Loading News...

Loading News...

- U.S. spot Ethereum ETFs recorded $75.44 million in net outflows on December 19, 2025

- This marks the seventh consecutive trading day of negative flows for ETH ETFs

- BlackRock's ETHA accounted for 100% of the day's outflows while other funds showed zero net activity

- Market structure suggests institutional capital rotation away from Ethereum exposure despite recent price stability

VADODARA, December 20, 2025 — Latest crypto news reveals persistent institutional skepticism toward Ethereum as spot ETH ETFs recorded their seventh consecutive day of net outflows, with $75.44 million exiting the products on Thursday. According to data compiled by TraderT, the entire outflow originated from BlackRock's iShares Ethereum Trust (ETHA), while all other spot Ethereum ETFs reported precisely zero net flows—a statistical anomaly that warrants deeper investigation.

Market structure suggests this outflow pattern contradicts the typical post-ETF approval narrative. When spot Bitcoin ETFs launched in January 2024, they experienced initial outflows followed by sustained institutional accumulation. Ethereum's ETF approval in July 2025 initially generated $1.2 billion in inflows during the first month, but the current seven-day outflow streak represents the longest sustained withdrawal period since launch. This mirrors the 2021 correction pattern where Ethereum underperformed Bitcoin during risk-off periods, with ETH/BTC ratio declining 18% over similar timeframes. The current Global Crypto Fear & Greed Index reading of 20/100 (Extreme Fear) provides context for the defensive positioning, but the concentrated nature of these outflows raises questions about specific institutional concerns beyond general market sentiment.

