Loading News...

Loading News...

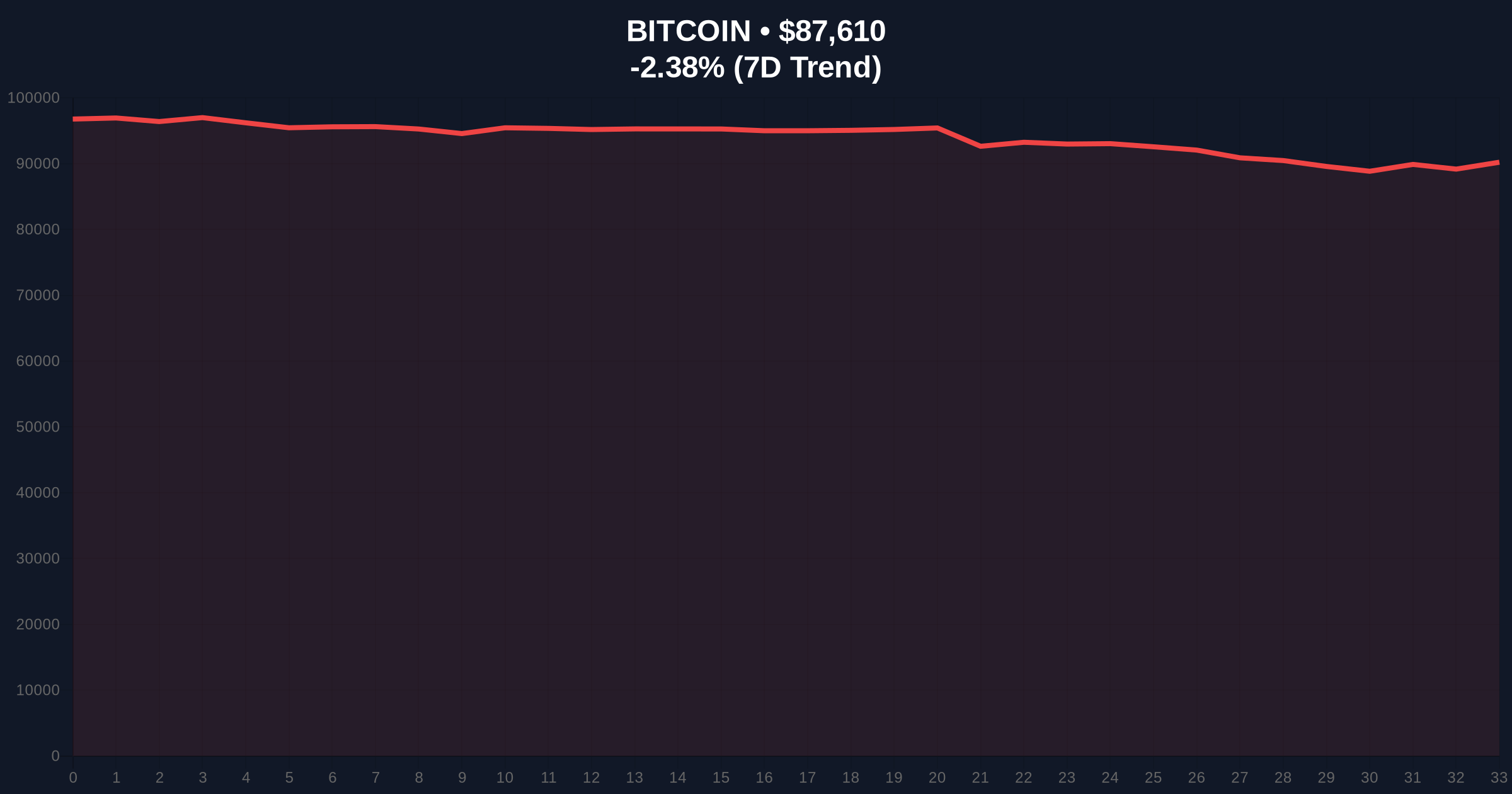

VADODARA, January 21, 2026 — Federal Reserve Governor Lisa Cook's public commitment to defend central bank independence collides with cryptocurrency markets experiencing Extreme Fear sentiment, creating a complex macro backdrop for today's daily crypto analysis. According to the official Federal Reserve announcement, Cook pledged to maintain the institution's autonomy throughout her tenure, a statement that arrives as Bitcoin tests critical support at $87,659 following a 2.33% 24-hour decline.

