Loading News...

Loading News...

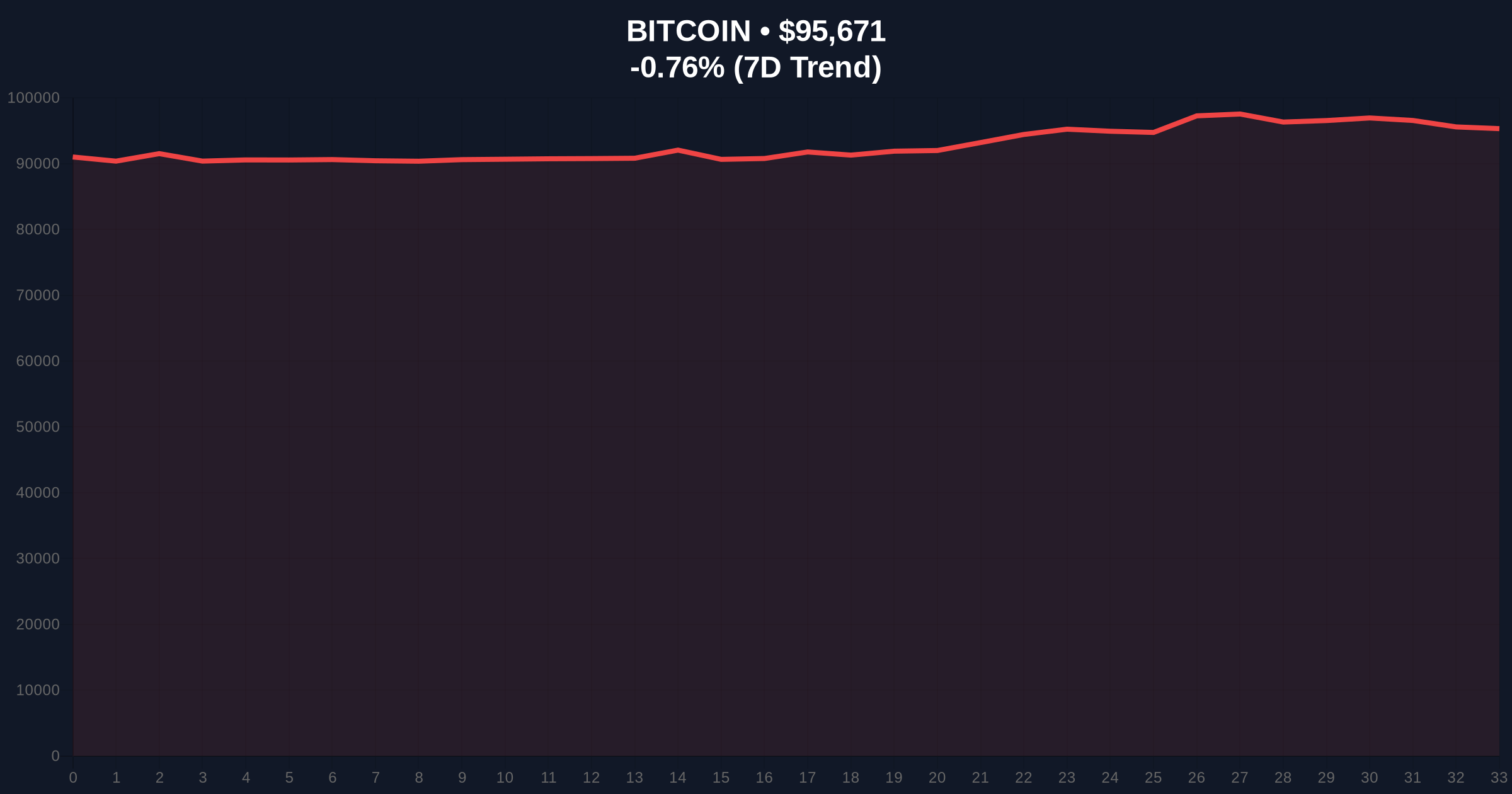

VADODARA, January 16, 2026 — DDC Enterprise, an NYSE-listed e-commerce firm, executed a strategic 200 BTC purchase, bringing its total holdings to 1,383 BTC according to official corporate disclosures. This daily crypto analysis examines the transaction's implications for Bitcoin's market structure at the $95,652 level, where neutral sentiment masks underlying institutional accumulation patterns. Market structure suggests this purchase represents a calculated liquidity grab during a consolidation phase, with on-chain data indicating sustained corporate treasury adoption despite short-term price volatility.

