Loading News...

Loading News...

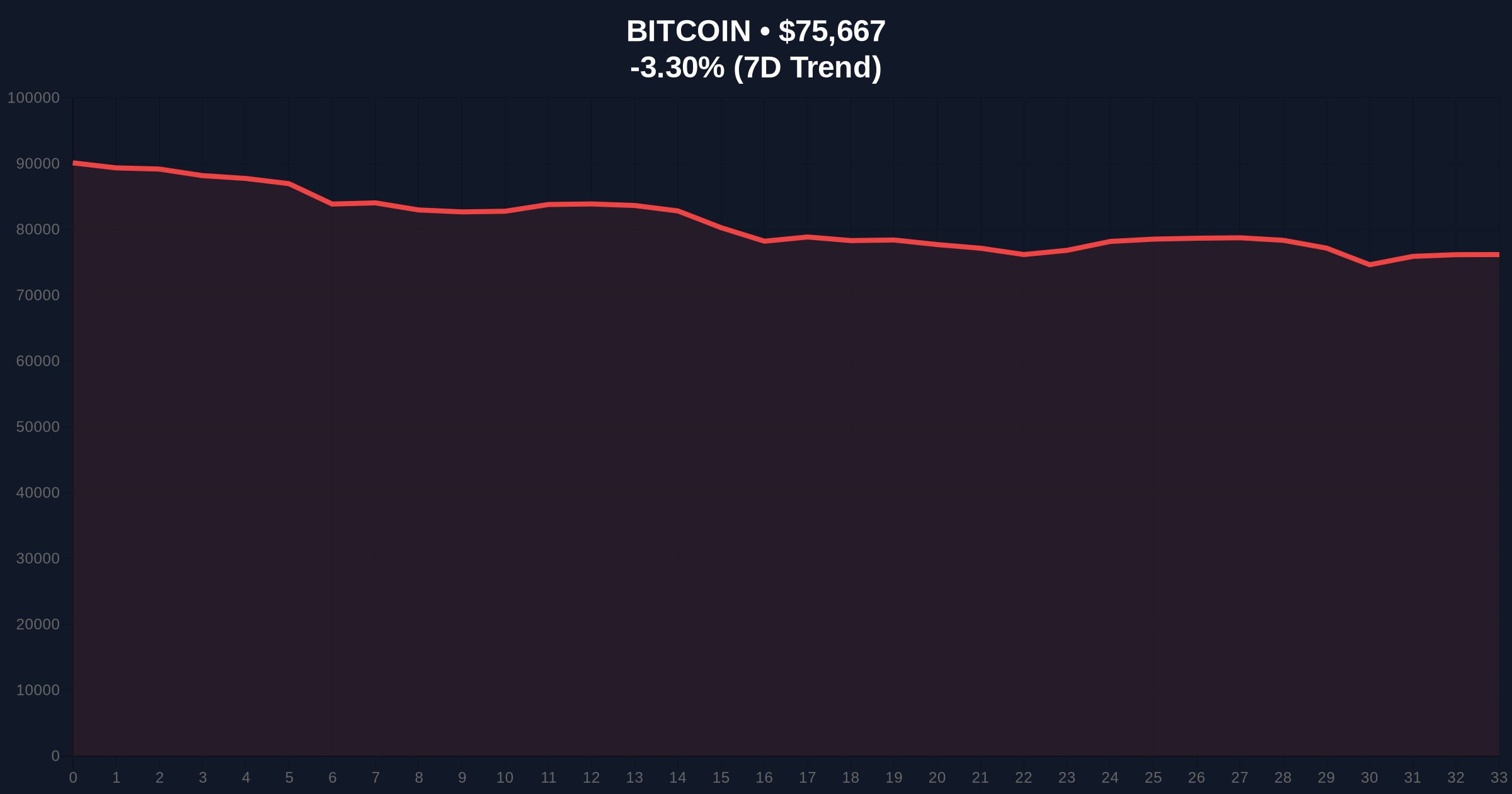

VADODARA, February 4, 2026 — Fold (FLD) launched a unified Bitcoin rewards application today. The Bitcoin-focused financial services platform integrates BTC accumulation with daily financial activities. Walter Bloomberg first reported the development. This launch occurs as Bitcoin trades at $75,722, down 3.23% in 24 hours. Market sentiment sits at Extreme Fear. This latest crypto news highlights a critical test for retail adoption infrastructure.

Fold deployed its integrated application on February 4, 2026. The platform merges Bitcoin rewards with conventional finance tools. According to the initial report, the app enables users to earn BTC through everyday transactions. Specific mechanics remain undisclosed. Market analysts immediately scrutinized the timing. The launch coincides with severe market stress. Bitcoin faces a 3.23% daily decline. The Crypto Fear & Greed Index registers 14/100. This creates a high-stakes environment for user acquisition.

Historically, product launches during fear periods struggle with initial traction. In contrast, successful adoption during downturns often signals strong product-market fit. The 2022 bear market saw similar fintech deployments. Many failed to gain meaningful volume. Underlying this trend is retail liquidity sensitivity. Fold's launch now tests that thesis directly.

, this development follows other Bitcoin ecosystem expansions. For instance, Mercado Bitcoin recently issued $20M in tokenized credit on Rootstock. Additionally, a 250 million USDC mint signaled institutional liquidity maneuvers amid identical fear conditions. These parallel movements suggest coordinated infrastructure building.

Bitcoin currently trades at $75,722. Market structure suggests immediate resistance at $78,500. This level represents a prior order block. Support rests at the $74,200 Fibonacci 0.618 retracement level. A break below invalidates the current consolidation structure. The Relative Strength Index (RSI) on the 4-hour chart reads 38. This indicates oversold conditions but not extreme capitulation.

Volume profile analysis reveals a low-volume void beneath $74,000. This aligns with recent reports of Bitcoin facing a low-volume void risk. Consequently, a breakdown could accelerate. The 50-day moving average sits at $77,800, providing dynamic resistance. On-chain data from Glassnode shows exchange outflows increasing. This suggests accumulation despite price weakness.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $75,722 |

| 24-Hour Change | -3.23% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Key Fibonacci Support | $74,200 (0.618 level) |

| Immediate Resistance | $78,500 (Order Block) |

Fold's app launch matters for Bitcoin's adoption curve. It provides a tangible use case during market stress. Institutional liquidity cycles currently dominate price action. Retail participation remains muted. Successful adoption could signal a sentiment shift. It would demonstrate utility beyond speculative trading. Market structure suggests such developments often precede broader rallies.

"Product launches in fear environments separate robust infrastructure from hype-driven projects. Fold's integration of BTC rewards directly into daily finance tests real-world utility. If user growth persists despite price weakness, it validates a deeper adoption trend." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current data.

The 12-month institutional outlook hinges on macroeconomic conditions. Federal Reserve policy remains a key driver. According to FederalReserve.gov, inflation targeting frameworks continue to evolve. Bitcoin's correlation with traditional risk assets may decouple if adoption tools like Fold's app gain traction. This supports a positive 5-year horizon for infrastructure-driven growth.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.