Loading News...

Loading News...

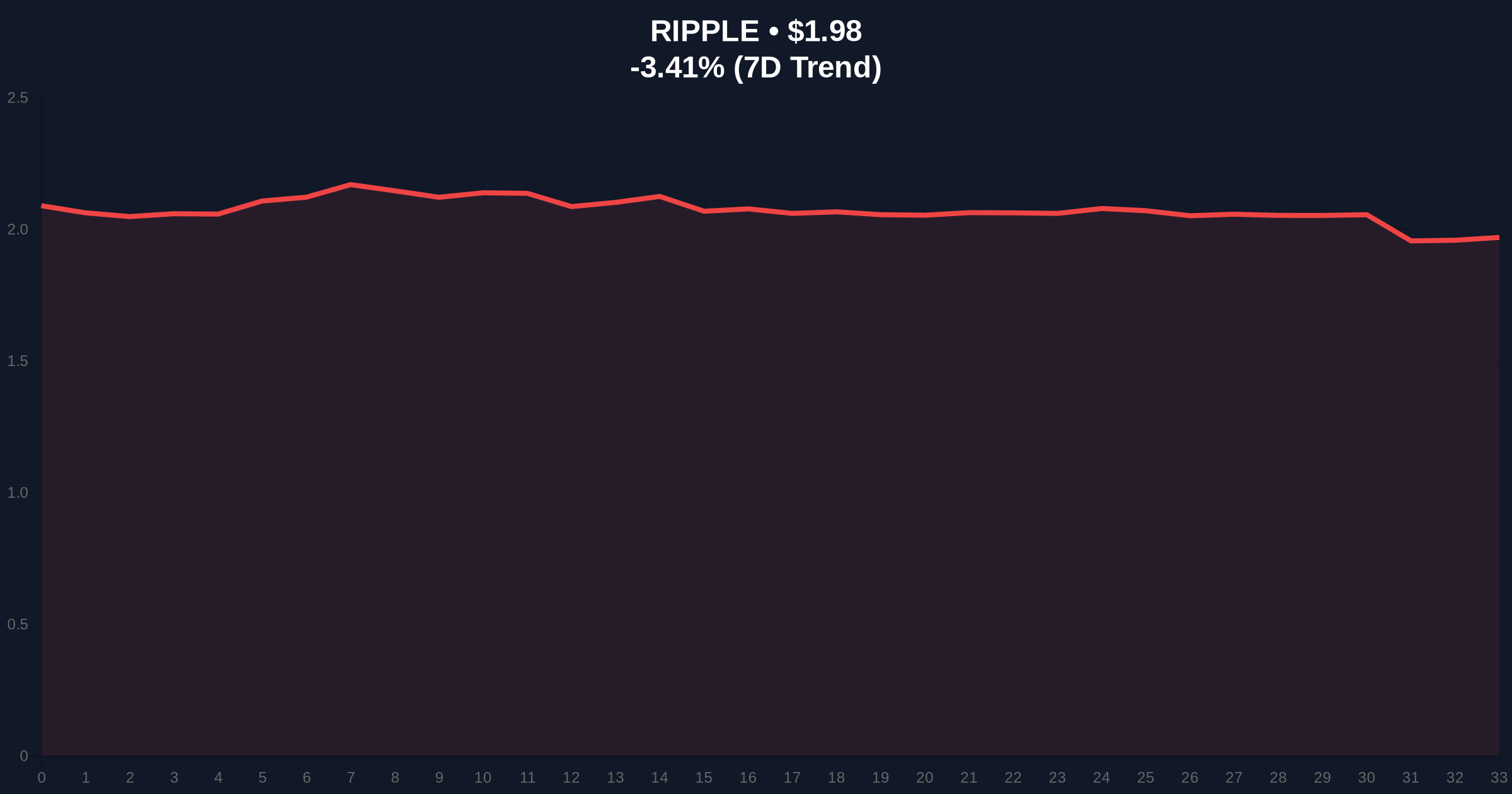

VADODARA, January 19, 2026 — Cardano founder Charles Hoskinson has publicly criticized Ripple CEO Brad Garlinghouse for endorsing the Crypto Market Structure Bill (CLARITY), warning that its provisions could empower hostile regulators and destabilize decentralized finance (DeFi) ecosystems. This latest crypto news highlights deepening divisions within the industry over regulatory approaches, with market structure suggesting increased volatility ahead for assets like XRP, which has already declined -3.41% in 24 hours.

