Loading News...

Loading News...

VADODARA, January 27, 2026 — Over $235 million in cryptocurrency futures positions liquidated in 24 hours, with Ethereum leading at $131 million, according to data from Coinness. This daily crypto analysis reveals a market structure dominated by short squeezes, where 77.53% of Ethereum and 84.32% of Bitcoin liquidations targeted bearish bets. Consequently, the event highlights extreme leverage and shifting sentiment amid a Fear-dominated environment.

Market data from Coinness indicates a concentrated liquidation event across perpetual futures markets. Ethereum (ETH) recorded $131 million in liquidations, with short positions comprising 77.53% of the total. Bitcoin (BTC) followed with $96.03 million, where shorts accounted for 84.32%. In contrast, Silver (XAG) futures saw $7.98 million liquidated, dominated by long positions at 70.77%. This asymmetry between crypto and traditional assets a sector-specific risk event.

Perpetual futures, which lack expiry dates, amplified the volatility through high leverage ratios. The liquidation cascade likely triggered stop-loss orders, creating a feedback loop that exacerbated price swings. Market structure suggests this was a classic liquidity grab, where rapid price movements flushed out overleveraged positions to fill order blocks.

Historically, liquidation events of this magnitude often precede short-term trend reversals or consolidation phases. For instance, the 2021 bull market saw similar squeezes that reset leverage before upward moves. Underlying this trend is the growing institutional participation in crypto derivatives, which now mirrors traditional finance patterns.

In contrast, the dominance of short liquidations indicates a crowded bearish trade. This scenario frequently leads to a gamma squeeze, where forced buying from liquidated shorts temporarily boosts prices. , regulatory developments globally influence market sentiment. For example, South Korea's reversal of its ICO ban may introduce new capital flows, while incidents like the $29 million Bitcoin phishing attack on prosecutors highlight security risks that affect trader confidence.

