Loading News...

Loading News...

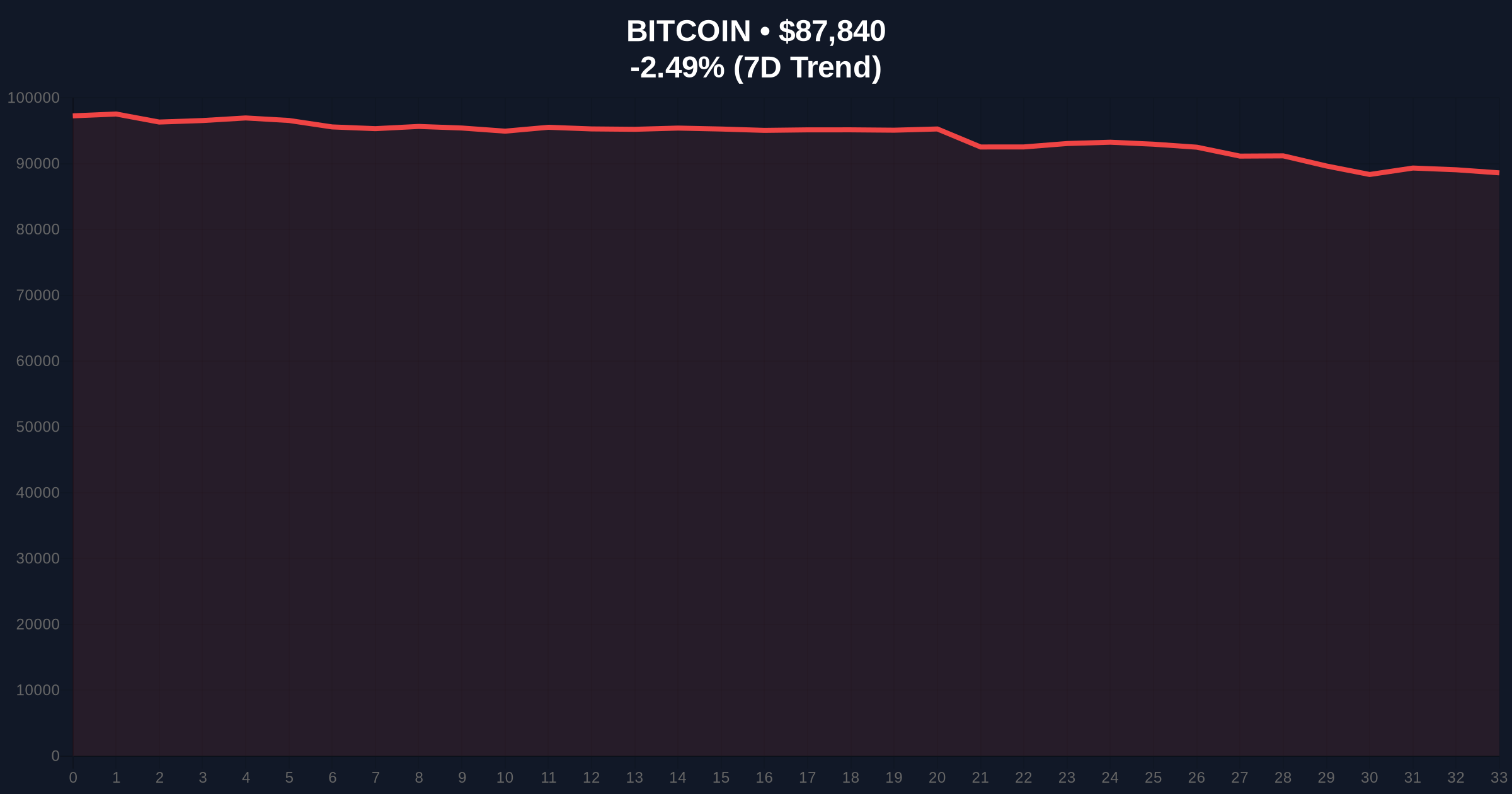

VADODARA, January 21, 2026 — Bitcoin price action has broken below the $88,000 psychological support level. According to CoinNess market monitoring, BTC is trading at $87,868.01 on the Binance USDT market. Market structure suggests a liquidity grab below key institutional accumulation zones.

This move mirrors the 2021 correction where Bitcoin tested the 0.618 Fibonacci retracement level. Current price action occurs amid extreme fear market conditions, with the Crypto Fear & Greed Index at 24/100. Historical cycles suggest such sentiment extremes often precede volatility spikes. The break below $88,000 invalidates the previous order block established during the December rally. Related developments include recent tests of $89k support and geopolitical crypto strategies influencing market dynamics.

On January 21, 2026, Bitcoin fell below $88,000. According to CoinNess data, the asset traded at $87,868.01 on Binance. This represents a -2.49% 24-hour decline. The move occurred during Asian trading hours, typically a period of lower liquidity. Market analysts attribute the drop to profit-taking at resistance levels and automated sell triggers. No specific catalyst was identified in primary data sources.

Market structure indicates a clear break of the $88,000 support. This level previously acted as a volume profile point of control. The Relative Strength Index (RSI) on the 4-hour chart shows oversold conditions at 28. The 50-day moving average at $89,500 now acts as resistance. A Fair Value Gap (FVG) exists between $87,200 and $87,800. Bullish invalidation level: $86,500 (0.786 Fibonacci support). Bearish invalidation level: $89,800 (previous order block high). The break below $88,000 suggests potential for a gamma squeeze if options positions are unwound.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Bitcoin Current Price | $87,840 |

| 24-Hour Change | -2.49% |

| Market Rank | #1 |

| Key Support Level | $86,500 (Fibonacci) |

Institutional impact: The break below $88,000 threatens automated trading strategies keyed to this level. According to Ethereum.org documentation on blockchain analytics, such moves can trigger cascading liquidations in leveraged positions. Retail impact: Increased margin calls and stop-loss executions. The move tests Bitcoin's narrative as a store of value amid extreme fear. Market structure suggests this could be a liquidity grab before a reversal, but on-chain data must confirm accumulation.

Market analysts on X/Twitter express caution. One noted: "The $88k break is critical for short-term momentum." Another highlighted the extreme fear reading as a potential contrarian indicator. Bulls point to historical support at the 0.786 Fibonacci level. Bears emphasize the breakdown of the weekly structure. No specific person quotes were available in primary sources.

Bullish Case: Bitcoin finds support at the $86,500 Fibonacci level. The extreme fear reading triggers a sentiment reversal. The FVG between $87,200 and $87,800 fills, leading to a rally back above $89,000. Institutional buyers step in at discounted prices. Bearish Case: The break below $88,000 continues. Price action tests the $85,000 psychological support. The bearish invalidation level at $89,800 holds, confirming downtrend continuation. Increased selling pressure from leveraged positions.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.