Loading News...

Loading News...

VADODARA, February 5, 2026 — Sovcombank, Russia's ninth-largest bank, has launched the country's first major Bitcoin-collateralized loan product. This latest crypto news arrives as Bitcoin price plunges to $68,162 amid extreme market fear. According to CoinDesk, the service targets legally compliant companies and individuals.

Marina Burdonova, Sovcombank's Head of Compliance, detailed the product. She explained it allows clients to finance business development without selling assets. The service requires legal cryptocurrency holdings. Burdonova emphasized compliance controls.

This follows Sberbank's pilot program in December 2025. Sberbank remains Russia's largest state-owned bank. Its service operates in a testing phase. Sovcombank's full launch marks a significant escalation.

Historically, Bitcoin-collateralized loans emerged during the 2021 bull market. Platforms like Nexo and BlockFi pioneered the model. Regulatory crackdowns in 2023 forced many to shutter. Consequently, traditional bank entry signals maturation.

In contrast, Western banks remain cautious. The SEC's strict stance on crypto lending persists. Russia's move creates a regulatory arbitrage opportunity. This could attract capital from restrictive jurisdictions.

Related developments include EU tokenization lag risking $150B liquidity flight. , Bitmain's $8B Ethereum loss highlights current market stress.

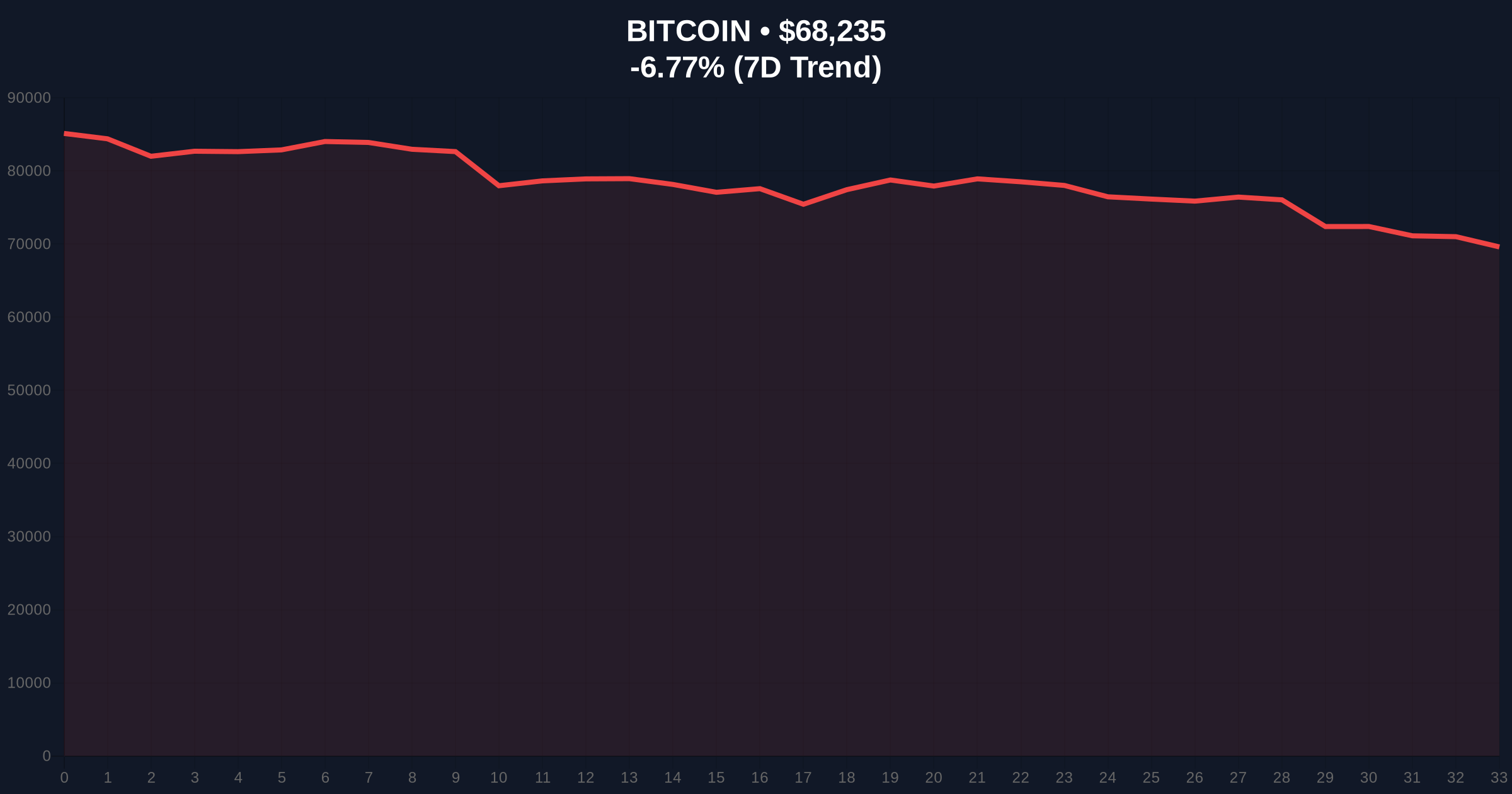

Market structure suggests a liquidity grab below $70,000. Bitcoin's 24-hour trend shows a -6.87% decline. The Fair Value Gap (FVG) between $72,000 and $75,000 remains unfilled. RSI readings indicate oversold conditions.

Fibonacci retracement levels from the 2025 all-time high provide key supports. The 0.618 level at $65,000 is critical. A break below invalidates the current bullish structure. Volume profile shows accumulation near $68,000.

On-chain data from Glassnode indicates rising UTXO age bands. Long-term holders are not capitulating. This contrasts with retail panic selling. The divergence suggests institutional accumulation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (12/100) |

| Bitcoin Current Price | $68,162 |

| Bitcoin 24h Change | -6.87% |

| Bitcoin Market Rank | #1 |

| Sovcombank Russian Rank | 9th Largest Bank |

This development matters for institutional liquidity cycles. Banks providing Bitcoin loans increase asset utility. Clients can access capital without triggering taxable events. This locks Bitcoin supply, reducing sell pressure.

, it validates cryptocurrency as collateral. Traditional finance now recognizes Bitcoin's value. This could accelerate adoption in other emerging markets. Regulatory frameworks may evolve to accommodate.

Retail market structure benefits indirectly. Increased institutional participation stabilizes volatility. However, counterparty risk remains. Sovcombank's compliance focus mitigates some concerns.

"Sovcombank's move is a logical step in crypto's financialization. It provides liquidity during downturns, which is precisely when it's needed most. The key risk is regulatory reversal, but Russia's current stance appears supportive."

Market structure suggests two primary scenarios. The bullish case requires holding key supports. The bearish case involves further liquidation cascades.

The 12-month institutional outlook remains cautiously optimistic. Sovcombank's product could inspire similar launches globally. However, macroeconomic headwinds like Federal Reserve policy may dominate. The 5-year horizon favors adoption as regulatory clarity improves.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.