Loading News...

Loading News...

VADODARA, January 6, 2026 — The Ethereum validator withdrawal queue has collapsed to zero, effectively neutralizing a major source of sell pressure that has weighed on ETH markets since the Shanghai upgrade. This daily crypto analysis examines the on-chain mechanics behind this shift, revealing a 99.9% reduction from the September peak of 2.67 million ETH. Concurrently, the deposit queue has swelled to 1.3 million ETH, suggesting a potential pivot in institutional capital flows. Market structure suggests this combination creates a net-positive supply shock, though price action remains constrained by broader macro sentiment.

The Ethereum validator withdrawal mechanism, enabled by the Shanghai upgrade, introduced a controlled exit pathway for staked ETH. This created a predictable, queue-based sell pressure that has acted as a persistent overhang on the asset. Historical cycles suggest that such structural sell flows typically cap rallies until the queue is exhausted or demand overwhelms it. The current development mirrors the post-merge issuance reduction in its potential to alter ETH's fundamental supply/demand equation. Underlying this trend is the broader market's struggle with liquidity conditions, as seen in related developments like Bitcoin's test of the $92k support level and the $109 million in futures liquidations that have characterized recent volatility.

According to an analysis by The Block reporter Brian Danga, the Ethereum validator withdrawal queue reached zero on January 6, 2026. This represents a 99.9% reduction from its peak of 2.67 million ETH in September 2025. On-chain data indicates the queue's dissolution has been gradual but accelerated in recent weeks as validators completed their exit process. Simultaneously, the deposit queue—representing new ETH being staked—has grown to 1.3 million ETH. This divergence between exits and entries creates a net staking flow positive of 1.3 million ETH, equivalent to approximately $4.2 billion at current prices. The data, sourced from Ethereum's chain via explorers like Etherscan, shows a clear inflection point in validator behavior.

