Loading News...

Loading News...

VADODARA, January 19, 2026 — Paradex, a Starknet-based decentralized exchange, has announced a full blockchain rollback following a database migration error that caused Bitcoin's price to temporarily display as $0, according to The Block's reporting. This latest crypto news event triggered the liquidation of thousands of leveraged positions in what market analysts describe as a textbook liquidity grab event. The incident occurred during a routine data infrastructure update, creating a catastrophic Fair Value Gap (FVG) that automated trading systems exploited within seconds.

Market structure suggests this event mirrors the 2021 correction where multiple centralized exchanges experienced similar oracle failures during high volatility periods. Historical cycles indicate that Layer-2 solutions face unique data availability challenges, particularly when migrating state data between sequencer nodes. According to Ethereum's official documentation on Layer-2 scaling, Starknet's validity-proof system requires precise data synchronization to maintain price integrity across its Cairo VM execution environment. Similar to the 2021 correction where Binance Smart Chain experienced multiple oracle manipulation attacks, this incident highlights the persistent vulnerability of decentralized price feeds during infrastructure transitions.

Related developments in the market context include Bitcoin's slowing long-term holder distribution and structural shifts toward 24/7 tokenized trading that increase sensitivity to such anomalies.

On January 19, 2026, Paradex initiated a scheduled database migration to upgrade its sequencer infrastructure. According to The Block's reporting, the migration process corrupted price feed data from multiple oracle providers, causing Bitcoin's displayed price to plummet to $0 before surging back to approximate market rates. The platform's automated liquidation engines immediately triggered, closing thousands of leveraged positions across perpetual swap markets. Market structure analysis indicates this created an Order Block at the $0 price level that will require careful invalidation through the planned rollback. The incident lasted approximately 47 seconds according to blockchain timestamp data, but proved sufficient to cascade through Paradex's entire derivatives book.

