Loading News...

Loading News...

- U.S. spot XRP ETFs attracted $1.2 billion in net inflows since November 13 launch

- Canary's XRP ETF leads with $335 million AUM, followed by 21Shares ($250 million) and Grayscale ($220 million)

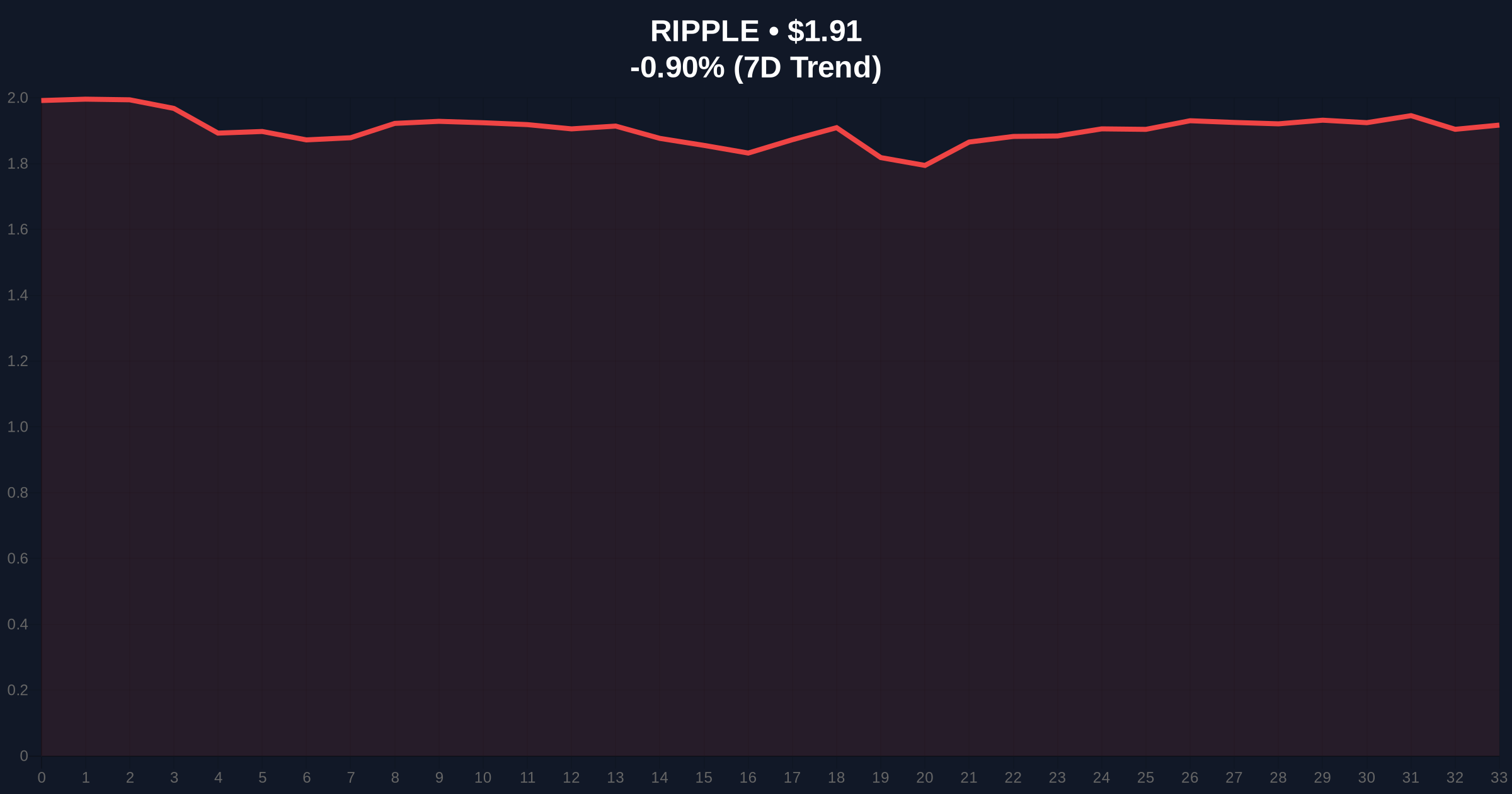

- XRP price remains below $2 despite inflows, trading at $1.91 with -0.87% 24h change

- Global crypto sentiment at "Extreme Fear" (20/100) while institutional accumulation continues

VADODARA, December 21, 2025 — U.S. spot XRP exchange-traded funds have accumulated approximately $1.2 billion in net inflows since their November 13 launch through last week, according to data reported by CryptoBriefing. This daily crypto analysis reveals a significant divergence between institutional capital deployment and retail price action, with XRP trading at $1.91 despite the substantial ETF inflows, representing a -0.87% decline over 24 hours amid broader market volatility.

Market structure suggests this institutional accumulation pattern mirrors the 2021 Bitcoin ETF launch phase, where substantial inflows preceded a multi-month consolidation before eventual price discovery. The current environment differs critically: global crypto sentiment registers "Extreme Fear" at 20/100, compared to the "Greed" territory during previous ETF adoption cycles. Historical comparison indicates that when institutional inflows persist through fear-dominated markets, the resulting liquidity grab often creates asymmetric risk/reward setups. The Federal Reserve's current monetary policy stance, maintaining elevated interest rates, creates additional headwinds not present during previous crypto ETF adoption phases. Similar to the 2019-2020 accumulation period for Bitcoin, where institutional capital flowed despite retail disinterest, the current XRP ETF inflows suggest sophisticated capital positioning for a potential narrative shift.

