Loading News...

Loading News...

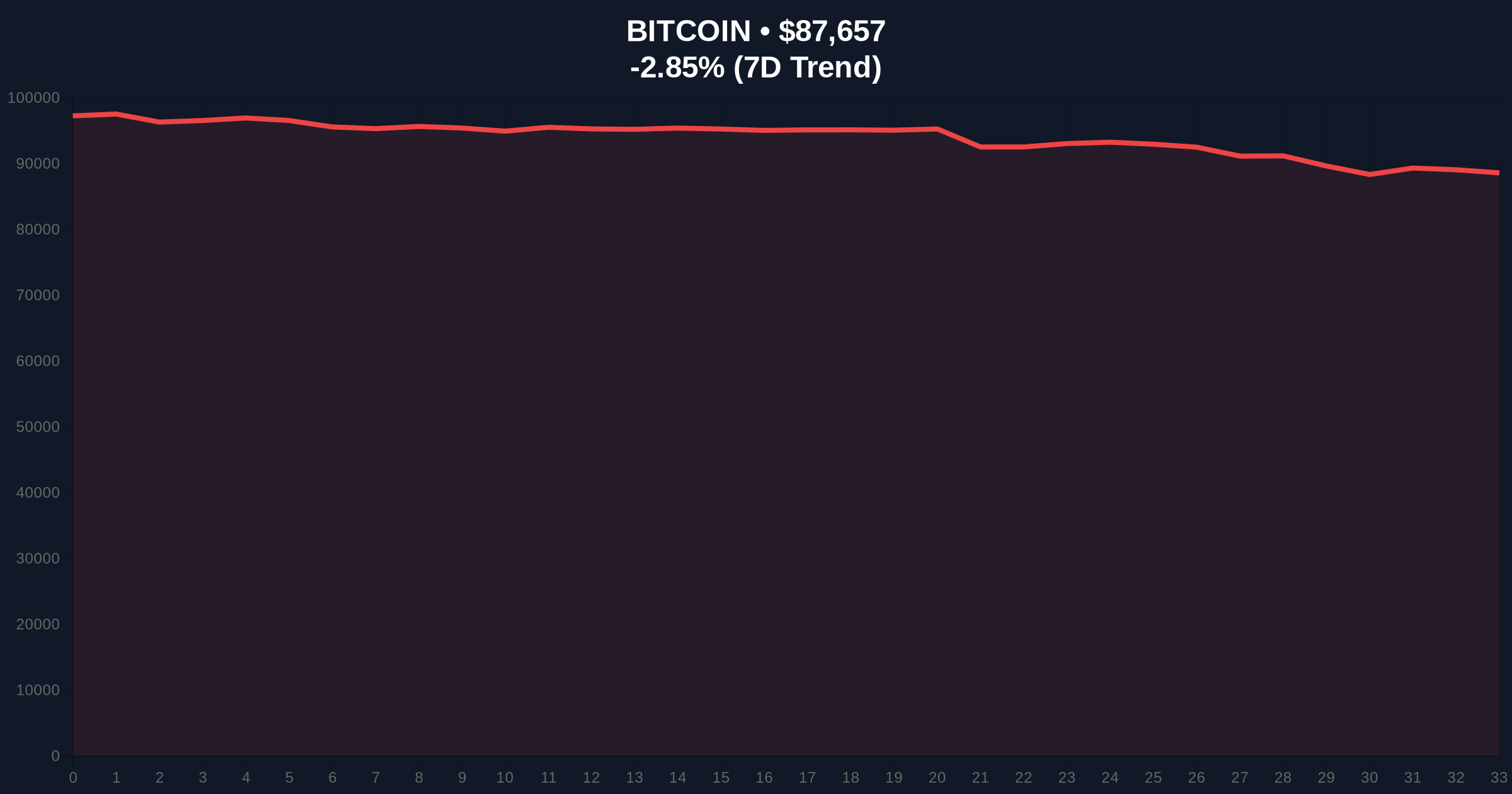

VADODARA, January 21, 2026 — Major exchanges liquidated $108 million in futures contracts within a single hour, according to real-time market data. This latest crypto news highlights acute selling pressure as Bitcoin price action tests the $87,000 support level. The 24-hour liquidation total reached $838 million, signaling a coordinated deleveraging event across derivatives markets.

