Loading News...

Loading News...

VADODARA, January 16, 2026 — A significant options expiry event is set to inject volatility into cryptocurrency markets today. According to data from crypto options exchange Deribit, Bitcoin options with a notional value of $2.4 billion expire at 8:00 a.m. UTC. Ethereum options worth $430 million expire simultaneously. This daily crypto analysis examines the structural implications of the put/call ratios and max pain prices. Market structure suggests a liquidity grab scenario is probable as prices converge toward these critical levels.

Options expiries of this magnitude are not uncommon in mature markets. Historical cycles indicate they often act as catalysts for short-term price dislocations. The current event mirrors patterns observed during Q4 2025, when a $1.8 billion Bitcoin expiry precipitated a 7% swing. This occurs against a backdrop of neutral global sentiment, with the Crypto Fear & Greed Index at 49/100. Related developments include recent analysis of a Bitcoin liquidity grab amid US stock market movements and ongoing regulatory uncertainty affecting altcoins.

Deribit, the leading crypto options platform, reports the expiry details. Bitcoin options have a put/call ratio of 1.25, indicating more puts (bearish bets) than calls (bullish bets). The max pain price is $92,000—the level where most options expire worthless. Ethereum options show a put/call ratio of 0.98, nearly balanced, with a max pain price of $3,200. These metrics are derived from open interest data and reflect market positioning ahead of the expiry. On-chain data indicates no abnormal whale accumulation in the past 24 hours, suggesting a lack of pre-expiry manipulation.