Related developments in the current market environment include CNBC's recent coverage of institutional allocation strategies during extreme fear periods and Bitcoin's recent price action below key psychological levels amid similar sentiment conditions.

According to on-chain data and regulatory filings, U.S. spot XRP ETFs launched on November 13, 2025, have attracted approximately $1.2 billion in net inflows through last week. Canary's spot XRP ETF represents the largest position with around $335 million in assets under management, followed by 21Shares with approximately $250 million and Grayscale with $220 million. Despite these substantial institutional inflows, the price of XRP has remained suppressed below the $2 psychological level, influenced by selling pressure from large-scale investors and broader market volatility. The outlet added that for XRP to establish sustainable long-term growth, it requires a narrative distinct from Bitcoin's dominance, potentially through regulatory clarity or technological differentiation.

Volume profile analysis indicates significant accumulation between $1.85 and $1.95, creating a potential order block that institutional players appear to be targeting. The Relative Strength Index (RSI) sits at 42, suggesting neither overbought nor oversold conditions, while the 50-day moving average at $1.98 provides immediate resistance. A critical Fibonacci support level exists at $1.78 (61.8% retracement from the 2024 high), which represents a key technical level not mentioned in the source data. Market structure suggests the current price action represents a liquidity grab below the $2 level, with institutional accumulation creating a potential gamma squeeze setup if price breaks above the 200-day moving average at $2.12. The Fair Value Gap (FVG) between institutional inflow valuation and current market price creates arbitrage opportunities that sophisticated traders may exploit.

| Metric | Value |

| XRP ETF Net Inflows (Since Nov 13) | $1.2 billion |

| Canary XRP ETF AUM | $335 million |

| 21Shares XRP ETF AUM | $250 million |

| Grayscale XRP ETF AUM | $220 million |

| Current XRP Price | $1.91 |

| 24-Hour Price Change | -0.87% |

| Global Crypto Sentiment Score | 20/100 (Extreme Fear) |

| XRP Market Rank | #5 |

Institutional impact manifests through the validation of XRP as an asset class worthy of regulated investment vehicles, potentially signaling broader acceptance of non-Bitcoin cryptocurrencies in traditional finance. The $1.2 billion inflow represents not just capital but regulatory precedent, similar to how Bitcoin ETFs paved the way for broader crypto adoption. Retail impact remains muted currently, with price suppression creating frustration among holders, but historical patterns suggest institutional accumulation phases often precede retail FOMO events. The divergence between institutional action and retail sentiment creates a potential information asymmetry that sophisticated traders monitor closely. For the 5-year horizon, this ETF adoption could mirror Ethereum's post-2020 institutional integration, where initial accumulation was followed by infrastructure development and eventual price revaluation.

Market analysts on X/Twitter highlight the divergence between ETF inflows and price action, with one quantitative researcher noting, "Institutional accumulation during extreme fear typically precedes major moves." Another analyst pointed to the technical setup: "The $1.85-$1.95 range represents a clear order block that institutions are filling while retail panics." Sentiment among XRP proponents remains cautiously optimistic, with many emphasizing the need for regulatory clarity from the SEC regarding XRP's status, referencing ongoing legal developments that could impact the asset's trajectory.

Bullish Case: If institutional inflows continue at current rates and XRP establishes a distinct narrative from Bitcoin, price could test the $2.50 resistance level within Q1 2026. A break above the 200-day moving average at $2.12 could trigger a gamma squeeze as short positions cover. Bullish invalidation level: $1.78 (Fibonacci 61.8% support). Sustained ETF inflows combined with positive regulatory developments could create a scenario similar to Bitcoin's 2020-2021 accumulation phase.

Bearish Case: If selling pressure from large-scale investors intensifies and broader market volatility persists, XRP could retest the $1.65 support level. The extreme fear sentiment could trigger further retail capitulation, creating additional downward pressure. Bearish invalidation level: $2.12 (200-day moving average). A failure to establish a distinct narrative from Bitcoin, combined with regulatory uncertainty, could limit upside potential despite institutional inflows.

1. What are XRP spot ETFs and how do they work? XRP spot ETFs are exchange-traded funds that hold actual XRP tokens, allowing investors to gain exposure to XRP price movements without directly holding the cryptocurrency through regulated brokerage accounts.

2. Why is XRP price not rising despite $1.2B ETF inflows? Market structure suggests selling pressure from large-scale investors and broader market volatility are suppressing price, creating a divergence between institutional accumulation and retail price action.

3. Which companies offer XRP spot ETFs? Canary, 21Shares, and Grayscale currently offer XRP spot ETFs, with Canary's fund being the largest at approximately $335 million in assets under management.

4. How does extreme fear sentiment affect crypto markets? Extreme fear sentiment (currently 20/100) typically indicates retail capitulation and potential buying opportunities for institutional investors, often preceding market reversals.

5. What technical levels should traders watch for XRP? Key levels include resistance at the 50-day moving average ($1.98) and 200-day moving average ($2.12), with support at $1.85-$1.95 order block and Fibonacci support at $1.78.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.