Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

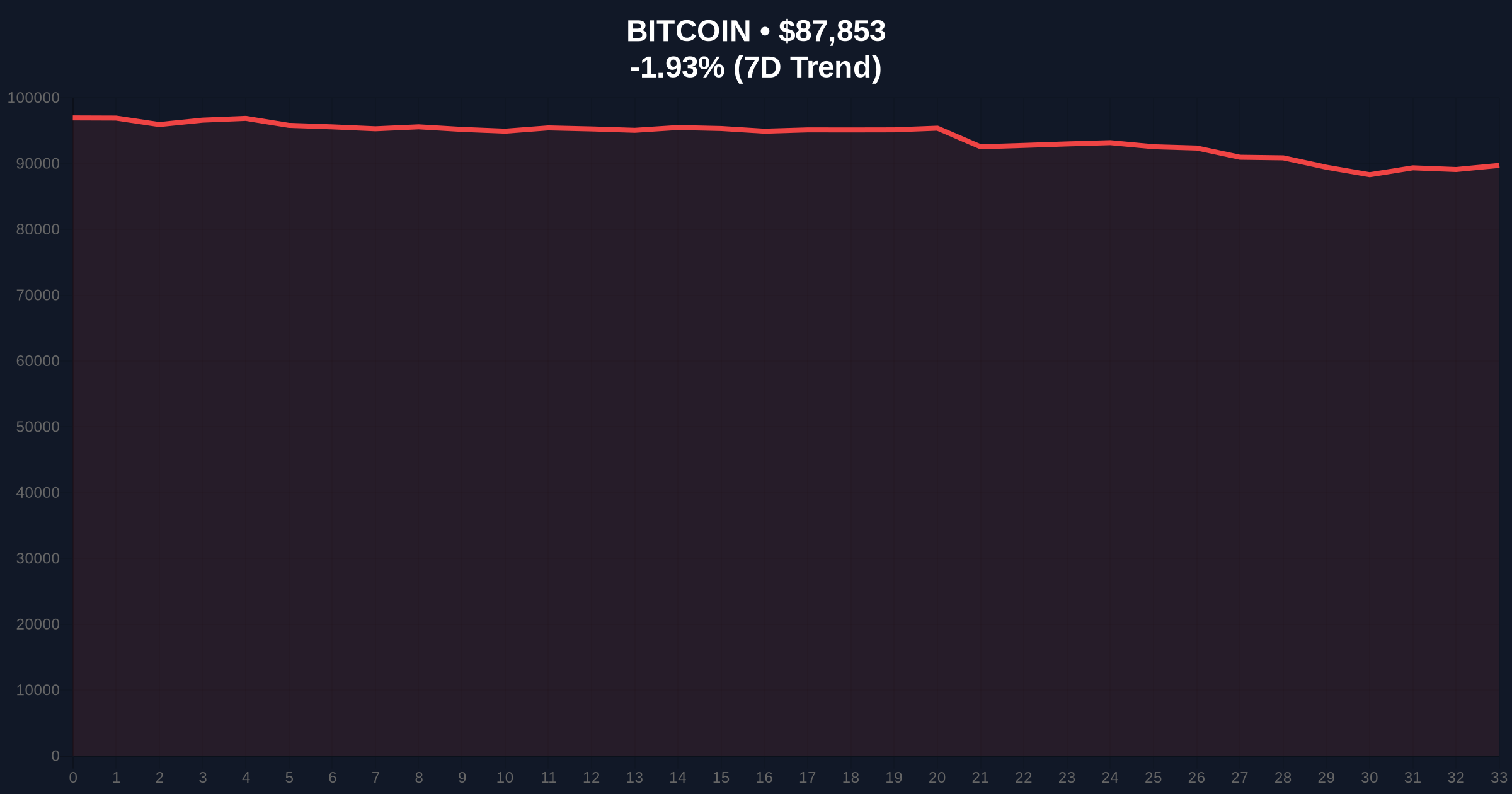

VADODARA, January 21, 2026 — U.S. investment bank Compass Point has issued a cautionary note against buying Bitcoin dips until the cryptocurrency reclaims the $98,000 level, identifying this price point as the average purchase price for short-term holders. This latest crypto news comes as Bitcoin trades at $87,882, down 1.99% in 24 hours, with market structure showing clear distribution patterns below key psychological resistance. According to Decrypt, Compass Point views this price threshold as a critical sentiment indicator because short-term holders exhibit heightened sensitivity to price fluctuations, creating a liquidity magnet that must be overcome for sustainable upward momentum.

