Loading News...

Loading News...

- Fundstrat's leaked internal document projects Bitcoin could fall to $60,000 and Ethereum to $1,800-$2,000 in H1 2026.

- Chairman Tom Lee clarifies the firm doesn't impose a single viewpoint, highlighting divergent analytical approaches within the organization.

- Market structure suggests a potential liquidity grab below the $85,000 support level amid Extreme Fear sentiment (20/100).

- Technical analysis identifies critical invalidation levels at $92,000 (bullish) and $82,000 (bearish) based on Fibonacci retracement.

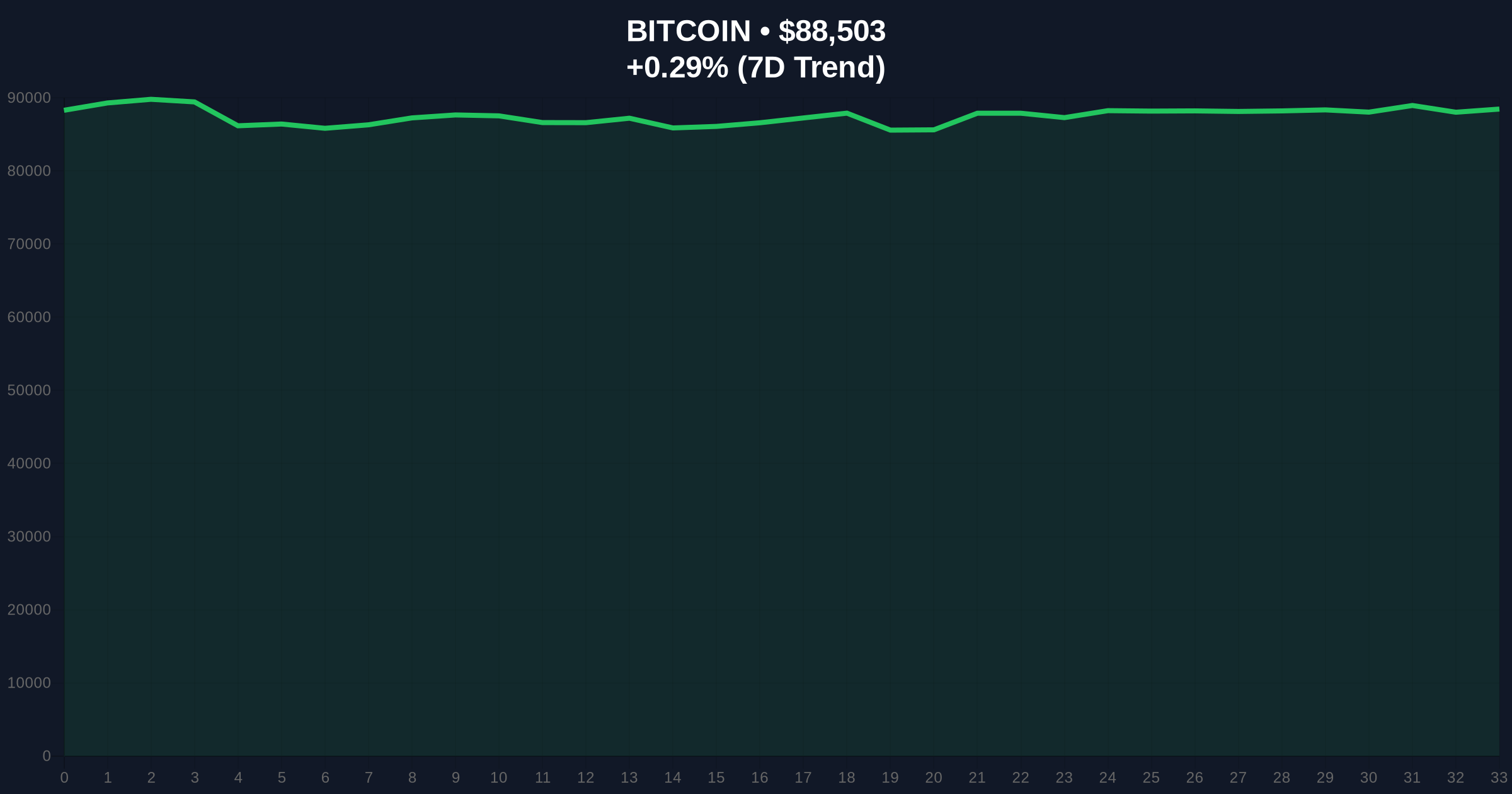

VADODARA, December 22, 2025 — This daily crypto analysis examines the contradictory signals emerging from Fundstrat Global Advisors, where a leaked internal memo projecting significant cryptocurrency declines conflicts with public statements from leadership. The document, believed authored by Head of Digital Asset Strategy Sean Farrell, suggests Bitcoin could drop to $60,000 and Ethereum to $1,800-$2,000 in the first half of 2026, while Chairman Tom Lee emphasizes the firm accommodates multiple viewpoints. Market structure suggests this internal divergence reflects broader uncertainty as Bitcoin trades at $88,488 with minimal 24-hour movement.

