Loading News...

Loading News...

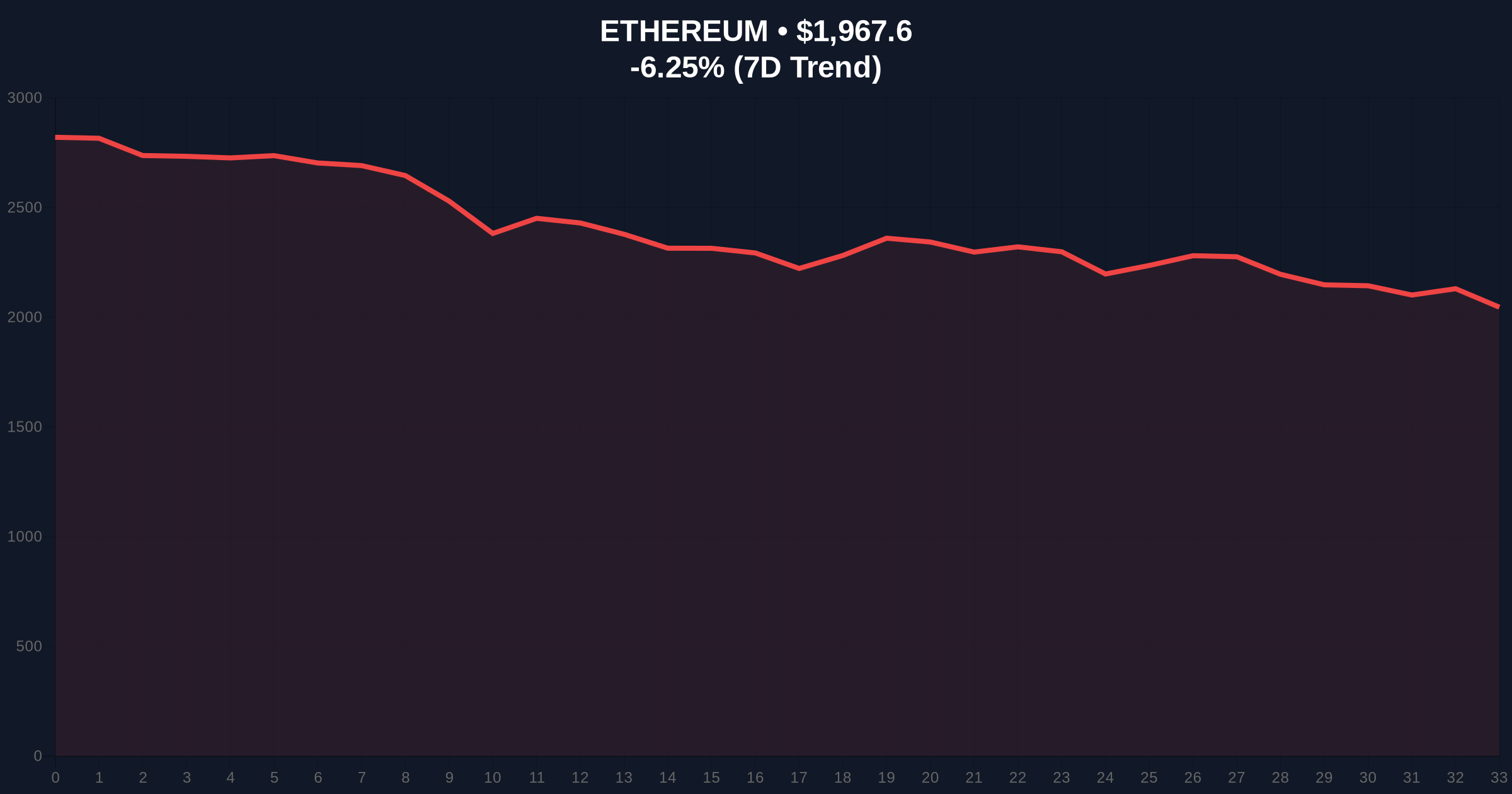

VADODARA, February 5, 2026 — Large-scale Ethereum holders expanded their positions over the past five months, yet negative on-chain indicators suggest downward price pressure persists. According to an analysis by Cointelegraph, addresses holding over 10,000 ETH increased their stakes, with wallets above 100,000 ETH growing from 2.75 million to 3.68 million. In contrast, mid-tier holders (100–1,000 ETH) decreased from 9.79 million to 8.32 million. The current ETH price trades below the average cost basis for most holders, placing the market in a state of overall loss. This latest crypto news highlights a classic divergence between whale behavior and retail sentiment.

