Loading News...

Loading News...

- Bitcoin breaks above $89,000 resistance level while market sentiment remains in "Extreme Fear" territory

- Technical structure suggests potential liquidity grab above previous highs with clear invalidation levels

- Historical comparison to 2021 bull market correction patterns reveals similar consolidation characteristics

- Institutional positioning diverges from retail sentiment, creating potential gamma squeeze conditions

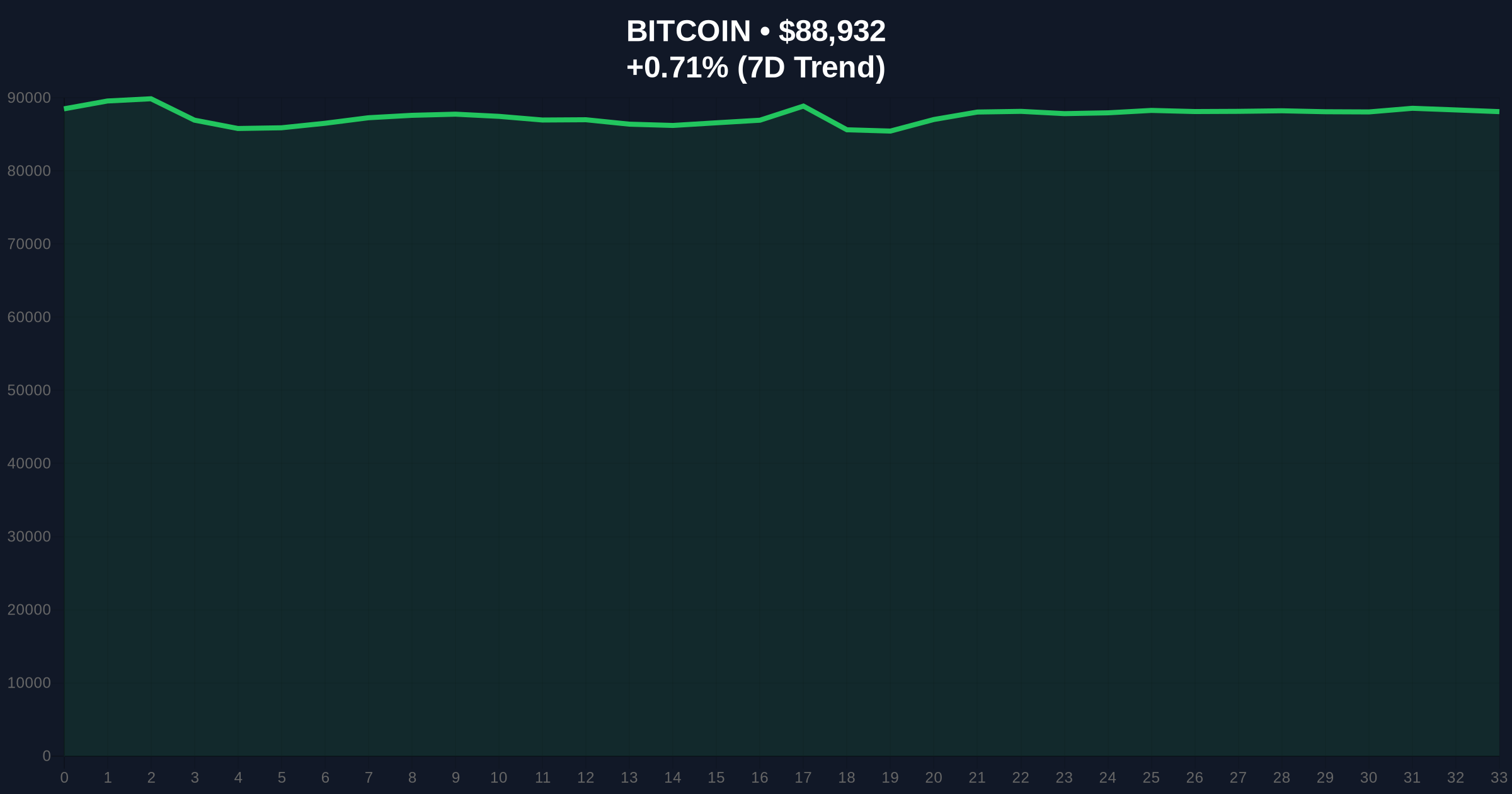

VADODARA, December 22, 2025 — Bitcoin has broken through the $89,000 psychological barrier in what market structure suggests may be a liquidity grab above previous resistance levels. This Daily Crypto Analysis examines the technical setup as BTC trades at $89,009.66 on the Binance USDT market while the broader cryptocurrency market sentiment registers at "Extreme Fear" with a score of 25/100.

