Loading News...

Loading News...

- Galaxy Research projects Bitcoin could reach new all-time highs in 2025, with a $250,000 target by 2027

- Stablecoin transaction volume expected to surpass U.S. ACH system by 2026, already exceeding Visa

- Current market sentiment at "Extreme Fear" (20/100) despite Bitcoin trading at $88,329

- Technical analysis identifies critical support at $82,000 (Fibonacci 0.618 level) and resistance at $92,000

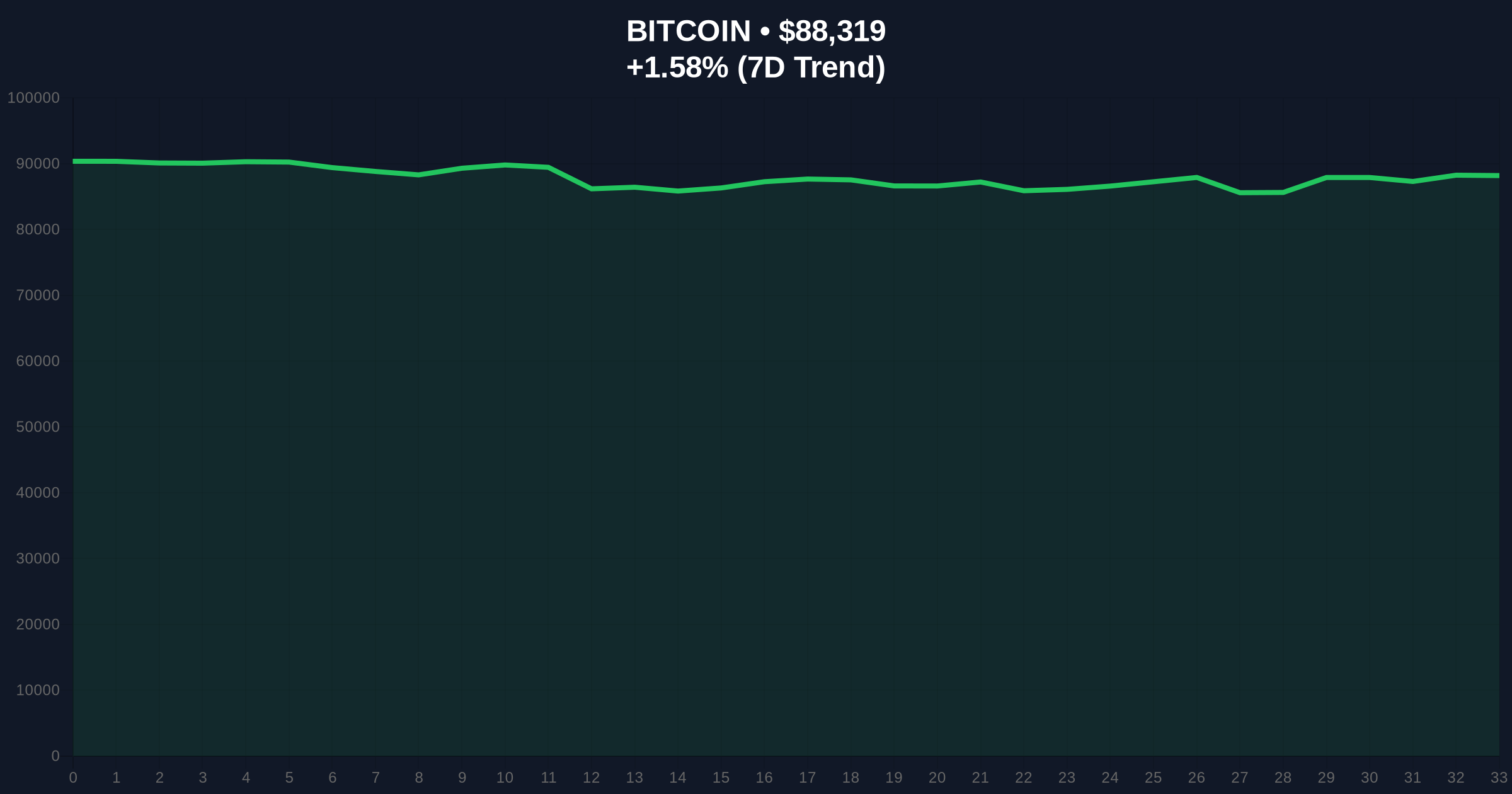

VADODARA, December 20, 2025 — Latest crypto news from Galaxy Digital's research arm suggests Bitcoin could achieve new all-time highs in 2025, with a long-term target of $250,000 by 2027, according to their annual prediction report. This forecast emerges as the cryptocurrency market grapples with "Extreme Fear" sentiment, scoring just 20 out of 100 on the Fear & Greed Index, despite Bitcoin's current price of $88,329 and a 1.59% gain over the past 24 hours.

