Loading News...

Loading News...

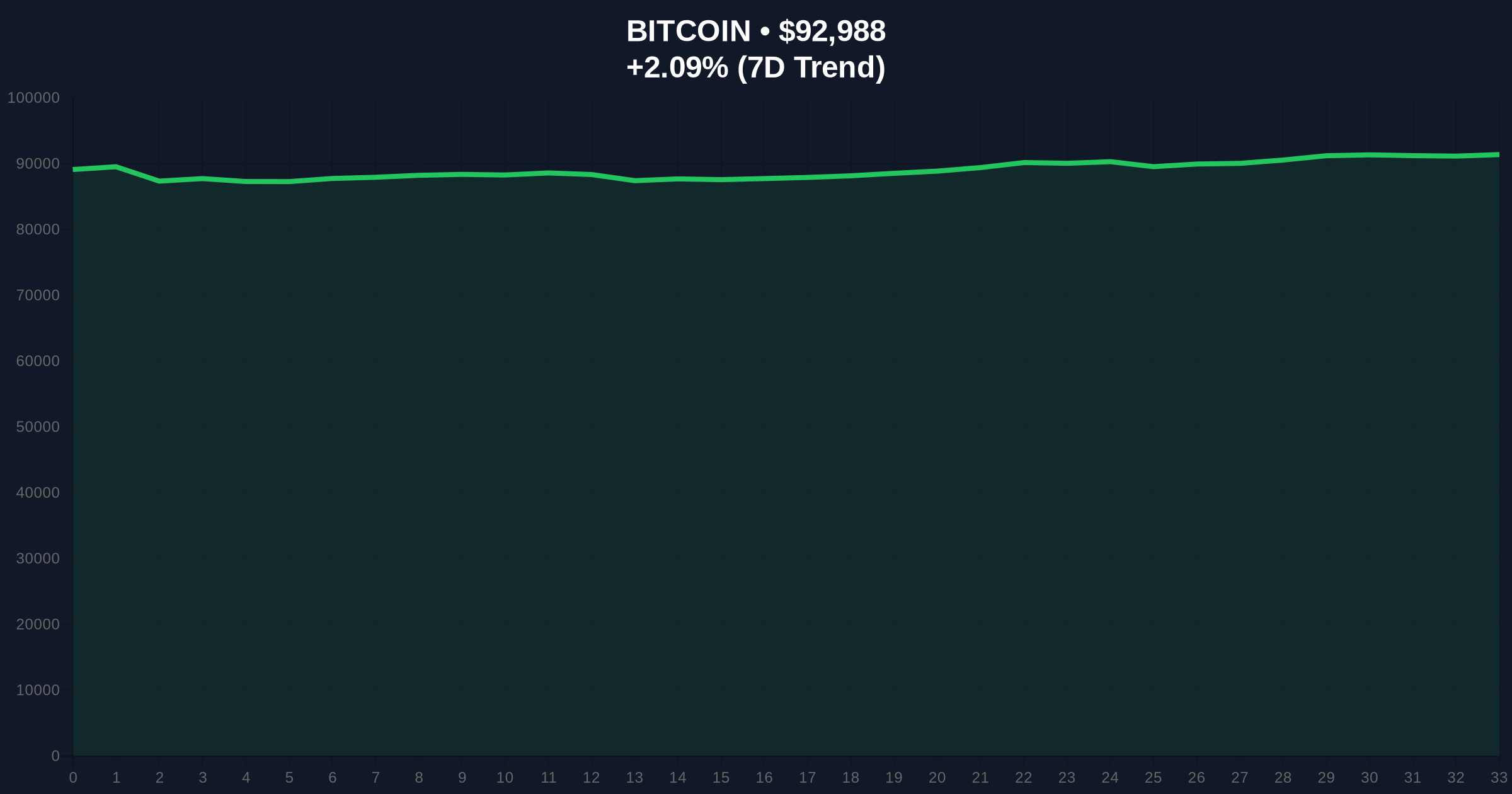

VADODARA, January 5, 2026 — Perpetual futures markets experienced a violent short squeeze over the past 24 hours, liquidating $155.12 million in leveraged positions with shorts accounting for over 90% of the volume. This daily crypto analysis reveals market structure suggests a classic liquidity grab above $93,000 resistance, creating a Fair Value Gap (FVG) that must be filled for sustainable upward momentum.