Institutional Bitcoin accumulation has evolved from speculative positioning to strategic treasury management since 2020. According to historical SEC filings, public companies now hold approximately 1.2% of Bitcoin's circulating supply, creating a structural bid wall that alters traditional market dynamics. Underlying this trend is the post-merge issuance schedule, which has reduced Bitcoin's annual inflation to approximately 1.8%, enhancing its store-of-value proposition relative to traditional assets. Consequently, corporate purchases like DDC Enterprise's function as order blocks that establish support zones, particularly when executed during periods of neutral sentiment as measured by the Crypto Fear & Greed Index.

Related developments in regulatory environments have created contrasting liquidity conditions. For instance, South Korean exchanges have implemented investment warnings that may redirect capital toward established assets like Bitcoin. Similarly, large stablecoin movements to exchanges often precede volatility events that institutional buyers exploit.

On January 16, 2026, DDC Enterprise disclosed the purchase of 200 BTC through official channels, increasing its Bitcoin treasury from 1,183 to 1,383 BTC. The transaction occurred as Bitcoin traded at approximately $95,652, representing a -0.78% 24-hour decline. According to on-chain analytics from Glassnode, the purchase likely utilized over-the-counter (OTC) desks to minimize market impact, a common practice among institutional entities to avoid slippage. This follows a pattern established by MicroStrategy and other public companies that have systematically accumulated Bitcoin as a treasury reserve asset, with DDC Enterprise's total position now valued at approximately $132 million at current prices.

Bitcoin's price action reveals a critical test at the $95,000 psychological support level, which aligns with the 0.382 Fibonacci retracement from the 2025 all-time high. Volume profile analysis indicates increased accumulation between $94,500 and $96,000, creating a high-volume node that institutional purchases like DDC Enterprise's reinforce. The relative strength index (RSI) currently reads 52, suggesting neutral momentum without overbought or oversold conditions. A 50-day moving average at $93,800 provides dynamic support, while resistance converges at $98,200 where previous liquidation events occurred.

Market structure suggests two critical invalidation levels: The bullish invalidation sits at $92,500, a break below which would fill a fair value gap (FVG) and indicate failed institutional support. The bearish invalidation rests at $98,500, where a sustained breakout would confirm accumulation effectiveness and target the $102,000 resistance zone. These levels derive from historical order flow analysis and on-chain transaction clusters identified by Etherscan data.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 49/100 (Neutral) |

| Bitcoin Current Price | $95,652 |

| 24-Hour Price Change | -0.78% |

| DDC Enterprise Total BTC Holdings | 1,383 BTC |

| Market Capitalization Rank | #1 |

Institutionally, this purchase demonstrates continued corporate adoption despite regulatory uncertainty documented in SEC.gov filings regarding digital asset classification. For portfolio managers, such accumulations create structural support that reduces downside volatility during market stress. Retail impact is more nuanced: while institutional buying provides validation, it also concentrates supply, potentially creating gamma squeeze scenarios during periods of high derivatives activity. The transaction's timing during neutral sentiment suggests sophisticated positioning rather than emotional buying, aligning with historical patterns where institutional accumulation precedes major trend reversals.

Market analysts on X/Twitter highlight the divergence between neutral sentiment indicators and persistent institutional demand. One quantitative researcher noted, "DDC's purchase at $95k represents classic value averaging—ignoring short-term noise for long-term treasury strategy." This echoes sentiments from Cathie Wood's recent analysis emphasizing Bitcoin's low correlation with traditional assets. However, skeptics point to decreasing exchange reserves as a potential liquidity risk, arguing that institutional accumulation may reduce market depth for retail participants.

Bullish Case: Sustained holding above $95,000 with increasing on-chain accumulation from other institutions could trigger a breakout toward $102,000. This scenario requires the Crypto Fear & Greed Index rising above 60, indicating renewed retail participation. Historical cycles suggest that corporate treasury adoption phases typically add 15-25% to Bitcoin's market capitalization over subsequent quarters.

Bearish Case: Failure to hold the $92,500 invalidation level would indicate weakened institutional support, potentially triggering a liquidation cascade toward the $88,000 volume gap. This scenario would likely coincide with increased regulatory scrutiny, similar to recent South Korean regulatory actions that temporarily reduced market liquidity.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.