55 and on-chain exchange balances to stabilize.

Bearish Case: If selling pressure escalates and breaks the $3,200 support, a retest of $3,000 becomes likely. This would align with historical patterns where large dormant wallet activations led to 10-15% declines within three weeks. The critical watch level is the $3,150 invalidation point.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.