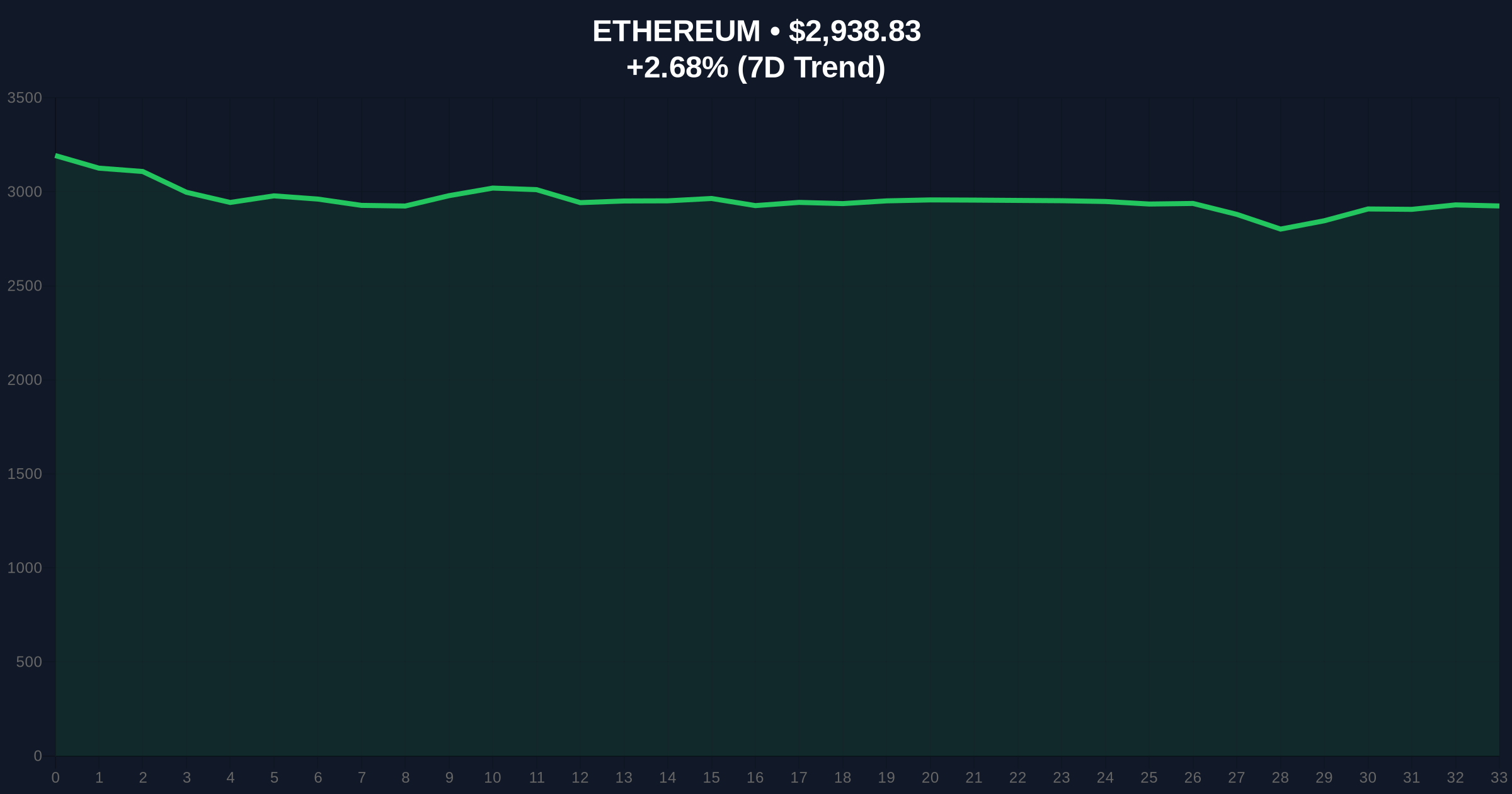

Ethereum's price action reveals critical technical levels. The asset currently trades at $2,938.83, up 2.68% in 24 hours. Key support lies at the Fibonacci 0.618 retracement level of $2,850, derived from recent swing highs and lows. A breach below this level would invalidate the current bullish structure and target the $2,700 volume profile node.

Bitcoin shows similar dynamics, with its liquidation cluster around the $92,000 mark acting as a temporary support. The Relative Strength Index (RSI) for both assets hovers near 60, indicating neutral momentum with room for movement. Additionally, on-chain data from Ethereum.org shows rising gas fees during the event, suggesting increased network activity from arbitrage bots and liquidations.

| Metric | Value | Insight |

|---|---|---|

| Total Liquidations (24h) | $235M | High leverage flush |

| Ethereum Short % | 77.53% | Dominant bearish bet |

| Bitcoin Short % | 84.32% | Crowded short trade |

| Crypto Fear & Greed Index | 29/100 (Fear) | Negative sentiment |

| Ethereum Current Price | $2,938.83 | +2.68% in 24h |

This liquidation event matters because it exposes fragility in market structure. High leverage amplifies losses during volatility, impacting both retail and institutional portfolios. Consequently, risk management protocols must adapt to these rapid shifts. The dominance of short liquidations suggests a potential short-term bullish bias, as covering positions creates buying pressure.

Institutional liquidity cycles often follow such events, with entities like Bitmain adjusting holdings. For instance, Bitmain's $610 million Ethereum stake demonstrates strategic positioning amid fear. Retail sentiment, however, remains cautious, as seen in prediction market volumes. BSC prediction markets hitting $10 billion indicate speculative activity but also raise wash trading concerns.

Market structure suggests this liquidation cascade was a necessary reset. Overleveraged shorts created a powder keg, and the resulting squeeze has cleared excess risk. However, the Fear & Greed Index at 29 shows underlying anxiety. Traders should monitor Ethereum's $2,850 support and Bitcoin's $92,000 level for trend confirmation. – CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. First, a bullish reversal if liquidation-driven buying sustains. Second, a bearish continuation if support levels fail. Technical analysis from Fibonacci levels and volume profiles guides these outcomes.

The 12-month institutional outlook hinges on regulatory clarity and adoption trends. Events like South Korea's policy shift may inject positivity, while security incidents could dampen sentiment. For the 5-year horizon, such liquidations may become less frequent as markets mature and leverage norms stabilize.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.