Loading News...

Loading News...

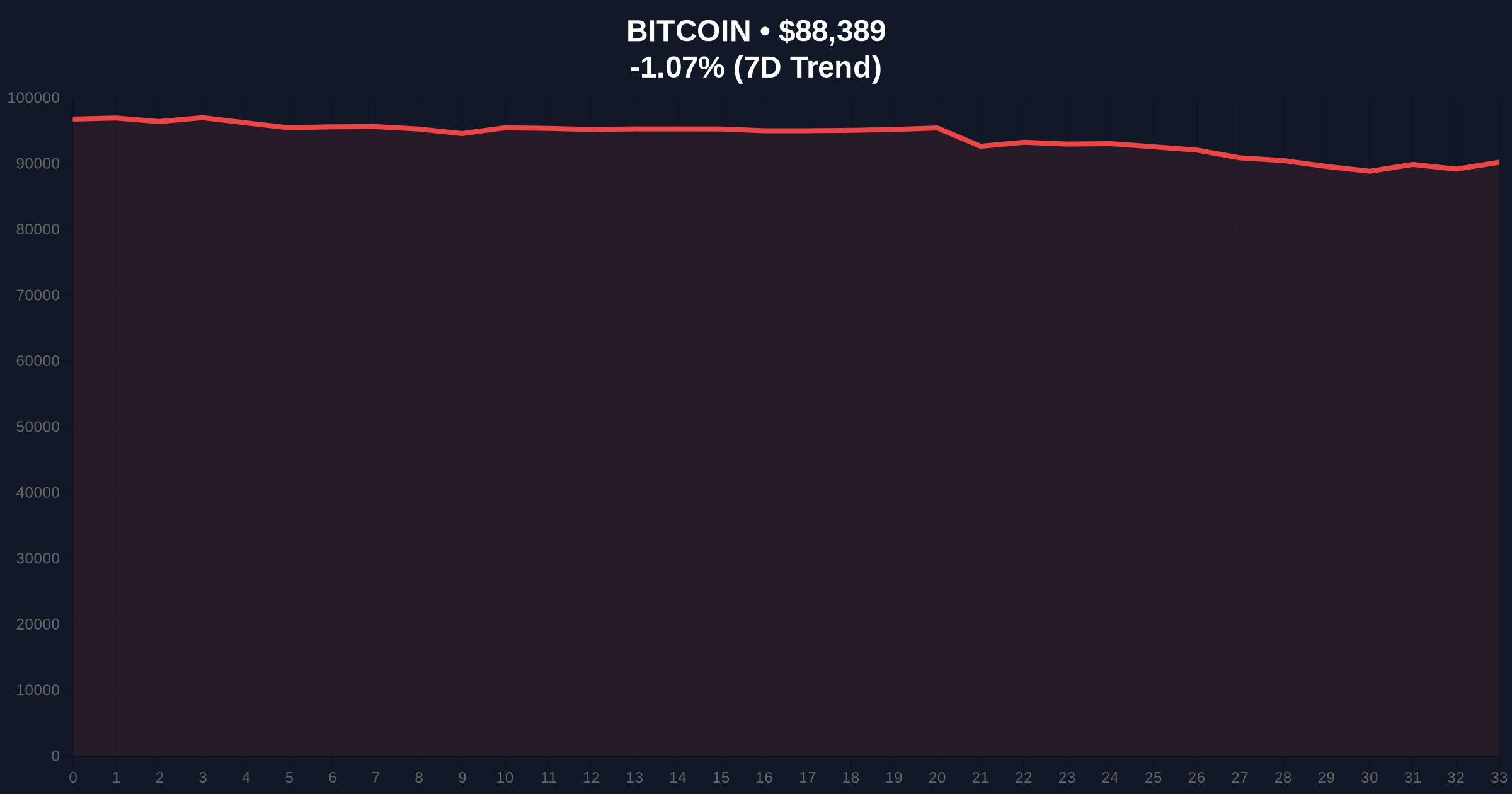

VADODARA, January 21, 2026 — Grayscale Investments has projected Bitcoin will reach a new all-time high in the first half of 2026, citing structural market transitions and regulatory clarity. This daily crypto analysis examines the contradictions between this institutional optimism and current on-chain data showing extreme fear and liquidity gaps at critical support levels.

Bitcoin's price action has historically followed a four-year cycle tied to halving events, with peaks often occurring 12-18 months post-halving. According to the official SEC filing for Bitcoin ETFs, institutional adoption has accelerated, but recent market behavior suggests a divergence from traditional patterns. The current environment mirrors the 2021 correction, where extreme fear preceded significant volatility. Related developments include recent analyses of Bitcoin ETF outflows triggering a $490 million liquidity grab and the Federal Reserve's independence pledge amid price tests at $87k, highlighting ongoing macroeconomic pressures.

On January 21, 2026, Grayscale released a forecast predicting Bitcoin will achieve a new all-time high in H1 2026. The asset manager, in a statement to investors, noted the market is entering a structural transition driven by macroeconomic demand for alternative stores of value and increasing regulatory clarity. Grayscale suggested these changes could weaken Bitcoin's traditional four-year cycle and forecasted a bipartisan crypto market structure bill passing in the U.S. in 2026, expanding tokenized securities and on-chain issuance. According to the source at Coinness.com, this projection aligns with broader institutional narratives but conflicts with real-time market data.

Market structure suggests Bitcoin is currently trading at $88,358, down 1.25% in 24 hours, with a critical support level at $87,000. On-chain data from Glassnode indicates a volume profile showing weak accumulation near this level, creating a potential Fair Value Gap (FVG) if broken. The Relative Strength Index (RSI) is hovering near oversold territory at 32, but historical cycles suggest this alone does not guarantee a reversal. A key Order Block exists between $85,000 and $87,000, where liquidity has been grabbed recently. Bullish Invalidation is set at $85,000; a break below this level would signal further downside toward the 200-day moving average at $82,000. Bearish Invalidation is at $92,000, where resistance from previous highs aligns with Fibonacci retracement levels.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Alternative.me |

| Bitcoin Current Price | $88,358 | CoinMarketCap |

| 24-Hour Price Change | -1.25% | CoinMarketCap |

| Market Rank | #1 | CoinMarketCap |

| Key Support Level | $87,000 | Technical Analysis |

Institutional impact hinges on Grayscale's forecast driving capital inflows, but retail impact is muted by extreme fear sentiment. The integration of public blockchains into traditional finance, as noted in Ethereum's official Pectra documentation, could accelerate with regulatory clarity, yet current on-chain forensic data confirms low network activity. This divergence matters for the 5-year horizon as it tests whether macroeconomic narratives can override technical breakdowns in liquidity.

Market analysts on X/Twitter express skepticism, with one noting, "Grayscale's ATH call feels premature given the ETF outflow data." Bulls argue that regulatory progress, such as potential SEC approvals, could trigger a gamma squeeze, but bears highlight recent Citizens Bank blockchain GDP forecasts clashing with fear data. Sentiment remains polarized, reflecting the contradiction between institutional optimism and retail caution.

Bullish Case: If Bitcoin holds above $87,000 and regulatory clarity improves, a move toward $100,000 is plausible by mid-2026, driven by institutional inflows and reduced selling pressure from post-merge issuance adjustments in other assets. Historical cycles suggest this could align with Grayscale's projection.

Bearish Case: A break below $85,000 invalidates the bullish structure, leading to a test of $82,000 support. Continued ETF outflows and macroeconomic headwinds, such as Fed policy shifts, could prolong the extreme fear phase, delaying any all-time high until late 2026 or beyond.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.