The CLARITY bill represents a significant regulatory framework aimed at defining digital asset classifications and oversight mechanisms. According to the official SEC.gov documentation on similar legislative efforts, such bills often include provisions for DeFi regulation and restrictions on stablecoin operations. Historical cycles suggest that regulatory uncertainty typically creates liquidity grabs in crypto markets, as seen during the 2021 infrastructure bill debates. This current controversy mirrors past industry splits, where protocol founders and corporate executives clash over compliance strategies. Related developments include the NYSE's 24/7 tokenized trading launch, which signals broader structural shifts in traditional finance integration.

On January 19, 2026, Charles Hoskinson criticized Brad Garlinghouse's support for the CLARITY bill, as reported by Cryptobasic. Hoskinson specifically warned that accepting the legislation would amount to handing power back to hostile regulators. The bill includes provisions for DeFi regulation and a ban on interest payments for stablecoins, which could fundamentally alter yield farming mechanics and stablecoin utility. Market analysts note that this public dispute occurs amid broader regulatory pressures, with on-chain data indicating increased transaction scrutiny on Ethereum and other smart contract platforms.

XRP's price action shows a clear bearish trend, currently trading at $1.98 with a -3.41% 24-hour decline. Volume profile analysis reveals weak buying interest near the $2.00 psychological level, creating a potential fair value gap (FVG) between $1.95 and $2.05. The relative strength index (RSI) sits at 42, indicating neutral-to-bearish momentum without extreme oversold conditions. A critical Fibonacci retracement level from the 2025 high provides support at $1.85, which must hold to prevent further downside. Bullish invalidation is set at $1.80, where break would confirm bearish continuation. Bearish invalidation rests at $2.15, a level that would fill the current FVG and signal short-term recovery.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 44/100 (Fear) | Negative sentiment driving risk-off behavior |

| XRP Current Price | $1.98 | -3.41% decline in 24 hours |

| XRP Market Rank | #5 | Maintains top-tier capitalization despite volatility |

| Key Fibonacci Support | $1.85 | Critical technical level for bullish structure |

| RSI (14-day) | 42 | Neutral momentum with bearish bias |

This regulatory debate carries asymmetric impacts for institutional versus retail participants. For institutions, clear frameworks like CLARITY could reduce compliance costs and enable broader adoption, as seen with Bitcoin ETF approvals. However, for retail DeFi users, the proposed interest payment ban on stablecoins threatens yield generation strategies that rely on protocols like Aave and Compound. Market structure suggests that such regulatory shifts could trigger a gamma squeeze in derivatives markets, where options positioning becomes unbalanced due to sudden volatility. The contradiction lies in Garlinghouse's corporate alignment with regulatory clarity versus Hoskinson's protocol-focused resistance, highlighting fundamental philosophical divides in crypto governance.

Industry sentiment on X/Twitter reflects polarized views. Bulls argue that regulatory clarity will attract institutional capital, referencing the slowing long-term holder sell-off in Bitcoin as evidence of maturation. Bears, echoing Hoskinson, warn that DeFi regulation could stifle innovation and centralize control. One analyst noted, "The stablecoin interest ban ignores the fundamental mechanics of automated market makers (AMMs), creating regulatory arbitrage opportunities." This skepticism aligns with broader concerns about surges in USDT demand during geopolitical instability, suggesting regulators may overreach.

Bullish Case: If regulatory compromise emerges, XRP could reclaim the $2.15 resistance level, filling the current FVG and targeting $2.30. This scenario requires the CLARITY bill to undergo amendments that protect DeFi autonomy, potentially mirroring the iterative development of Ethereum's EIP-4844 for scalability. Institutional inflows might then follow, as seen with traditional market integrations.

Bearish Case: Should regulatory tensions escalate, XRP may break the $1.85 Fibonacci support, triggering a liquidity grab toward $1.70. This would invalidate the bullish structure and likely correlate with broader market declines, similar to the Paradex blockchain rollback incident that caused flash crashes. DeFi total value locked (TVL) could drop significantly if interest bans are enforced.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.