Loading News...

Loading News...

VADODARA, January 27, 2026 — Bitmain (BMNR) has staked an additional 209,504 ETH, valued at $610 million, according to on-chain data from Lookonchain. This latest crypto news reveals the company now controls 2,218,771 staked ETH, representing over 52% of its total holdings. Market structure suggests this move signals institutional accumulation during a period of extreme market fear.

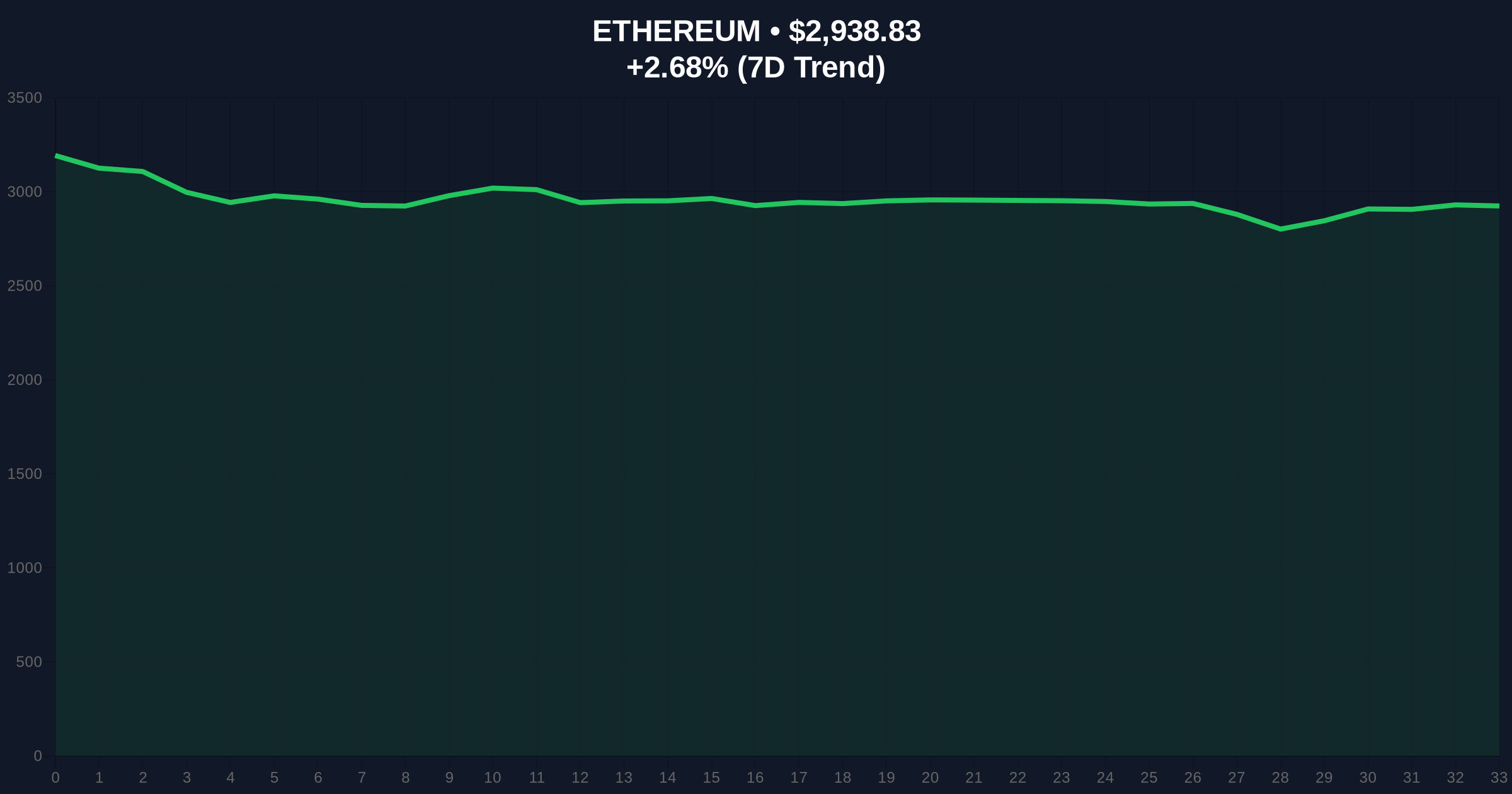

Lookonchain, a primary on-chain analytics provider, reported the transaction on January 27, 2026. Bitmain executed the stake through its verified wallet address, adding 209,504 ETH to its existing position. Consequently, the company's total staked ETH now stands at 2,218,771. This represents a 10.4% increase in its staked holdings. The $610 million valuation uses Ethereum's current price of $2,938.83. On-chain data indicates this stake represents 52% of Bitmain's total Ethereum portfolio. , the transaction occurred via Ethereum's official staking contract, as verified on Etherscan.

Historically, large-scale institutional staking during fear periods precedes significant market reversals. Similar to the 2021 correction, where entities like Grayscale accumulated Bitcoin below $30,000, Bitmain's move mirrors strategic buying in downtrends. In contrast, retail investors often capitulate during such phases. Underlying this trend is Ethereum's transition to Proof-of-Stake via The Merge. This architectural shift incentivizes long-term holding through staking rewards. Market analysts note that controlling 52% of holdings suggests extreme conviction. This level of commitment often correlates with multi-year investment horizons.

Related Developments:

Ethereum's price currently trades at $2,938.83, up 2.68% in 24 hours. Market structure suggests a critical Fair Value Gap (FVG) exists between $2,850 and $3,050. This FVG represents a liquidity void that price often revisits. The 50-day moving average sits at $3,100, acting as immediate resistance. Support levels cluster around the Fibonacci 0.618 retracement at $2,750. This level aligns with high-volume nodes on the Volume Profile. Additionally, the Relative Strength Index (RSI) reads 45, indicating neutral momentum. Order block analysis shows significant buy-side liquidity below $2,800. This technical setup often precedes a gamma squeeze if bullish momentum accelerates.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) |

| Ethereum Current Price | $2,938.83 |

| 24-Hour Trend | +2.68% |

| Market Rank | #2 |

| Bitmain's New Stake | 209,504 ETH ($610M) |

| Total Staked by Bitmain | 2,218,771 ETH |

| Percentage of Holdings | 52% |

Bitmain's stake directly impacts Ethereum's circulating supply. Removing 209,504 ETH from liquid markets reduces selling pressure. This creates a structural supply shock. Institutional liquidity cycles typically follow such accumulation phases. Retail market structure often lags, leading to FOMO-driven rallies. The stake also validates Ethereum's staking economics. According to Ethereum.org, staking provides a 3-5% annual yield. This yield attracts long-term capital. , controlling 52% of holdings signals ultra-long-term conviction. This behavior often precedes institutional adoption waves. Historical cycles suggest similar moves in 2020-2021 propelled Bitcoin to all-time highs.

"Bitmain's stake represents a classic liquidity grab during fear. Market structure suggests institutions are accumulating at technical support levels. This aligns with historical patterns where smart money buys when retail panics. The 52% holding ratio indicates a strategic, multi-year outlook rather than short-term speculation." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data.

The 12-month institutional outlook remains cautiously optimistic. Bitmain's move suggests confidence in Ethereum's post-merge issuance model. This model, detailed in EIP-4844 documentation, reduces net supply inflation. Consequently, long-term price discovery favors accumulation phases. The 5-year horizon likely includes continued institutional staking growth. This growth could mirror Bitcoin's ETF adoption cycle of 2023-2024.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.