Market structure suggests this price action mirrors the 2021 bull market correction patterns, where Bitcoin experienced similar consolidation phases before continuation moves. The current Extreme Fear sentiment reading of 25/100 represents a significant divergence from price action, creating conditions reminiscent of the March 2021 correction that preceded a 40% rally. Historical data indicates that when the Fear & Greed Index reaches these levels while price maintains above key moving averages, it often signals institutional accumulation against retail capitulation. The current setup bears similarity to the 2021 scenario where Bitcoin consolidated between $58,000 and $64,000 for six weeks before breaking to new all-time highs.

Related developments in the market context include recent analysis of CME Bitcoin futures gaps and institutional positioning shifts highlighted in Fundstrat's internal research. Additionally, allocation patterns among Chinese high-net-worth individuals suggest strategic repositioning that may be influencing current price action.

According to CoinNess market monitoring, Bitcoin broke above the $89,000 resistance level on December 22, 2025, trading at $89,009.66 on the Binance USDT market. The move represents a 0.70% gain over the previous 24 hours, occurring against a backdrop of Extreme Fear sentiment across global cryptocurrency markets. Market structure suggests this represents a technical breakout from a consolidation range that has persisted for approximately two weeks, with volume profile analysis indicating accumulation between $86,500 and $88,200.

Technical analysis reveals several critical levels. The current price action has created a Fair Value Gap (FVG) between $88,200 and $88,700 that may serve as future support. The 50-day moving average at $85,400 provides additional structural support, while the 200-day moving average at $78,200 represents the primary trend confirmation level. RSI readings at 62 suggest moderate bullish momentum without overbought conditions. Volume profile indicates significant liquidity pools above $90,000, potentially creating conditions for a gamma squeeze if options positioning aligns with spot movement.

Bullish invalidation is defined at $85,400 (50-day MA break), while bearish invalidation sits at $91,500 (previous swing high resistance). The current order block between $87,800 and $88,300 represents the immediate support zone that must hold for continuation. Market structure suggests that a break above the Fibonacci extension level at $92,500 would confirm the next leg of the bullish impulse wave.

| Metric | Value |

| Current Bitcoin Price | $88,931 |

| 24-Hour Price Change | +0.70% |

| Market Sentiment Score | 25/100 (Extreme Fear) |

| 50-Day Moving Average | $85,400 |

| 200-Day Moving Average | $78,200 |

This price action matters because it represents a potential inflection point in market structure. For institutional participants, a sustained break above $89,000 with Extreme Fear sentiment creates asymmetric opportunity, similar to patterns observed during the 2021 institutional adoption phase. Retail traders face different implications—the sentiment divergence suggests potential for rapid sentiment shifts that could trigger volatile moves. The technical setup resembles conditions preceding major moves in both 2017 and 2021 cycles, where price broke through psychological barriers while sentiment remained depressed.

From a regulatory perspective, sustained price strength above key levels may influence upcoming policy decisions, particularly regarding spot Bitcoin ETF flows and institutional custody requirements. The current technical structure aligns with historical patterns where Bitcoin has outperformed during periods of monetary policy uncertainty, as detailed in Federal Reserve research on digital asset correlations.

Market analysts on social platforms express cautious optimism, with many noting the sentiment-price divergence. One quantitative analyst stated, "The Extreme Fear reading at 25 while price holds above key moving averages creates textbook accumulation conditions." Another observer noted, "This mirrors the 2021 setup where institutions accumulated while retail capitulated." The consensus among technical analysts suggests watching for volume confirmation above $90,000 to validate the breakout.

Bullish Case: Market structure suggests that sustained trading above $89,000 with volume expansion could target the $92,500 Fibonacci extension level, with potential extension to $95,000 if institutional flows accelerate. This scenario requires holding above the $85,400 bullish invalidation level and would be confirmed by a shift in sentiment from Extreme Fear to Neutral.

Bearish Case: A rejection at current levels followed by a break below $85,400 would invalidate the bullish structure and target the $82,000 support zone. This scenario would likely coincide with continued Extreme Fear sentiment and could trigger a test of the 200-day moving average at $78,200. Market structure suggests this would represent a deeper correction within the broader uptrend rather than trend reversal.

What does Bitcoin breaking $89,000 mean for the market?Technical analysis suggests this represents a potential breakout from consolidation, but requires volume confirmation and sustained trading above this level to validate.

Why is market sentiment Extreme Fear while price is rising?This divergence often signals institutional accumulation against retail capitulation, creating potential for rapid sentiment shifts.

What are the key support levels for Bitcoin?Immediate support at $88,200-$88,700 FVG, with major support at the 50-day MA ($85,400) and 200-day MA ($78,200).

How does this compare to previous Bitcoin cycles?Market structure shows similarities to 2021 consolidation patterns before continuation moves, though each cycle has unique characteristics.

What should traders watch for next?Volume confirmation above $90,000, sentiment shifts from Extreme Fear, and whether price holds above the $85,400 invalidation level.

Data source: Read Original Report

Source Note: Market data and factual reporting in this article are sourced from original reports. Commentary and analysis provided by CoinMarketBuzz.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.