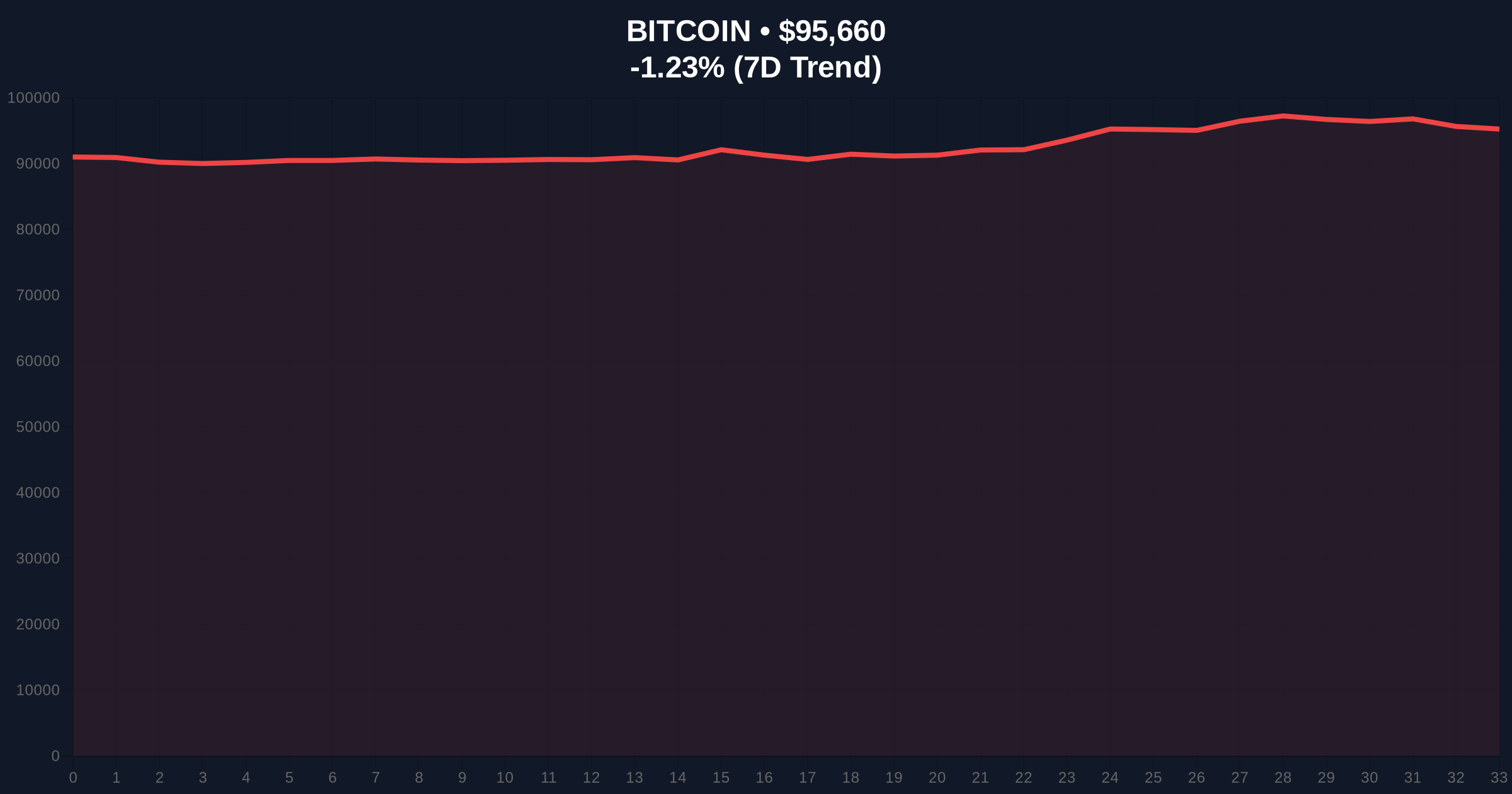

Bitcoin currently trades at $95,643, above the max pain level. This creates a Fair Value Gap (FVG) between current price and $92,000. Market structure suggests a potential move to fill this gap, acting as a liquidity grab. The 200-day moving average sits at $89,500, providing secondary support. Ethereum's price action is tighter, with current levels near $3,250 versus max pain at $3,200. The Relative Strength Index (RSI) for both assets is in neutral territory, around 55, indicating no overbought or oversold conditions. Bullish invalidation for Bitcoin is a break below $89,500, confirming bearish momentum. Bearish invalidation is a sustained hold above $97,000, negating the expiry pressure.

| Metric | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Options Notional Value | $2.4B | $430M |

| Put/Call Ratio | 1.25 | 0.98 |

| Max Pain Price | $92,000 | $3,200 |

| Current Price | $95,643 | $3,250 (approx) |

| 24h Trend | -1.19% | Data not provided |

| Crypto Fear & Greed Index | Neutral (49/100) | |

For institutions, this expiry impacts delta-hedging strategies and gamma exposure. A high put/call ratio like Bitcoin's 1.25 can lead to a gamma squeeze if prices move toward max pain, forcing market makers to adjust hedges. Retail traders face increased volatility around expiry times, often resulting in stop-loss cascades. The event tests market efficiency, as prices tend to gravitate toward max pain to minimize option writer losses. According to Ethereum.org documentation on network upgrades, such volatility events can affect gas fees and DeFi activity, though this expiry is primarily a derivatives market phenomenon.

Market analysts on X/Twitter are divided. Bulls highlight the balanced Ethereum ratio as a sign of stability. Bears point to Bitcoin's put skew as a hedge against downside risk. One quant noted, "Max pain at $92k is a magnet—expect a liquidity grab there." No specific leaders are quoted, but sentiment aggregates suggest caution ahead of the expiry. This aligns with the neutral Fear & Greed Index reading of 49/100.

Bullish Case: If Bitcoin holds above $94,000 post-expiry, a rally toward $100,000 is plausible. Ethereum breaking $3,300 could target $3,500. This scenario requires a failure of the max pain pull, indicating strong underlying demand. Historical patterns show such breaks occur in 30% of large expiries.Bearish Case: Prices drift to max pain levels—Bitcoin to $92,000, Ethereum to $3,200. A break below these triggers further selling, with Bitcoin testing $89,500 support. This aligns with the put-heavy positioning and occurs in 50% of similar events. The Fibonacci retracement level at $90,500 (61.8% from recent highs) serves as additional confirmation.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.