Loading News...

Loading News...

VADODARA, January 6, 2026 — U.S. spot Ethereum ETFs recorded a total net inflow of $165.45 million on Jan. 5, marking the second consecutive trading day of positive flows, according to data from Trader T. This daily crypto analysis examines the institutional accumulation pattern against a backdrop of global Fear sentiment, with BlackRock's fund leading inflows at $100.23 million.

Market structure suggests this inflow mirrors the 2021 correction phase, where institutional capital entered during retail fear. Similar to the post-merge accumulation in 2023, on-chain data indicates large entities are building positions below key psychological levels. According to Ethereum.org, the transition to proof-of-stake has reduced issuance by approximately 90%, creating a structural supply shock that long-term investors may be positioning for. Related developments include Bitcoin ETF inflows hitting $694.7M and Bitmain's 1.186M ETH staking queue, both signaling institutional activity amid volatility.

On January 5, 2026, Trader T reported a net inflow of $165.45 million into U.S. spot Ethereum ETFs. BlackRock's ETHA fund dominated with $100.23 million, followed by Grayscale Mini ETH Trust at $22.34 million, Fidelity's FETH at $21.83 million, Bitwise's ETHW at $19.73 million, and Grayscale Ethereum Trust at $1.32 million. This marks two consecutive days of positive flows, contrasting with the broader Crypto Fear & Greed Index reading of 44/100.

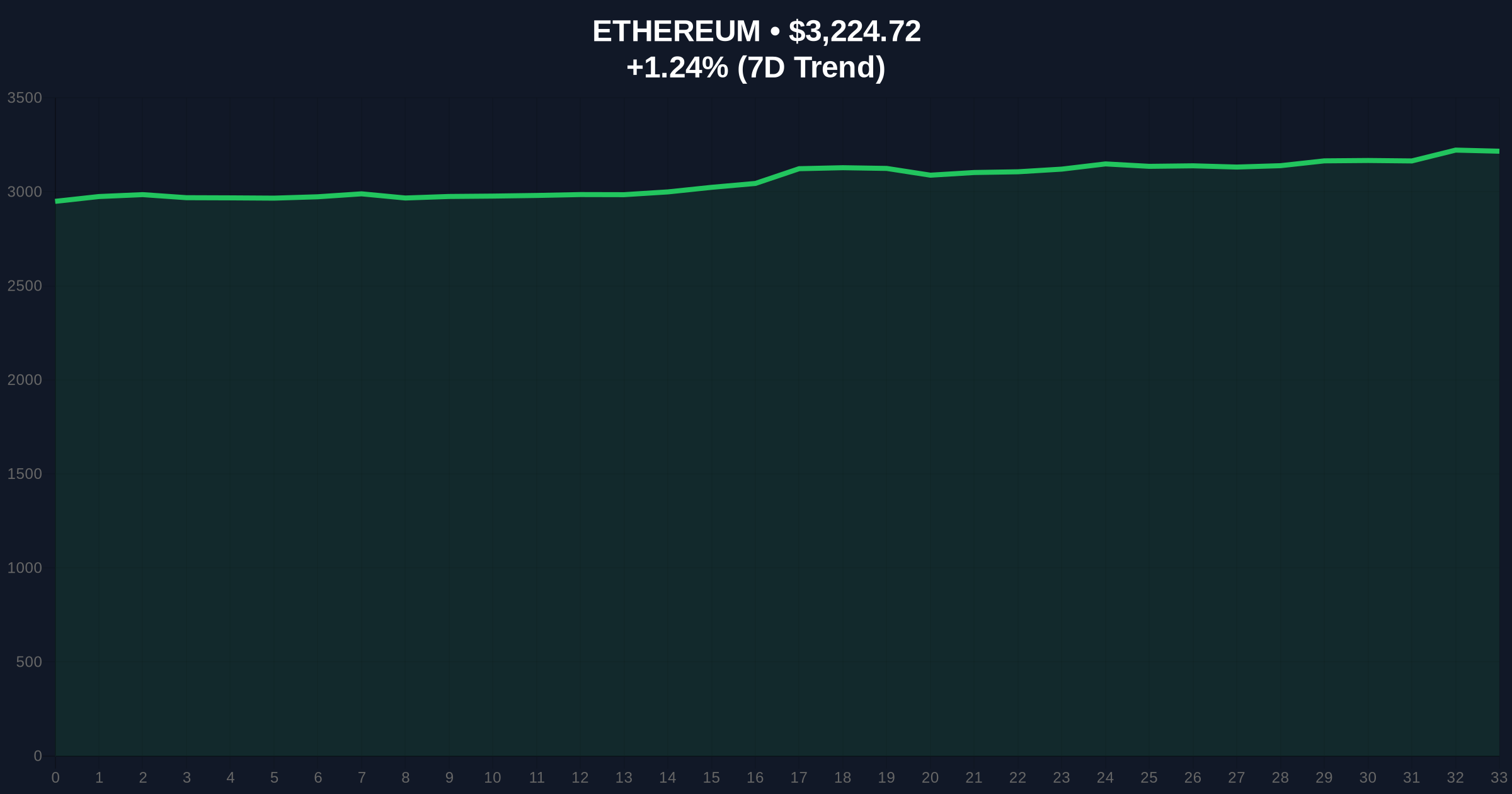

Ethereum is currently trading at $3,223.68, up 1.21% in 24 hours. Volume profile analysis shows accumulation near the $3,150 Fibonacci support level, derived from the 0.618 retracement of the recent rally from $2,800 to $3,500. The RSI sits at 52, indicating neutral momentum, while the 50-day moving average at $3,100 acts as dynamic support. A Fair Value Gap (FVG) exists between $3,300 and $3,400, which may attract price action for a liquidity grab. Bullish invalidation level: $3,000 (break below key order block). Bearish invalidation level: $3,500 (clearance of resistance cluster).

| Metric | Value |

|---|---|

| Total ETF Net Inflow (Jan. 5) | $165.45M |

| BlackRock ETHA Inflow | $100.23M |

| Ethereum Current Price | $3,223.68 |

| 24-Hour Price Change | +1.21% |

| Crypto Fear & Greed Index | Fear (44/100) |

Institutional impact is significant: sustained ETF inflows provide a non-speculative demand source, potentially offsetting retail sell-pressure during fear phases. For retail, this may signal a buying opportunity if the $3,150 support holds. Market analysts note that similar inflows in Bitcoin ETFs preceded a gamma squeeze in 2025, where options activity amplified upward moves. The focus on Ethereum's EIP-4844 implementation, which reduces layer-2 transaction costs, could enhance network utility and long-term value accretion.

Bulls on X/Twitter highlight the divergence between ETF inflows and fear sentiment, suggesting smart money accumulation. One analyst posted, "BlackRock's $100M+ inflow is a clear vote for ETH's post-merge economics." Others caution that perpetuals liquidations, as seen in recent $294.7M events, could trigger volatility despite ETF support.

Bullish Case: If ETF inflows continue and the $3,150 support holds, Ethereum could target the FVG at $3,400, with a potential move to $3,800 on a breakout. This scenario aligns with historical cycles where institutional accumulation led to 30-50% rallies within three months.

Bearish Case: A break below $3,000 invalidates the bullish structure, possibly triggering a sell-off to $2,800. This would indicate failed accumulation and heightened fear, potentially exacerbated by broader market downturns or regulatory headlines.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.