Cointelegraph's on-chain forensic data reveals a stark split in Ethereum holder behavior. Whale addresses (10,000+ ETH) aggressively accumulated, while mid-tier holders liquidated positions. The number of wallets holding more than 100,000 ETH surged by approximately 33.8%. This accumulation occurred despite ETH trading below its realized price—the average cost at which all coins last moved. Market structure suggests whales are positioning for a long-term recovery, exploiting retail fear. Simultaneously, exchange inflows spiked, indicating selling pressure from smaller holders. This creates a liquidity grab scenario where large players absorb supply at distressed levels.

Historically, whale accumulation during price declines often precedes major rallies. Similar to the 2021 correction, where ETH fell below its realized price before surging to new highs, current patterns mirror a consolidation phase. However, the surge in exchange inflows contrasts with typical accumulation phases. In past cycles, such as 2018, sustained exchange inflows led to prolonged bear markets. Underlying this trend is the global crypto sentiment index, which reads "Extreme Fear" at a score of 12/100. This sentiment aligns with broader market fears, as seen in recent developments like Deutsche Bank's analysis of Bitcoin's confidence crisis and Russia's Sovcombank launching Bitcoin-collateralized loans.

Ethereum's price action shows critical technical levels at play. The current price of $1,969.09 sits below the 200-day moving average, a key institutional benchmark. On-chain data indicates the realized price—currently around $2,100—acts as a major resistance level. A Fair Value Gap (FVG) exists between $1,850 and $2,000, where liquidity clusters. Market structure suggests a break below $1,850 could trigger a cascade of stop-loss orders. The Relative Strength Index (RSI) hovers near oversold territory, but negative funding rates persist. , Ethereum's post-merge issuance rate and upcoming Pectra upgrade (EIP-7702) add fundamental pressure, as detailed on Ethereum's official roadmap.

| Metric | Value | Change |

|---|---|---|

| Crypto Fear & Greed Index | Extreme Fear | Score: 12/100 |

| Ethereum (ETH) Price | $1,969.09 | -6.18% (24h) |

| Whale Wallets (100k+ ETH) | 3.68 million | +33.8% (5 months) |

| Mid-Tier Wallets (100-1k ETH) | 8.32 million | -15.0% (5 months) |

| Market Rank | #2 | Stable |

This divergence matters for institutional liquidity cycles and retail market structure. Whale accumulation signals long-term confidence, potentially stabilizing prices. However, retail exodus and exchange inflows create selling pressure. The market sits in a state of overall loss, with most holders underwater. This scenario often leads to capitulation events, where weak hands exit, allowing strong hands to accumulate. Institutional players monitor these on-chain metrics to time entries. The current environment resembles a gamma squeeze setup, where options positioning could amplify volatility. Related regulatory shifts, such as US Treasury flagging China's digital asset rumors, add macroeconomic uncertainty.

Market structure suggests whale accumulation is a contrarian bet against extreme fear. However, negative on-chain indicators like exchange inflows and price below realized cost indicate near-term headwinds. The key is whether support at $1,850 holds—if it breaks, we could see a retest of the 2025 lows.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, if whale accumulation continues and exchange inflows subside, ETH could consolidate above $1,850 and attempt a rally toward the realized price at $2,100. Second, if retail selling persists and negative metrics worsen, a breakdown below key support could trigger a drop to $1,700. The 12-month institutional outlook hinges on Ethereum's adoption of EIP-4844 blobs and scaling improvements. Historically, similar accumulation phases in 2020 led to 300% gains within 18 months.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.