Federal Reserve independence debates historically correlate with increased market volatility, particularly during periods of monetary policy transition. The current environment mirrors the 2021-2022 tightening cycle when Bitcoin's 60-day correlation with the S&P 500 reached 0.78 before decoupling during the 2024 halving cycle. Underlying this trend is the structural relationship between Fed policy credibility and risk asset valuations, where perceived central bank autonomy typically supports longer-duration assets. Consequently, Cook's statement represents a defensive posture against potential political interference that could destabilize forward guidance mechanisms.

Related developments in this regulatory climate include banking sector resistance to proposed crypto legislation and diverging economic forecasts from blockchain-based GDP models.

Federal Reserve Governor Lisa Cook explicitly committed to defending the central bank's operational independence, according to her public statement. This declaration follows increasing political scrutiny of Fed decision-making processes, particularly regarding interest rate policy and balance sheet management. The timing coincides with cryptocurrency markets registering Extreme Fear on the sentiment index at 24/100, while Bitcoin faces a technical test of the $87,000 support zone. Market structure suggests this confluence creates a potential Liquidity Grab scenario where weak hands exit positions ahead of potential macro volatility.

Bitcoin's current price action at $87,659 represents a test of the weekly Volume Profile Point of Control (POC). The 4-hour chart shows a developing Fair Value Gap (FVG) between $89,200 and $90,100 that requires filling for bullish continuation. Relative Strength Index (RSI) readings at 38.7 indicate neither oversold nor overbought conditions, while the 50-day Exponential Moving Average (EMA) at $91,450 provides immediate resistance. The critical Fibonacci 0.618 retracement level from the recent swing high sits at $85,200, establishing the primary Bullish Invalidation zone.

Market structure suggests failure to hold above $85,200 would invalidate the current bullish market structure and target the $82,000 Order Block established during the November 2025 accumulation phase. Conversely, reclaiming the $90,100 FVG would establish $88,500 as the Bearish Invalidation level for short positions.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Historically precedes major reversal zones |

| Bitcoin Current Price | $87,659 | Testing weekly Volume Profile POC |

| 24-Hour Price Change | -2.33% | Within normal volatility band |

| Recent Futures Liquidations | $108 million (1 hour) | Indicates leveraged position unwinding |

| Fed Funds Rate (Current) | 4.25-4.50% | Policy stance affecting risk premiums |

Federal Reserve independence directly impacts cryptocurrency valuations through three transmission channels: dollar liquidity conditions, institutional risk appetite, and macroeconomic stability expectations. According to the Federal Reserve's official policy framework, autonomous central banks typically maintain tighter control over inflation expectations, which affects real yields and consequently Bitcoin's attractiveness as an inflation hedge. For institutional investors, Fed credibility reduces policy uncertainty premiums, potentially increasing capital allocation to longer-duration assets including digital gold narratives.

Retail traders face different implications. Market structure suggests Extreme Fear sentiment combined with Fed policy statements creates asymmetric opportunity structures where panic selling near support zones often precedes technical rebounds. The $108 million futures liquidation event referenced in recent market analysis exemplifies this dynamic, where leveraged positions amplify volatility around key technical levels.

Market analysts express divided interpretations of the Fed independence declaration. Some bulls argue that central bank autonomy supports longer-term monetary policy consistency, reducing sudden pivot risks that historically trigger crypto market downdrafts. Others note that political pressure on the Fed often precedes election-year policy accommodations that could increase dollar liquidity. Neither faction disputes the technical significance of Bitcoin's $87,000 test, with most attention focused on whether this represents a Liquidity Grab before continuation or the beginning of a deeper correction.

Bullish Case: Bitcoin holds above the $85,200 Fibonacci support and fills the $89,200-$90,100 Fair Value Gap. Fed independence maintains policy credibility, reducing dollar strength and supporting risk assets. This scenario targets a retest of the $95,000 resistance zone within 30 days, with invalidation at $85,200.

Bearish Case: Bitcoin breaks the $85,200 Bullish Invalidation level, triggering a Gamma Squeeze in options markets. Political pressure on the Fed intensifies despite independence declarations, creating policy uncertainty that increases risk premiums. This scenario targets the $82,000 Order Block within 14 days, with invalidation at $88,500 if price reclaims the FVG zone.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.