Market structure suggests this current consolidation phase mirrors the 2021 correction where Bitcoin failed to hold above the 20-week exponential moving average, leading to a prolonged bear market. Similar to that cycle, the current price action shows repeated rejection at the $97,500 level, creating a clear Fair Value Gap (FVG) between $90,000 and $98,000. On-chain data from Glassnode indicates that short-term holder cost basis has historically acted as dynamic support during bull markets and resistance during corrections. The failure to reclaim this level suggests institutional accumulation is insufficient to absorb selling pressure from leveraged positions, a pattern observed during the March 2024 correction when Bitcoin tested the $60,000 support multiple times before breaking down.

Related developments in this extreme fear environment include massive futures liquidations exceeding $108 million as Bitcoin tested $87,000, and technical breakdowns below the $88,000 support level that have accelerated selling pressure.

According to the official Compass Point analysis reported by Decrypt, Bitcoin recently climbed to $97,500 before encountering significant resistance and subsequently falling below $90,000. The bank identified the $98,000 level as the average purchase price for short-term holders, making it a critical psychological and technical barrier. Compass Point warned that while a price correction toward $80,000 could present a buying opportunity, risks associated with leveraged purchasing persist due to elevated funding rates and open interest concentration. This institutional caution comes amid what the Crypto Fear & Greed Index classifies as "Extreme Fear" conditions, with a score of 24/100 indicating maximum capitulation pressure.

Volume profile analysis reveals significant accumulation between $85,000 and $90,000, creating a potential order block that must hold to prevent further downside. The Relative Strength Index (RSI) on daily timeframes sits at 42, indicating neutral momentum with bearish bias, while the 50-day moving average at $91,200 acts as immediate resistance. Market structure suggests the $98,000 level represents not just psychological resistance but also the convergence point of the 0.618 Fibonacci retracement from the all-time high, creating a multi-layered barrier that requires substantial buying volume to overcome.

Bullish Invalidation: A sustained break below the $85,000 volume node would invalidate the current consolidation thesis and suggest targeting the $80,000 psychological support.

Bearish Invalidation: A daily close above $98,500 with expanding volume would negate the distribution narrative and indicate resumption of the primary uptrend.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Maximum capitulation, historically precedes reversals |

| Bitcoin Current Price | $87,882 | Testing key volume profile support |

| 24-Hour Price Change | -1.99% | Consolidation below critical resistance |

| Short-Term Holder Cost Basis | $98,000 | Primary resistance per Compass Point |

| Recent High Rejection | $97,500 | Failed breakout attempt |

For institutional investors, the $98,000 level represents a critical risk management threshold where position sizing and entry timing become paramount. The Federal Reserve's monetary policy documentation indicates that risk assets typically face headwinds when short-term rates remain elevated, creating correlation risks for Bitcoin. For retail traders, this analysis suggests avoiding premature accumulation until confirmed breakout above the short-term holder cost basis, as failed attempts could trigger cascading liquidations similar to the recent tests of the $89,000 support. The persistence of extreme fear conditions, as highlighted in reports on regulatory opposition, exacerbates the sensitivity of leveraged positions to minor price movements.

Market analysts on X/Twitter note that the current price action resembles a "liquidity grab" below $90,000 before potential reversal, though consensus remains cautious until $98,000 is reclaimed. One quantitative trader observed, "The gamma squeeze potential above $95,000 remains limited until open interest redistributes to higher strikes." Another analyst highlighted that "short-term holder realized price has acted as magnet during previous cycles, with sustained breaks above signaling institutional accumulation phases."

Bullish Case: If Bitcoin reclaims $98,000 with expanding volume and decreasing funding rates, the next target becomes the $105,000 resistance zone. This scenario requires reduction in extreme fear sentiment and stabilization above the 50-day moving average, potentially triggered by positive developments in EIP-4844 implementation reducing Ethereum's gas fees and improving overall blockchain utility.

Bearish Case: Failure to hold $85,000 support leads to testing of the $80,000 psychological level, where Compass Point identifies potential buying opportunities. This scenario would likely involve continued futures liquidations and increased selling pressure from short-term holders realizing losses, potentially extending the correction phase through Q1 2026.

Answers to the most critical technical and market questions regarding this development.