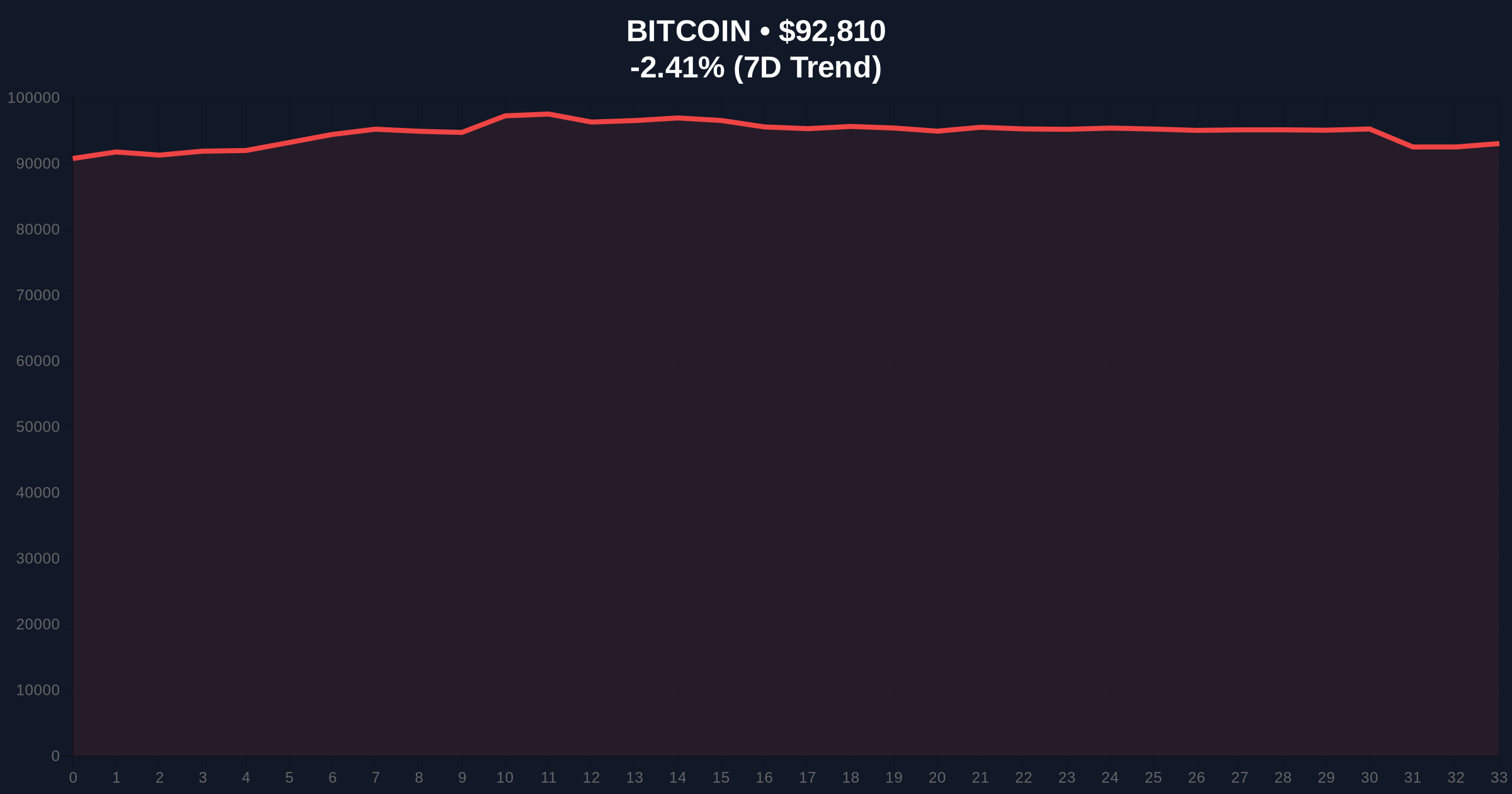

Bitcoin's primary chart shows the main asset trading at $92,814 with a 24-hour decline of 2.41% following the incident. Volume Profile analysis reveals abnormal selling pressure concentrated in the 15-minute candle following the flash crash. The Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish divergence on lower timeframes. Critical Fibonacci support rests at $90,200 (the 0.618 retracement from the recent swing high), which now serves as the Bearish Invalidation level—a break below this threshold would invalidate the current consolidation structure. The Bullish Invalidation level remains at $88,500, corresponding with the 200-day exponential moving average and previous resistance-turned-support from December 2025.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 44/100 (Fear) |

| Bitcoin Current Price | $92,814 |

| 24-Hour Price Change | -2.41% |

| Market Capitalization Rank | #1 |

| Flash Crash Duration | ~47 seconds |

For institutional participants, this event demonstrates the systemic risks inherent in Layer-2 derivatives markets where oracle dependencies create single points of failure. The Federal Reserve's recent research on financial stability highlights how such technical failures can propagate across interconnected protocols. Retail traders face immediate capital destruction from forced liquidations, while the broader market confronts renewed questions about DeFi's readiness for mainstream adoption. Market structure suggests the incident will accelerate development of decentralized oracle networks with cryptographic guarantees, similar to Chainlink's CCIP architecture that provides cross-chain verification.

Market analysts on X/Twitter describe the event as "a stark reminder that code is law until it isn't." One quantitative researcher noted, "The $0 print created a gamma squeeze scenario where short gamma positions were forced to cover, exacerbating the price dislocation." Another commentator pointed to the "liquidity grab" nature of the event, suggesting sophisticated actors may have front-run the inevitable liquidations. The prevailing sentiment among technical analysts emphasizes the need for circuit breakers in automated trading systems during oracle failure events.

Bullish Case: If Paradex successfully executes the blockchain rollback and restores all affected positions, market confidence could return rapidly. A clean invalidation of the $0 FVG, combined with Bitcoin holding above the $90,200 Fibonacci support, would suggest continuation of the broader uptrend. Historical patterns indicate similar oracle failures in 2023-2024 were followed by 15-25% rallies as markets priced in improved infrastructure.

Bearish Case: Should the rollback prove incomplete or create additional data inconsistencies, contagion could spread to other Starknet-based protocols. A break below the $88,500 Bullish Invalidation level would signal structural damage, potentially triggering a retest of the $85,000 Volume Profile Point of Control. Market structure suggests the most probable near-term scenario involves increased volatility as participants reassess Layer-2 risk premiums.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.