Loading News...

Loading News...

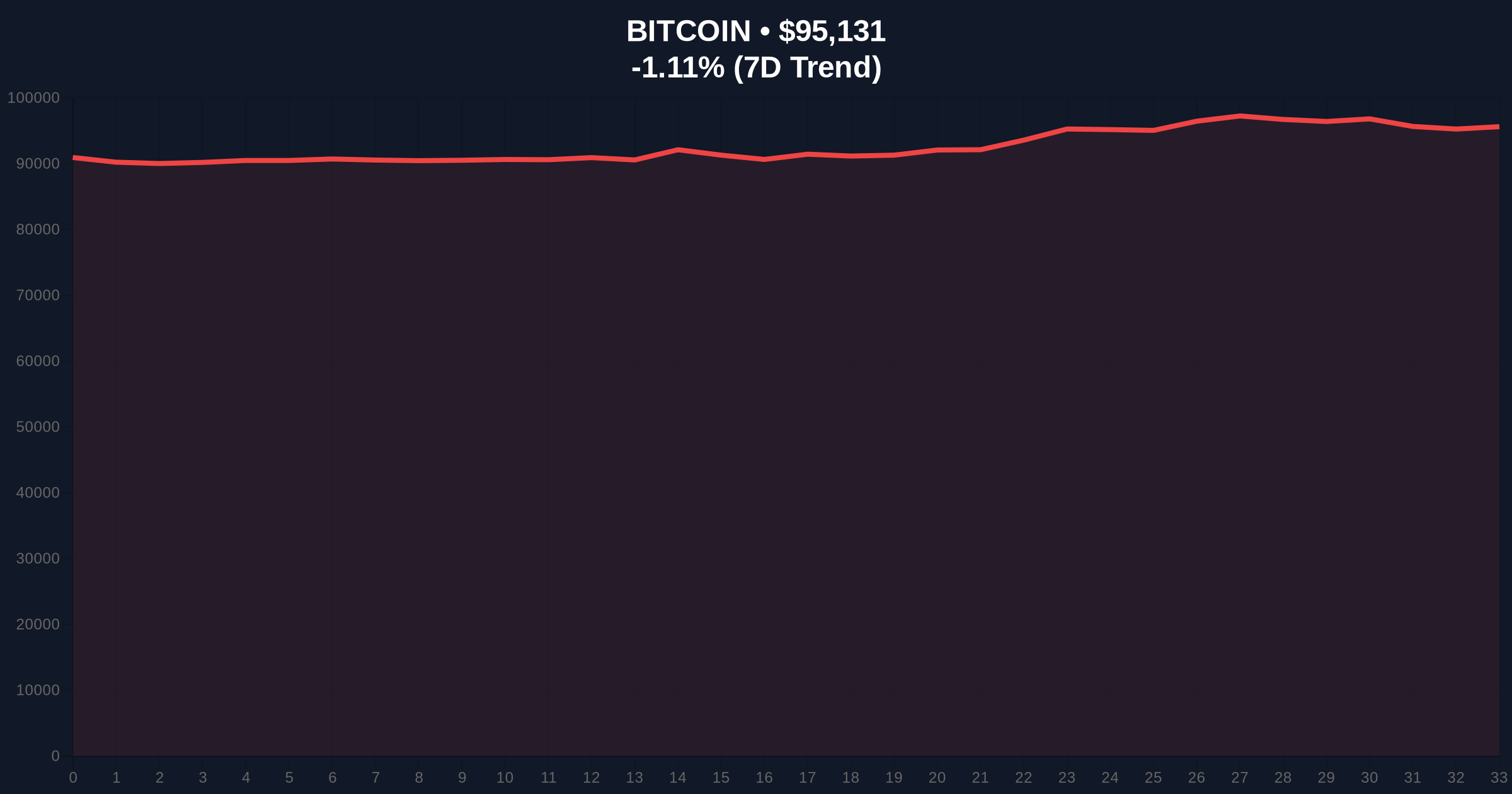

VADODARA, January 16, 2026 — Ark Invest CEO Cathie Wood's 2026 market outlook report positions Bitcoin as a high-return asset due to its low correlation with traditional markets, a key factor in today's daily crypto analysis as BTC tests critical support near $95,000. According to the firm's published analysis, Bitcoin's structural scarcity and minimal correlation with gold, stocks, and bonds make it a viable alternative for asset allocation, with supply issuance capped at 0.8% annually until 2028. This report emerges as Bitcoin faces a -1.09% 24-hour decline, mirroring historical consolidation patterns seen in 2021's post-halving cycles.