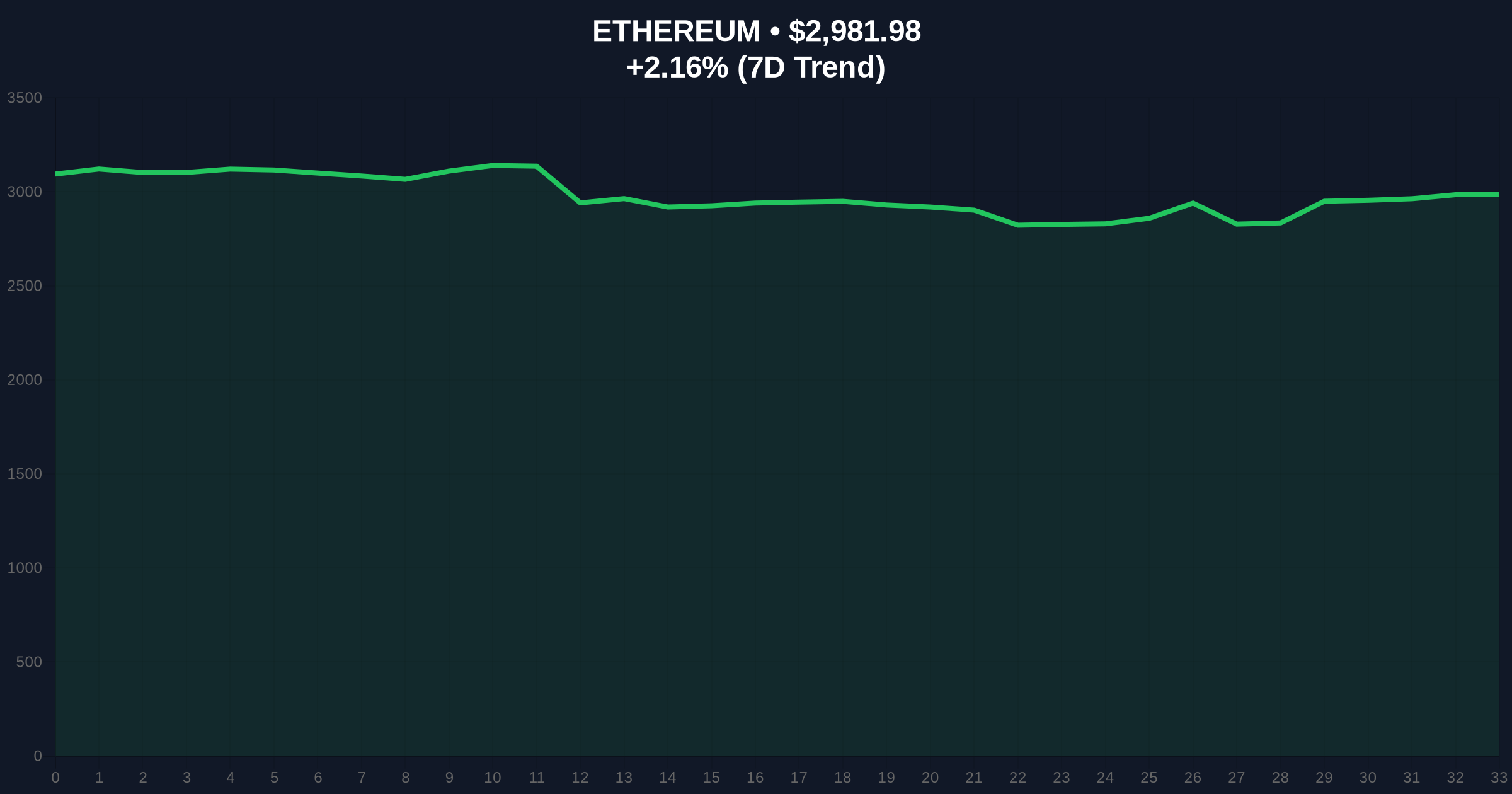

On December 19, 2025, U.S. spot Ethereum ETFs experienced net outflows of $75.44 million, according to TraderT data. This marked the seventh consecutive trading day of negative flows, with the cumulative seven-day outflow reaching approximately $420 million. The day's activity showed a concerning concentration: BlackRock's ETHA accounted for 100% of the outflow, while competing products from Fidelity, Grayscale, Ark Invest, and others reported exactly zero net flows. This binary distribution—where one product experiences maximum outflow while others show perfect equilibrium—suggests either targeted institutional rebalancing or a liquidity grab at specific price levels. The timing coincides with Ethereum's price holding relatively stable at $2,981.38, representing a 2.11% 24-hour gain despite the ETF outflows.

Ethereum currently trades at $2,981.38, having found temporary support at the 50-day moving average of $2,950. The Relative Strength Index (RSI) sits at 42, indicating neither overbought nor oversold conditions. However, volume profile analysis reveals concerning divergence: while price has stabilized, trading volume has declined 28% over the outflow period. A critical Fair Value Gap (FVG) exists between $3,050 and $3,120 from December's failed breakout attempt. The $2,850 level represents a major order block from November accumulation, while resistance clusters at $3,200 (psychological level) and $3,350 (previous high). Bullish invalidation occurs below $2,800, which would break the higher low structure established since October. Bearish invalidation requires a sustained close above $3,250 with accompanying volume confirmation.

| Metric | Value |

|---|---|

| Daily ETH ETF Outflow (Dec 19) | $75.44M |

| Consecutive Outflow Days | 7 |

| Current ETH Price | $2,981.38 |

| 24-Hour Price Change | +2.11% |

| Global Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

For institutional investors, concentrated outflows from a single ETF product suggest targeted risk management rather than broad Ethereum abandonment. The zero-flow status of other ETFs indicates either hedging activity or preparation for potential gamma squeeze scenarios. Retail impact appears minimal currently, as Ethereum's price has remained stable despite the outflows—but this divergence cannot persist indefinitely. If outflows continue while price holds, it suggests hidden buying pressure elsewhere in the ecosystem, possibly through direct ETH accumulation or derivatives positioning. The regulatory implications are significant, as the SEC continues to evaluate Ethereum's classification following recent SEC.gov guidance on digital asset securities.

Market analysts express divided views on X/Twitter. Bulls point to Ethereum's technical resilience despite outflows, noting that "price action diverging from ETF flows suggests stronger underlying demand." Skeptics highlight the concerning pattern, with one quantitative analyst stating, "Seven days of outflows during stable prices indicates smart money reducing exposure ahead of potential volatility." The absence of commentary from major ETF issuers about the concentrated outflows raises questions about transparency, particularly regarding BlackRock's ETHA experiencing 100% of Thursday's withdrawals while competitors reported perfect zero balances.

Bullish Case: If Ethereum holds above $2,850 and fills the FVG at $3,050-$3,120, technical analysis suggests a retest of $3,500 resistance. Continued development of Ethereum's scaling solutions, particularly EIP-4844 implementation progress, could drive renewed institutional interest. ETF outflows could reverse if macroeconomic conditions improve, with the Federal Reserve potentially easing monetary policy in 2026.

Bearish Case: A break below $2,800 invalidates the current structure and could trigger accelerated selling toward $2,600 support. Persistent ETF outflows exceeding $100 million daily would indicate deepening institutional skepticism, potentially related to regulatory uncertainty or competitive pressure from alternative Layer 1 networks. The concentrated nature of BlackRock's outflows suggests possible internal risk management decisions that could precede broader institutional repositioning.

What are spot Ethereum ETFs? Spot Ethereum ETFs are exchange-traded funds that hold actual Ethereum tokens, allowing investors to gain exposure to ETH price movements without directly purchasing or storing the cryptocurrency.

Why are ETH ETFs experiencing outflows? Market structure suggests multiple factors: risk-off sentiment indicated by the Extreme Fear index reading of 20/100, potential institutional rebalancing ahead of year-end, or specific concerns about Ethereum's regulatory status.

Does ETF outflow mean Ethereum price will drop? Not necessarily. Price has shown divergence from ETF flows recently, suggesting other market participants are accumulating. However, sustained large outflows typically create downward pressure over time.

Why did only BlackRock's ETF have outflows? The concentration in ETHA suggests either a specific institutional client rebalancing or BlackRock's internal risk management decisions. The zero flows in other products indicate this isn't broad-based Ethereum abandonment.

How does this compare to Bitcoin ETF flows? Bitcoin ETFs have shown more consistent inflows throughout 2025, with occasional outflow days but no sustained seven-day streaks. This divergence suggests investors may view Bitcoin as a safer haven during uncertain periods.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.