Loading News...

Loading News...

VADODARA, January 5, 2026 — Ethereum-based stablecoin trading volume surged to a record $8 trillion in Q4 2025, according to data from Token Terminal cited by Cointelegraph. This daily crypto analysis reveals a twofold increase from Q2 2025's $4 trillion, underscoring a seismic shift in on-chain activity beyond mere speculation. Market structure suggests this volume spike correlates with a peak in active Ethereum addresses and a 43% annual growth in stablecoin issuance.

Ethereum has historically dominated decentralized finance (DeFi) and tokenization, but recent data points to an expansion into real-world settlements. The network now holds 57% of all stablecoins and 65% of tokenized real-world assets (RWAs), per Token Terminal. This mirrors the 2021-2023 adoption curve where Ethereum's post-merge issuance reduction bolstered its store-of-value narrative. However, the current surge in stablecoin volume indicates a pivot toward utility-driven transactions, akin to the growth seen during the EIP-4844 upgrade that reduced layer-2 costs. Related developments include Trend Research's profitable $2 billion ETH position, highlighting institutional accumulation amid volatility.

In Q4 2025, stablecoin trading volume on Ethereum hit $8 trillion, an all-time high. Token Terminal data shows this doubled from Q2 2025's $4 trillion. Active Ethereum addresses also peaked during this period. Stablecoin issuance grew 43% in 2025, with over half of all Tether (USDT) now on Ethereum. Cointelegraph reports this trend reflects rising demand for on-chain payments and settlements, not just speculative trading. The network's dominance in RWAs further cements its role in tokenizing traditional assets.

