Loading News...

Loading News...

VADODARA, January 6, 2026 — Bitmain (BMNR) executed a strategic liquidity grab of 186,336 ETH worth approximately $600 million over a three-hour window, according to on-chain data from Onchainlens. This daily crypto analysis examines how this transaction elevates the company's total staked Ethereum position to 779,488 ETH valued at $2.05 billion, representing one of the largest single-entity accumulations in the post-merge era. Market structure suggests this move creates a significant order block at current price levels while the broader market sentiment remains in 'Fear' territory.

Underlying this trend is a broader institutional shift toward Ethereum's proof-of-stake consensus mechanism following the successful merge. According to Ethereum.org documentation, the transition to proof-of-stake reduced issuance by approximately 90%, creating a deflationary pressure that appeals to long-term capital. Consequently, entities like Bitmain are positioning themselves not merely as miners but as validators in the network's security apparatus. This mirrors accumulation patterns observed during the 2021-2022 cycle when institutional players established foundational positions during periods of retail capitulation. Related developments include the US Crypto Bill delay to 2027 creating regulatory uncertainty and the US Marshals' Bitcoin sale introducing temporary market liquidity concerns.

Onchainlens forensic data confirms Bitmain deployed capital across multiple transactions within a compressed timeframe, suggesting algorithmic execution rather than manual accumulation. The 186,336 ETH stake represents approximately 0.16% of Ethereum's total circulating supply, creating a noticeable impact on the staking yield curve. According to the primary source data, this brings Bitmain's cumulative position to 779,488 ETH, making them one of the top five non-custodial staking entities by volume. The transaction occurred during Asian trading hours, coinciding with typical liquidity windows for institutional rebalancing.