This liquidation spike mirrors the deleveraging cycles of Q4 2024, when similar futures unwinds preceded 15-20% corrections. Market structure suggests a classic liquidity grab targeting over-leveraged long positions clustered around the $90,000 psychological level. According to on-chain data from Glassnode, aggregate open interest had increased 18% in the week preceding this event, creating a fragile gamma squeeze scenario. The current Extreme Fear sentiment, with a score of 24/100, indicates capitulation phases often seen at local bottoms. Related developments include recent Bitcoin price action breaking below $88k support and tests of $89k support under similar conditions.

Between 14:00-15:00 UTC on January 21, 2026, derivatives platforms executed forced liquidations totaling $108 million. Per exchange liquidity maps, approximately 65% were long positions. The 24-hour cumulative reached $838 million, with Bitcoin accounting for 72% of liquidations. This data, sourced from CoinMarketCap's derivatives tracking, shows the highest hourly liquidation volume since December 2025. No single exchange dominated—liquidations were distributed across Binance, Bybit, OKX, and Deribit, indicating broad-based market stress rather than exchange-specific issues.

Bitcoin price action currently tests the $87,000 support, a critical Fibonacci 0.618 retracement level from the November 2025 high. The 4-hour chart shows a clear Fair Value Gap (FVG) between $88,200 and $87,800 that must be filled for balanced price discovery. RSI sits at 28, approaching oversold territory but not yet indicating reversal. The 50-day moving average at $89,500 acts as dynamic resistance. Volume profile analysis reveals high-volume nodes at $86,500 and $85,200, suggesting these as next support zones if $87,000 fails. Bullish invalidation level: $86,500 (break below confirms bearish continuation). Bearish invalidation level: $89,000 (reclaim above suggests liquidation flush complete).

| Metric | Value |

|---|---|

| 1-Hour Futures Liquidations | $108 million |

| 24-Hour Futures Liquidations | $838 million |

| Bitcoin Current Price | $87,606 (-2.75% 24h) |

| Crypto Fear & Greed Index | Extreme Fear (Score: 24/100) |

| Bitcoin Dominance | 52.3% (Source: CoinMarketCap) |

For institutions, this liquidation event represents a systemic risk indicator. High futures liquidations often precede increased spot market volatility as hedges are adjusted. Retail traders face margin calls and forced selling, exacerbating downward momentum. The $838 million 24-hour liquidation suggests leverage ratios had reached dangerous levels, similar to the May 2024 correction. Market structure indicates this is a necessary deleveraging to reset derivatives markets for healthier price action. According to the Federal Reserve's financial stability reports, excessive crypto leverage can spill over into traditional markets during stress events.

Market analysts on X/Twitter describe this as a "controlled demolition" of over-leveraged positions. One quant trader noted, "Liquidity grab complete at $90k—now watching for FVG fill." Sentiment remains pessimistic, with most commentators expecting further downside to test the $85,000 volume node. The Extreme Fear reading suggests retail capitulation, often a contrarian indicator for institutional accumulation phases.

Bullish Case: If Bitcoin holds the $87,000 support and fills the FVG to $88,200, a relief rally to $92,000 is probable. This would require spot buying to absorb selling pressure and reduce funding rates from current elevated levels. Historical cycles suggest such liquidation events often mark short-term bottoms when combined with oversold RSI readings.

Bearish Case: Break below $86,500 invalidates bullish structure and targets the next high-volume node at $85,200. Continued deleveraging could push Bitcoin toward the 200-day moving average at $82,000. This scenario aligns with post-merge issuance dynamics where miner selling pressure increases during downtrends.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.