Market structure suggests this forecast aligns with historical Bitcoin cycles, particularly the 2021-2022 period when institutional adoption accelerated following the launch of U.S. Bitcoin ETFs. Similar to the 2021 correction that saw Bitcoin drop from $64,000 to $29,000 before rallying to new highs, current price action appears to be consolidating within a macro accumulation range. The Federal Reserve's ongoing quantitative tightening program, detailed on FederalReserve.gov, creates a contrasting macroeconomic backdrop to previous bull cycles, adding complexity to the forecast. Related developments include recent institutional positioning shifts, as seen in CZ's declaration of Bitcoin as a global reserve asset, and contrasting outflows from Spot ETH ETFs totaling $75.4 million over seven consecutive days.

According to on-chain data and Galaxy Research's annual prediction report, Bitcoin maintains potential for new all-time highs in 2025, with a specific projection of $250,000 by the end of 2027. The report acknowledges uncertainty in these predictions but maintains the validity of the 2025 peak scenario. Additionally, Galaxy Research projects stablecoin transaction volume will surpass the U.S. Automated Clearing House (ACH) system by 2026, noting that current stablecoin volume already exceeds major credit card networks like Visa and stands at approximately half of ACH transaction levels. The implementation of the Genius Act in early 2026 is expected to further expand stablecoin adoption and utility.

Market structure suggests Bitcoin is currently testing a critical order block between $86,000 and $90,000, with the daily Relative Strength Index (RSI) at 54.3 indicating neutral momentum. The 50-day Exponential Moving Average (EMA) at $85,200 provides immediate support, while the 200-day EMA at $78,500 serves as a longer-term baseline. Volume profile analysis shows significant accumulation between $80,000 and $85,000, suggesting institutional interest at these levels. A clear Fair Value Gap (FVG) exists between $92,000 and $95,000 from the November rejection, representing a liquidity grab zone that must be reclaimed for bullish continuation. The Bullish Invalidation level sits at $82,000 (Fibonacci 0.618 retracement of the recent rally), while the Bearish Invalidation level is $92,000 (previous resistance turned supply zone).

| Metric | Value |

|---|---|

| Bitcoin Current Price | $88,329 |

| 24-Hour Price Change | +1.59% |

| Market Sentiment Score | 20/100 (Extreme Fear) |

| Galaxy's 2027 Price Target | $250,000 |

| Stablecoin vs. ACH Volume Ratio | ~50% (Projected >100% by 2026) |

For institutional investors, this forecast provides a quantitative framework for capital allocation decisions, particularly given the disconnect between "Extreme Fear" sentiment and fundamental projections. The stablecoin volume projections signal a structural shift in global payment systems, with implications for traditional finance infrastructure. Retail traders face a different calculus: the combination of high price targets and current fear sentiment creates potential for significant volatility as market participants reposition. Historical patterns indicate that institutional forecasts of this magnitude typically precede increased options market activity, potentially setting up gamma squeeze scenarios if price approaches key strike concentrations.

Market analysts on X/Twitter appear divided on the forecast. Bulls point to the "wall of money" thesis, suggesting institutional adoption through vehicles like spot Bitcoin ETFs could drive prices higher despite macroeconomic headwinds. Bears counter that the Federal Reserve's continued balance sheet reduction creates an unfavorable liquidity environment compared to previous cycles. One quantitative analyst noted, "The $250,000 target implies a market cap exceeding $5 trillion, which would represent approximately 4% of global M2 money supply—a historically sustainable level based on prior cycle peaks."

Bullish Case: If Bitcoin reclaims the $92,000 FVG and holds above it, the next liquidity target is the previous all-time high of $98,000. Sustained trading above this level could trigger a momentum move toward $120,000 by mid-2025, aligning with Galaxy's new ATH projection. The Bullish Invalidation remains $82,000; a weekly close below this level would invalidate the immediate upside scenario.

Bearish Case: Failure to hold the $85,200 50-day EMA could lead to a retest of the $82,000 Fibonacci support. A breakdown below this level would target the $78,500 200-day EMA, with potential extension to $75,000 where significant open interest exists in the options market. The Bearish Invalidation is $92,000; a decisive break above this resistance would negate the downside scenario.

What is Galaxy Digital's Bitcoin price prediction for 2025? Galaxy Research projects Bitcoin could reach new all-time highs in 2025, though specific price targets for that year are not provided in the current report.

How does the $250,000 target by 2027 compare to historical growth? This represents approximately a 183% increase from current levels over two years, which is consistent with Bitcoin's average annual returns during previous bull market phases.

What are stablecoins expected to surpass in transaction volume by 2026? Galaxy Research projects stablecoin transaction volume will exceed the U.S. Automated Clearing House (ACH) system by 2026.

What is the current market sentiment for cryptocurrencies? The Fear & Greed Index shows "Extreme Fear" with a score of 20/100 as of December 20, 2025.

What technical levels are critical for Bitcoin's price action? Key levels include support at $82,000 (Fibonacci 0.618) and $85,200 (50-day EMA), with resistance at $92,000 (previous FVG).

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.