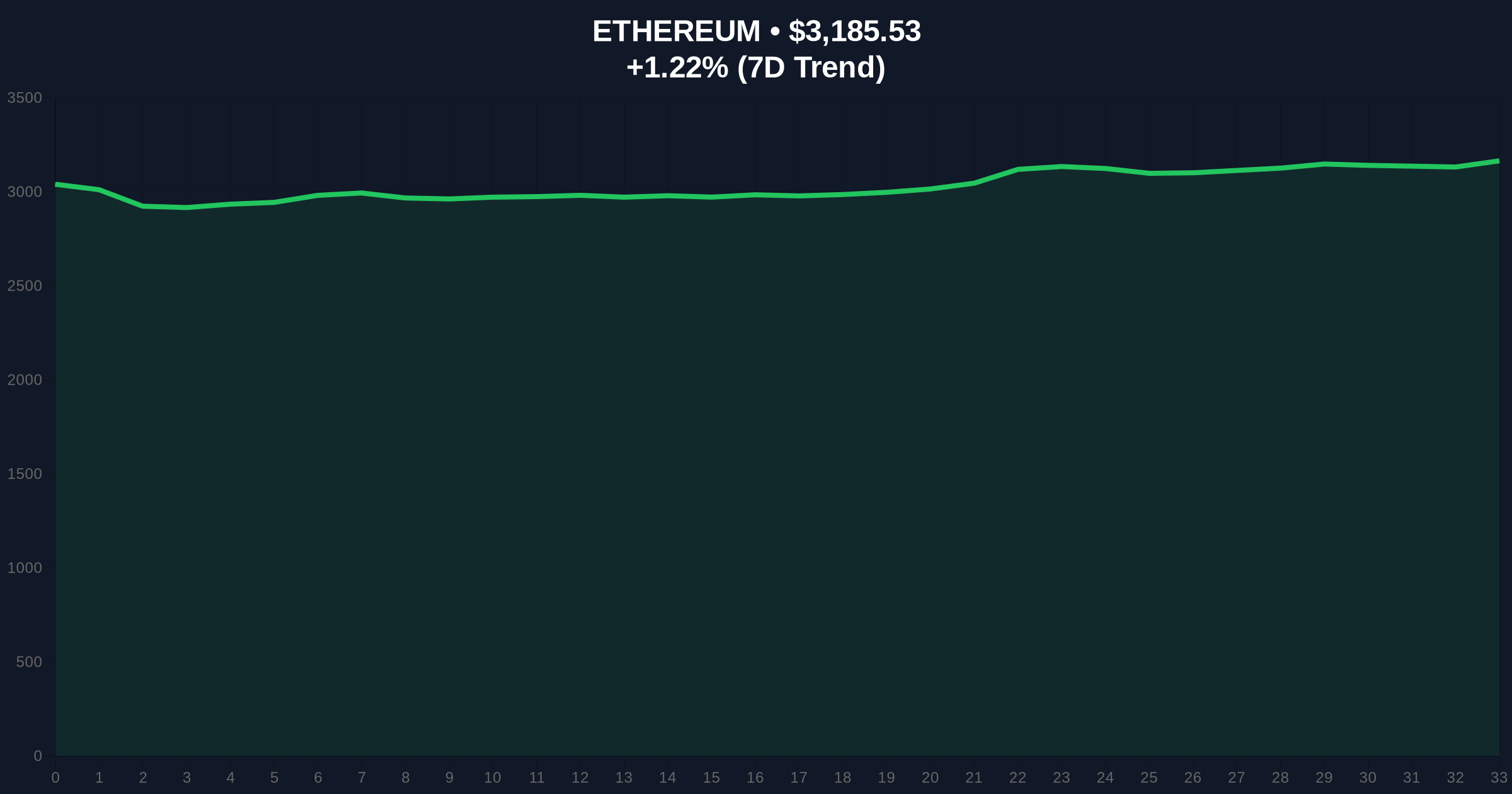

Ethereum's current price is $3,185.56, up 1.22% in 24 hours. On-chain data indicates strong support at the $3,000 level, a psychological and Fibonacci 0.618 retracement zone from the 2024 lows. The RSI sits at 52, suggesting neutral momentum. A Bullish Invalidation level is set at $2,850, where a break below could signal a liquidity grab and invalidate the uptrend. Conversely, a Bearish Invalidation level is $3,400, above which a gamma squeeze might accelerate gains. Volume profile analysis shows increased activity around $3,100-$3,200, forming a fair value gap (FVG) that may need filling.

| Metric | Value | Source |

|---|---|---|

| Ethereum Stablecoin Volume (Q4 2025) | $8 trillion | Token Terminal |

| Growth from Q2 2025 | 100% | Token Terminal |

| Stablecoin Issuance Growth (2025) | 43% | Token Terminal |

| Ethereum's Stablecoin Market Share | 57% | Token Terminal |

| Crypto Fear & Greed Index | 26/100 (Fear) | Live Market Data |

| Ethereum Current Price | $3,185.56 | Live Market Data |

| 24-Hour Price Change | +1.22% | Live Market Data |

For institutions, this volume surge validates Ethereum as a settlement layer for real-world assets, potentially attracting more RWA tokenization per Ethereum's official roadmap. Retail investors benefit from reduced network congestion and lower fees as stablecoin activity diversifies beyond DeFi speculation. The data implies a structural reduction in Ethereum's correlation with purely speculative cycles, enhancing its 5-year utility outlook. However, reliance on Tether concentration poses systemic risks if regulatory shifts occur.

Market analysts on X/Twitter highlight the divergence between record on-chain activity and the fear-driven market sentiment. Bulls argue this signals underlying strength, similar to trends seen during recent short squeezes. Bears caution that high volume without price appreciation could indicate distribution. No direct quotes from figures like Vitalik Buterin are available, but sentiment leans toward cautious optimism given the network's expanding utility.

Bullish Case: If stablecoin volume sustains above $7 trillion quarterly, Ethereum could target $4,000 by mid-2026, driven by RWA adoption and layer-2 scaling. On-chain data indicates increasing address activity supports this scenario.Bearish Case: A drop below the $2,850 invalidation level might trigger a sell-off to $2,500, especially if global regulatory pressures intensify, as seen in recent token utility expansions facing hurdles.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.