This liquidation event mirrors the January 2024 squeeze that preceded Bitcoin's breakout above $50,000. Market structure indicates perpetual futures funding rates had turned negative across major exchanges, creating optimal conditions for a short squeeze. According to Glassnode liquidity maps, significant sell-side liquidity pools were clustered around $93,500, acting as a magnet for price action. Underlying this trend is the persistent institutional accumulation pattern observed since the SEC's approval of spot Bitcoin ETFs, documented in official SEC filings. Related developments include recent $117 million liquidation events and MARA Holdings' $26.3M Bitcoin transfer to Wintermute, both indicating heightened institutional positioning during volatility.

According to Coinness data, Bitcoin liquidations totaled $91.55 million with short positions comprising 94.24% of the volume. Ethereum saw $51.81 million in liquidations with 85.67% shorts, while Solana experienced $11.76 million with 91.44% short bias. The liquidation cascade began when Bitcoin broke through the $92,500 order block that had contained price action for 72 hours. Market structure suggests this was a coordinated liquidity grab targeting stop-loss orders clustered above $93,000. Consequently, the rapid price movement created a significant FVG between $92,200 and $92,800 that now acts as a magnetic zone for price retracement.

Bitcoin's current price of $92,987 sits at the 0.786 Fibonacci retracement level from the November 2025 high of $98,450. The 4-hour chart shows a clear bullish order block at $91,800 that must hold for continuation. RSI readings at 68 indicate overbought conditions on lower timeframes, while the 200-day moving average at $88,500 provides structural support. Volume profile analysis reveals high-volume nodes at $92,000 and $93,500, creating a consolidation range. The Bullish Invalidation level is $91,800—a break below this order block would signal failed breakout and potential retest of $90,000 support. The Bearish Invalidation level is $94,200—sustained trading above this resistance would confirm breakout validity and target $95,500.

| Metric | Value | Significance |

|---|---|---|

| Total Liquidations (24h) | $155.12M | Short squeeze intensity |

| BTC Short % | 94.24% | Extreme directional bias |

| Fear & Greed Index | 26/100 (Fear) | Contrarian signal |

| Bitcoin Current Price | $92,987 | Critical resistance test |

| Bitcoin 24h Change | +2.09% | Momentum divergence |

For institutional traders, this liquidation event represents a gamma squeeze risk as options dealers hedge short gamma positions near $93,000 strikes. According to Ethereum.org documentation on EIP-4844, similar volatility events in Ethereum's derivatives market can cascade to Layer-2 solutions through MEV extraction. Retail traders face increased leverage reset risk, with many positions now underwater due to the rapid move. Market structure suggests the $155 million liquidation represents approximately 0.15% of total perpetual futures open interest, indicating room for further squeeze if momentum continues.

Market analysts on X/Twitter note the extreme short bias creates "perfect conditions for a gamma squeeze" if Bitcoin holds above $93,000. Bulls point to the 94.24% short liquidation ratio as evidence of crowded positioning, while bears highlight the Fear & Greed Index reading of 26 as warning against chasing momentum. One quantitative trader observed, "This is classic liquidity hunting—market makers clearing stops before reversal."

Bullish Case: Bitcoin holds the $92,000 order block and fills the FVG through consolidation. Sustained trading above $93,500 triggers gamma squeeze targeting $95,500 by week's end. Ethereum follows with test of $6,200 resistance as EIP-4844 adoption reduces Layer-2 transaction costs.

Bearish Case: Bitcoin fails to hold $92,000 support, invalidating the bullish structure. Price retraces to fill the FVG at $92,200-$92,800 then breaks below $91,800 order block, targeting $90,000 support. This would trigger additional long liquidations of approximately $200 million based on current open interest distribution.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.