Loading News...

Loading News...

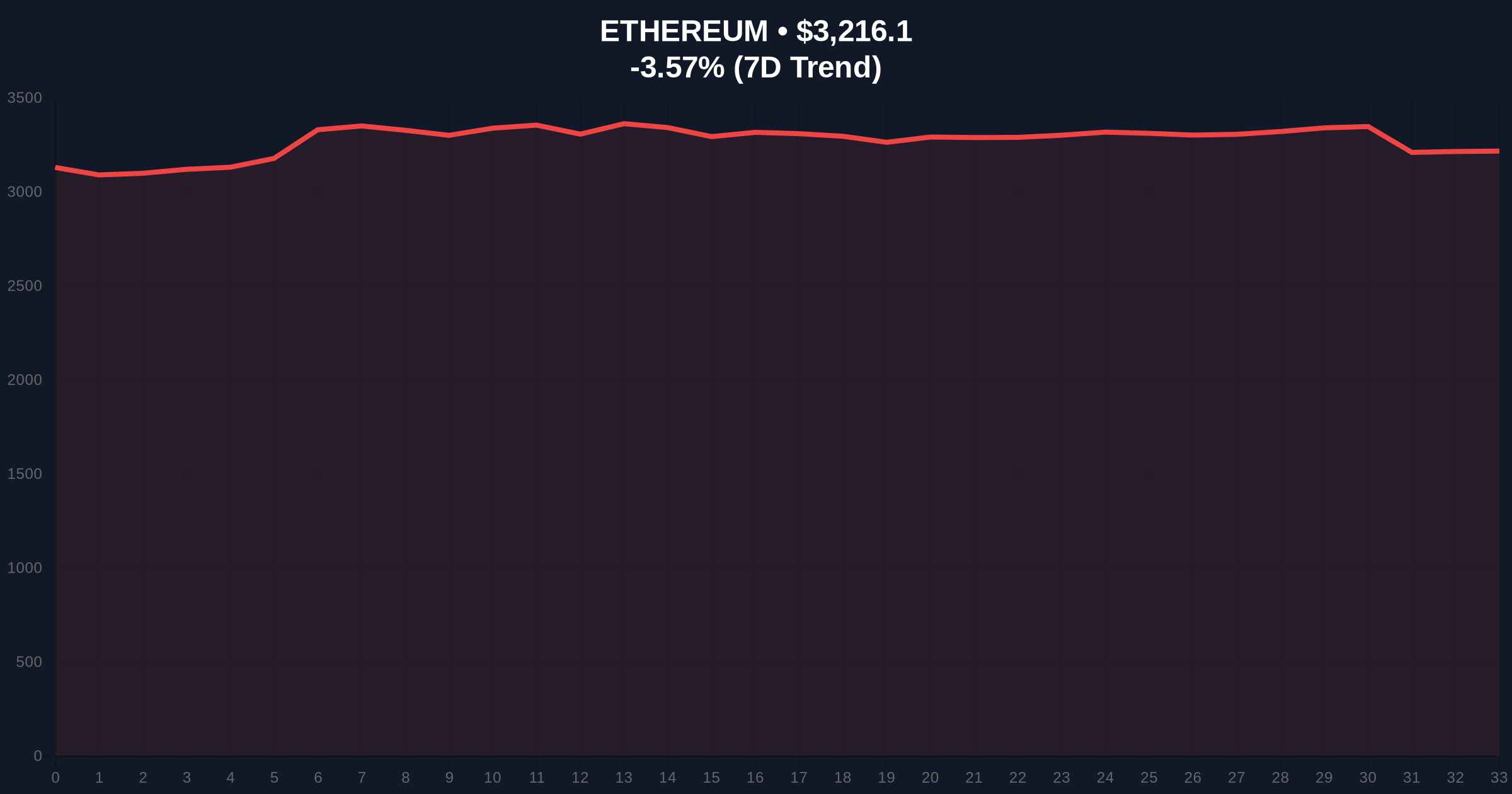

VADODARA, January 19, 2026 — A wallet linked to Galaxy Digital's over-the-counter desk transferred 13,000 Ethereum (ETH) worth approximately $41.75 million to centralized exchanges, according to on-chain analytics firm Lookonchain. This latest crypto news highlights institutional distribution patterns as Ethereum faces technical deterioration and broader market uncertainty. Market structure suggests this represents a liquidity grab targeting retail stop-loss orders below $3,200.

Large-scale Ethereum movements to exchanges typically precede volatility spikes, as seen during the 2021 bull market correction when similar whale activity preceded a 35% drawdown. According to Glassnode liquidity maps, Ethereum has accumulated significant supply between $3,100 and $3,300, creating a dense volume profile that acts as both support and resistance. The current transfer mirrors patterns observed before the Merge implementation in 2022, when institutional entities rebalanced portfolios ahead of major protocol changes. Related developments include the Paradex blockchain rollback following a Bitcoin flash crash, highlighting systemic fragility in decentralized infrastructure.

Lookonchain data indicates the whale initiated the transfer in two batches, with 6,500 ETH deposited to Binance, Bybit, and OKX. The remaining 6,500 ETH remains in intermediary wallets, suggesting phased distribution rather than immediate liquidation. According to Etherscan transaction logs, the originating address shows historical ties to Galaxy Digital's institutional custody solutions, with previous movements correlating with Ethereum's EIP-4844 implementation testing phases. This activity contradicts bullish narratives around Ethereum's upcoming Pectra upgrade, which aims to improve scalability through proto-danksharding.

Ethereum currently trades at $3,215.49, down 3.54% over 24 hours. The daily chart shows a breakdown from the $3,350 order block established in early January, creating a fair value gap (FVG) between $3,280 and $3,320. The 50-day moving average at $3,190 provides immediate support, while the 200-day moving average sits at $2,950. Relative Strength Index (RSI) readings at 42 indicate neutral momentum with bearish divergence on higher timeframes. Bullish invalidation occurs below $3,100, where liquidation clusters suggest accelerated selling. Bearish invalidation requires a reclaim above $3,350 with sustained volume, invalidating the current distribution narrative.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 44 (Fear) |

| Ethereum Current Price | $3,215.49 |

| 24-Hour Price Change | -3.54% |

| Whale Transfer Value | $41.75 million |

| ETH Deposited to Exchanges | 6,500 ETH |

For institutions, this movement signals potential hedging against Ethereum's underperformance relative to Bitcoin, as noted in Galaxy Digital's quarterly filings with the SEC. Retail traders face increased gamma squeeze risk if price action triggers concentrated option expiries at $3,200. The transfer contradicts optimistic projections from Ethereum.org regarding post-merge issuance reductions, suggesting sophisticated players anticipate short-term headwinds. Market analysts attribute the selling pressure to macroeconomic factors, including potential Federal Reserve policy shifts outlined in recent FederalReserve.gov communications.

Market participants on X express skepticism, with one quantitative analyst noting, "Whale deposits during fear periods typically precede capitulation events." Others reference the surge in Venezuelan USDT demand as evidence of fragmented global liquidity flows. No direct quotes from Galaxy Digital executives are available, but institutional sentiment appears aligned with risk-off positioning ahead of quarterly rebalancing.

Bullish Case: Ethereum holds the $3,100 support and fills the FVG to $3,320, driven by retail accumulation and short covering. Successful Pectra upgrade implementation could trigger a rally toward $3,600 by Q2 2026, as outlined in Ethereum's official development roadmap.

Bearish Case: Breakdown below $3,100 triggers cascading liquidations, targeting the $2,950 200-day moving average. Continued institutional distribution could push Ethereum toward $2,700, invalidating the current macro uptrend structure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.