The cryptocurrency market currently registers Extreme Fear with a sentiment score of 20/100, creating fertile ground for contradictory projections. This environment mirrors the 2021 correction when institutional analysts issued wildly divergent forecasts during similar sentiment extremes. The Federal Reserve's ongoing quantitative tightening program, detailed on FederalReserve.gov, has created persistent liquidity headwinds that amplify downward pressure on risk assets. Historical patterns indicate that internal institutional disagreements often precede significant market inflection points, as seen during the 2018 bear market when conflicting bank reports preceded Bitcoin's 40% decline.

Related developments in the current market environment include significant ETF inflows amid extreme fear sentiment and institutional allocation recommendations during market uncertainty.

On December 22, 2025, Fundstrat Chairman Tom Lee addressed a leaked internal document projecting substantial cryptocurrency declines. According to statements to investors, the document—believed authored by Sean Farrell, Fundstrat's Head of Digital Asset Strategy—projects Bitcoin could fall to $60,000 in the first half of 2026. The same analysis suggests Ethereum could drop to between $1,800 and $2,000, while Solana (SOL) might decline to between $50 and $75. Lee clarified that Fundstrat doesn't impose a single viewpoint, explaining that short-term and long-term opinions can differ within the organization. He attributed the divergence to analytical methodology differences: Lee focuses on macroeconomic market cycles and liquidity, while Farrell concentrates on fund flows and risk management.

Bitcoin currently trades at $88,488 with minimal 24-hour movement of 0.27%. The weekly chart shows a clear Fair Value Gap (FVG) between $85,000 and $82,000 that market makers may target for a liquidity grab. The 50-day moving average at $86,500 provides immediate support, while the 200-day moving average at $78,000 represents a critical structural level. Volume profile analysis indicates weak accumulation above $90,000, suggesting limited conviction at current levels. The Relative Strength Index (RSI) at 42 remains neutral but trending toward oversold territory. Fibonacci retracement from the recent high of $92,000 to the swing low of $82,000 identifies the 0.618 level at $85,800 as a potential reversal zone.

| Metric | Value |

| Bitcoin Current Price | $88,488 |

| 24-Hour Change | +0.27% |

| Global Crypto Sentiment | Extreme Fear (20/100) |

| Fundstrat Bitcoin Projection | $60,000 (H1 2026) |

| Fundstrat Ethereum Projection | $1,800-$2,000 |

For institutional investors, this internal divergence signals deeper uncertainty about cryptocurrency valuation methodologies. The conflict between macroeconomic analysis (Lee) and fund flow analysis (Farrell) reflects a fundamental schism in how institutions approach digital asset valuation. Retail traders face increased volatility risk as contradictory signals from respected analysts create confusion in order flow. The five-year horizon suggests cryptocurrency markets remain in a discovery phase where traditional analytical frameworks produce conflicting results, potentially delaying institutional adoption until clearer valuation metrics emerge.

Market analysts on X/Twitter express skepticism about the leaked projections. One quantitative trader noted, "Fundstrat's $60K Bitcoin call contradicts their own liquidity models—this looks like risk management theater rather than conviction." Another analyst questioned the timing: "Why leak bearish projections during Extreme Fear? This feels like narrative manipulation to flush weak hands." The broader community remains divided, with bulls pointing to Bitcoin's resilience above $85,000 and bears highlighting the deteriorating volume profile.

Bullish Case: If Bitcoin holds above the $85,000 FVG and reclaims the $90,000 psychological level, market structure suggests a retest of the all-time high at $92,000. A sustained break above this level could trigger a gamma squeeze toward $95,000. The bullish invalidation level sits at $82,000—a breach would confirm bearish structure and target the $78,000 200-day moving average.

Bearish Case: If Bitcoin fails to defend the $85,000 support cluster, order block analysis suggests a swift decline to test the $82,000 Fibonacci level. A breakdown below this point would validate Fundstrat's bearish projection and open the path to $75,000. The bearish invalidation level is $92,000—a weekly close above this resistance would negate the downward structure and signal renewed bullish momentum.

What did Fundstrat's leaked document say about Bitcoin?The document projects Bitcoin could fall to $60,000 in the first half of 2026, along with declines for Ethereum and Solana.

How did Tom Lee respond to the leaked projections?Lee clarified that Fundstrat doesn't impose a single viewpoint and explained that different analysts use different methodologies.

What is the current market sentiment for cryptocurrencies?The global crypto sentiment is Extreme Fear with a score of 20/100 according to market indicators.

What are the key technical levels for Bitcoin?Critical levels include support at $85,000 and $82,000, with resistance at $90,000 and $92,000.

How do analysts view the conflicting signals from Fundstrat?Many analysts question whether the projections reflect genuine conviction or risk management positioning during market uncertainty.

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.