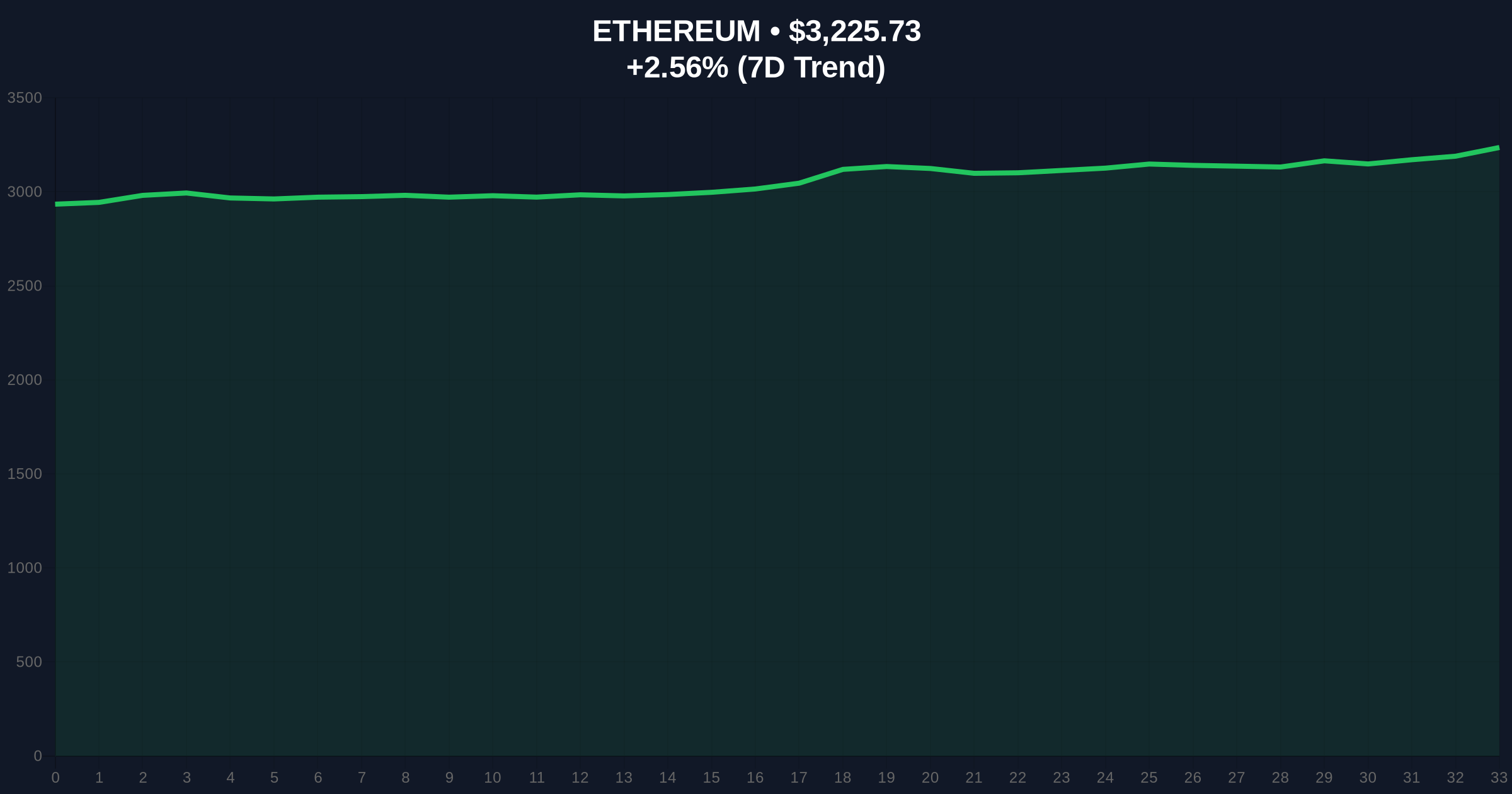

Market structure suggests the $3,225.93 level now represents a critical volume profile node following this accumulation. The rapid stake execution created a Fair Value Gap (FVG) between $3,180 and $3,210 that may require filling in subsequent sessions. The 200-day moving average at $3,150 provides secondary support, while resistance converges at the $3,350 Fibonacci extension level from the November 2025 swing high. Bullish Invalidation is set at $3,100, where the order block would be compromised. Bearish Invalidation rests at $3,450, representing the upper bound of the current consolidation range. The Relative Strength Index (RSI) at 54 indicates neutral momentum despite the 2.77% 24-hour gain, suggesting price discovery remains constrained.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 44/100 (Fear) |

| Ethereum Current Price | $3,225.93 |

| 24-Hour Price Change | +2.77% |

| Bitmain's New Stake | 186,336 ETH ($600M) |

| Bitmain's Total Stake | 779,488 ETH ($2.05B) |

For institutional portfolios, this stake represents a multi-year commitment to Ethereum's validator economics, locking capital through the upcoming Pectra upgrade cycle. The $2.05 billion position generates approximately $123 million annually at current 6% staking yields, creating a revenue stream independent of price volatility. For retail participants, this signals reduced liquid supply and potential upward pressure on staking yields as competition for validation slots intensifies. The transaction's timing during 'Fear' sentiment suggests contrarian accumulation, a pattern historically associated with cycle bottoms.

Market analysts on X/Twitter note the divergence between on-chain accumulation and retail sentiment. One quantitative researcher observed, "Bitmain's stake represents a gamma squeeze on future validator queue positions, anticipating EIP-7251's increase in effective balance." Bulls argue this demonstrates conviction in Ethereum's roadmap beyond mere price speculation, while skeptics question the concentration risk in a single entity controlling nearly 2.5% of staked ETH.

Bullish Case: If the $3,100 support holds and staking derivatives like Lido's stETH maintain parity, Ethereum could test the $3,600 resistance by Q2 2026. Continued institutional accumulation would reduce circulating supply, creating structural scarcity ahead of the next halving cycle.

Bearish Case: A break below the $3,100 Bearish Invalidation level would trigger stop-loss cascades, potentially filling the FVG down to $2,950. This scenario would be exacerbated by broader market contagion from events like the Brevis airdrop creating sell pressure or regulatory developments from jurisdictions like the Cayman Islands affecting institutional access.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.