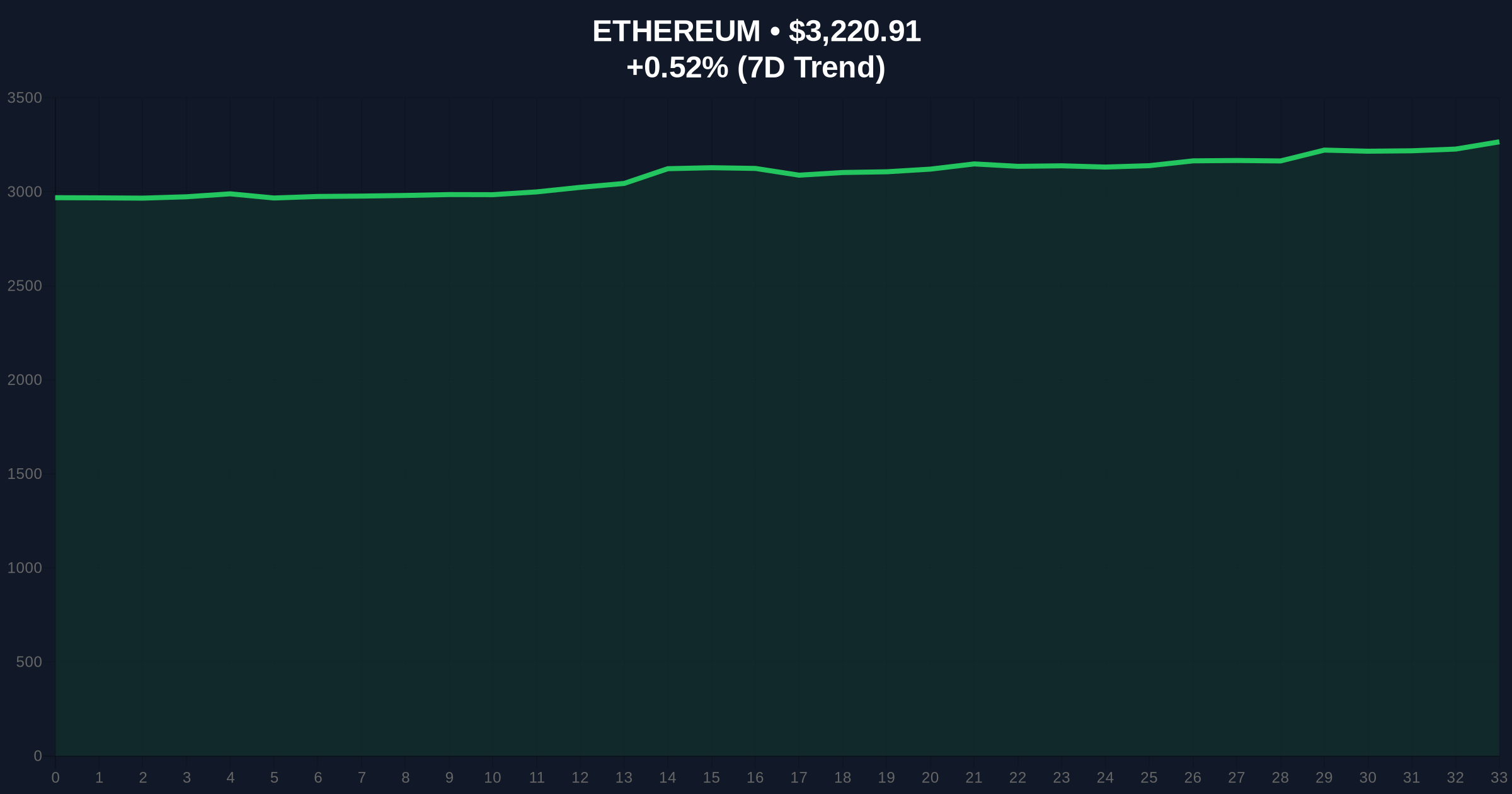

ETH currently trades at $3,220.91, up 0.52% in 24 hours. The price sits within a consolidation range bounded by the 50-day moving average at $3,150 and the 200-day moving average at $3,350. The Relative Strength Index (RSI) reads 52, indicating neutral momentum. Volume profile analysis shows significant accumulation between $3,000 and $3,100, establishing that zone as a high-volume node and primary support. A Fair Value Gap (FVG) exists between $3,400 and $3,500 from the late-December rejection, which price must fill to confirm a bullish continuation. The Bullish Invalidation level is set at $3,050, a break below which would signal failure of the current structure and likely lead to a test of the $2,800 Fibonacci support. The Bearish Invalidation level is $3,500, a breach above which would confirm a new bullish impulse and target the $3,800 resistance zone.

| Metric | Value | Source/Context |

|---|---|---|

| Validator Withdrawal Queue | 0 ETH | Ethereum Chain (Jan 6, 2026) |

| Peak Withdrawal Queue (Sep 2025) | 2.67M ETH | The Block Analysis |

| Deposit Queue | 1.3M ETH | Ethereum Chain (Jan 6, 2026) |

| ETH Current Price | $3,220.91 | Live Market Data |

| 24-Hour Change | +0.52% | Live Market Data |

| Crypto Fear & Greed Index | 44/100 (Fear) | Live Market Data |

This development matters because it removes a structural headwind that has suppressed ETH's price appreciation for months. For institutions, the growing deposit queue signals renewed confidence in Ethereum's proof-of-stake yield, particularly as traditional finance explores tokenization via platforms like those highlighted in VanEck's MarketVector index launch. For retail, the reduction in sell pressure lowers the probability of sudden downside volatility from validator exits. The net effect is a tightening of available ETH supply on exchanges, which could precipitate a gamma squeeze if derivatives demand increases. According to Ethereum.org's documentation on staking, the deposit queue growth aligns with the network's shift toward greater institutional participation post-merge.

Market analysts on X/Twitter are interpreting the data as a bullish inflection. One quant noted, "The validator exit queue hitting zero is the equivalent of a miner capitulation event in Bitcoin—it removes forced selling." Others caution that macro conditions, including potential Federal Reserve policy shifts, could override this micro dynamic. The sentiment is cautiously optimistic, with many pointing to the deposit queue as evidence of "smart money" positioning for the next cycle. This contrasts with the fear-driven narratives surrounding events like Riot Platforms' $200M Bitcoin sale, which some view as miner capitulation.

Bullish Case: If the deposit queue continues to grow and ETH holds above $3,050, the reduced sell pressure could catalyze a move to fill the FVG at $3,500. A break above that level would target $3,800 and potentially $4,200 as the supply shock permeates price discovery. This scenario assumes stable macro conditions and no adverse regulatory developments.

Bearish Case: If broader market fear intensifies, perhaps due to a hawkish Fed or a black swan event, ETH could break below $3,050. This would invalidate the bullish structure and likely lead to a test of $2,800 and possibly $2,500. In this scenario, the deposit queue growth could stall or reverse, exacerbating the downturn.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.