Loading News...

Loading News...

VADODARA, January 27, 2026 — U.S. spot Ethereum ETFs recorded $110 million in net inflows on January 26, according to data from TraderT. This daily crypto analysis reveals the move ended a four-day outflow streak. Fidelity's FETH product attracted $137 million, single-handedly offsetting $20.16 million in outflows from BlackRock's ETHA. Market structure suggests this isolated inflow may represent a tactical liquidity grab rather than a sustained bullish reversal.

TraderT data confirms the January 26 inflow event. Fidelity's FETH dominated the action. It absorbed $137 million in new capital. Consequently, it overwhelmed BlackRock's concurrent $20.16 million redemption. The net result was a $110 million positive flow day. This snapshot interrupts a concerning trend. Outflows had persisted for the prior four sessions. The data raises immediate questions. Is this a genuine demand signal or a one-off rebalancing event? The concentration in one fund suggests the latter.

Historically, ETF flow reversals during broad market fear require scrutiny. The current Global Crypto Fear & Greed Index sits at 29/100. This indicates extreme caution. In contrast, the 2021 bull run saw sustained multi-week inflows alongside rising sentiment. A single-day spike, especially one driven by a single issuer, often precedes distribution. Underlying this trend, the market grapples with macro headwinds and Federal Reserve policy uncertainty. Related developments this week include significant futures market activity, as seen in recent Ethereum shorts liquidations, and major staking moves by entities like Bitmain.

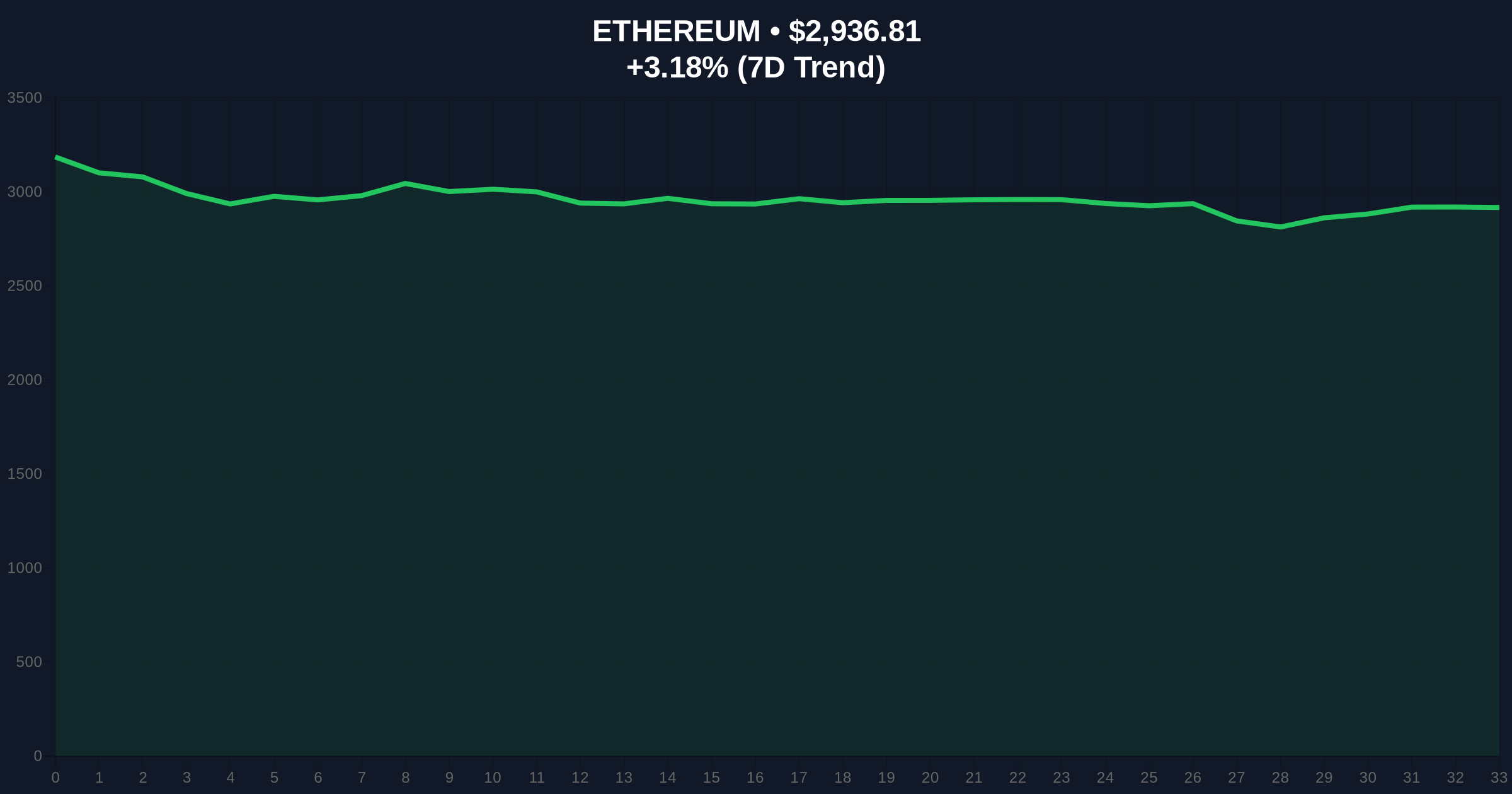

Ethereum's price action tells a conflicting story. ETH currently trades at $2,936.82, up 3.18% on the day. However, this move fails to reclaim key Fibonacci resistance. The 0.618 retracement level from the recent swing high sits near $3,050. , the daily Relative Strength Index (RSI) remains below 60. This indicates a lack of strong bullish momentum. A critical Fair Value Gap (FVG) exists between $2,880 and $2,910. This zone must hold as support to validate the inflow narrative. If broken, it becomes a liquidity target for sellers.

| Metric | Value | Context |

|---|---|---|

| Net ETF Inflow (Jan 26) | $110M | TraderT Data |

| Fidelity FETH Inflow | $137M | Primary Driver |

| BlackRock ETHA Outflow | $20.16M | Offsetting Factor |

| Crypto Fear & Greed Index | 29 (Fear) | Global Sentiment |

| Ethereum (ETH) Price | $2,936.82 | +3.18% (24h) |

This event matters for institutional liquidity cycles. A one-day inflow does not alter the market structure. Retail sentiment, measured by the Fear & Greed Index, remains deeply negative. Consequently, this could be a classic "bull trap." Large players may be providing liquidity into minor strength. The real test is whether follow-through buying emerges. Without it, this becomes a noted Order Block for future sellers. The divergence between ETF flows and pervasive fear is a critical red flag.

"A single issuer driving the entire net inflow is statistically anomalous. It suggests specific, perhaps tactical, capital allocation rather than broad-based institutional demand. Until we see consecutive days of multi-issuer inflows that coincide with a break in the Fear Index, skepticism is the prudent stance."

Market structure suggests two primary scenarios. The bullish case requires ETH to hold the FVG support and challenge the $3,050 Fibonacci level. The bearish case views this inflow as a liquidity provision event before a retest of lower supports.

For the 12-month institutional outlook, the focus shifts to Ethereum's core protocol developments, like the implementation of EIP-4844 for scaling, which will have a far greater impact on the 5-year valuation horizon than transient ETF flows.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.