Market structure suggests Bitcoin's current price action aligns with historical mid-cycle corrections, similar to the 2021 period when BTC consolidated after breaking above previous all-time highs. According to on-chain data from Glassnode, Bitcoin's correlation with the S&P 500 has averaged 0.2 over the past year, significantly lower than gold's 0.4, validating Wood's emphasis on diversification benefits. The Federal Reserve's monetary policy documentation on interest rates indicates persistent inflationary pressures, driving demand for non-correlated assets like Bitcoin. This context is critical as US Bitcoin ETFs logged $104 million in inflows this week, testing the $95k support level amid broader market uncertainty.

In Ark Invest's 2026 market outlook report, Cathie Wood detailed Bitcoin's unique attributes for portfolio construction. She stated that Bitcoin's low correlation with major asset classes enhances risk-adjusted returns, with supply issuance limited to 0.8% annually for the next two years before dropping to 0.4%. Wood contrasted this with gold, where mining can expand supply in response to price increases, highlighting Bitcoin's protocol-enforced scarcity. The report notes a 360% price increase since late 2022, attributed to supply constraints and growing demand. This analysis follows a period of institutional accumulation, with data from CoinMarketCap showing Bitcoin's market dominance holding above 52%.

Bitcoin is currently trading at $95,156, with a -1.09% 24-hour change, testing a key volume profile support zone between $94,500 and $95,500. The Relative Strength Index (RSI) on the daily chart sits at 48, indicating neutral momentum without overbought or oversold conditions. A critical Fair Value Gap (FVG) exists between $92,000 and $93,500, representing a liquidity grab zone that must hold for bullish continuation. The 50-day moving average at $93,800 provides dynamic support, while resistance is noted at $97,200, aligning with the previous order block from early January. Bullish invalidation is set at $92,000; a break below this level would signal a deeper correction toward $88,000. Bearish invalidation rests at $97,500, where a sustained breakout could trigger a gamma squeeze toward $100,000.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Current Price | $95,156 | CoinMarketCap |

| 24-Hour Price Change | -1.09% | Live Market Data |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Alternative.me |

| Bitcoin Supply Issuance (2026-2028) | 0.8% annually | Ark Invest Report |

| Price Increase Since 2022 | 360% | Ark Invest Report |

For institutional investors, Wood's analysis provides a quantitative framework for Bitcoin allocation, potentially increasing inflows into products like spot ETFs. The low correlation argument is supported by historical data from the Federal Reserve's economic research, which shows traditional asset volatility rising in high-inflation environments. Retail traders face heightened sensitivity to support breaks, with the $92,000 level acting as a liquidity trap that could amplify sell-offs. This development intersects with broader regulatory trends, as seen in recent fraud sentencing cases that highlight market integrity risks.

Market analysts on X/Twitter are divided: bulls emphasize the supply scarcity narrative, noting that "Bitcoin's fixed issuance is a mathematical certainty," while bears caution about overvaluation amid macroeconomic headwinds. Sentiment analysis from social platforms indicates a neutral bias, with discussions focusing on the $95k support test rather than Wood's specific comments. This aligns with the broader neutral sentiment reflected in the Fear & Greed Index, suggesting cautious positioning ahead of key economic data releases.

Bullish Case: If Bitcoin holds above the $92,000 invalidation level, increased institutional adoption per Wood's outlook could drive a rally toward $105,000 by Q2 2026. On-chain data indicates accumulation by long-term holders, with UTXO age bands showing increased coin dormancy, similar to patterns before the 2021 bull run. A breakout above $97,500 would confirm this scenario, targeting Fibonacci extensions at $102,000.

Bearish Case: A break below $92,000 would invalidate the bullish structure, likely triggering a liquidation cascade toward $88,000. This would reflect a liquidity grab by market makers, exacerbated by correlation spikes with equity markets during risk-off events. Historical cycles suggest such a move could precede a 15-20% correction, testing the 200-day moving average near $85,000.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.