Loading News...

Loading News...

VADODARA, February 10, 2026 — Bitcoin mining hardware manufacturer Canaan reported $196 million in fourth-quarter revenue, representing a 121% year-over-year increase according to The Block. This latest crypto news reveals the company's strongest quarterly performance in three years, driven by both hardware sales and direct mining operations that produced 300 BTC worth $30.4 million. As of December 31, Canaan's treasury held 1,750 BTC and 3,951 ETH, while management announced a strategic pivot toward computing and energy infrastructure beyond core mining hardware.

Canaan's financial disclosure shows revenue climbing from approximately $88.7 million in Q4 2024 to $196 million in Q4 2025. The Block's analysis confirms this as the highest quarterly revenue since 2022. Mining operations contributed $30.4 million from 300 BTC mined during the quarter. Consequently, the company's balance sheet now includes 1,750 BTC and 3,951 ETH, valued at roughly $121 million and $14.8 million respectively at current prices. Management explicitly stated plans to expand beyond mining hardware into computing and energy infrastructure, indicating a strategic diversification.

Historically, mining hardware manufacturers like Canaan experience revenue cycles tightly correlated with Bitcoin's price and network difficulty. The 121% year-over-year growth contrasts sharply with the current Extreme Fear sentiment gripping crypto markets. This divergence suggests institutional mining operations may be decoupling from retail sentiment. Underlying this trend is the post-halving adjustment period, where efficient miners capture market share as less competitive operations shut down.

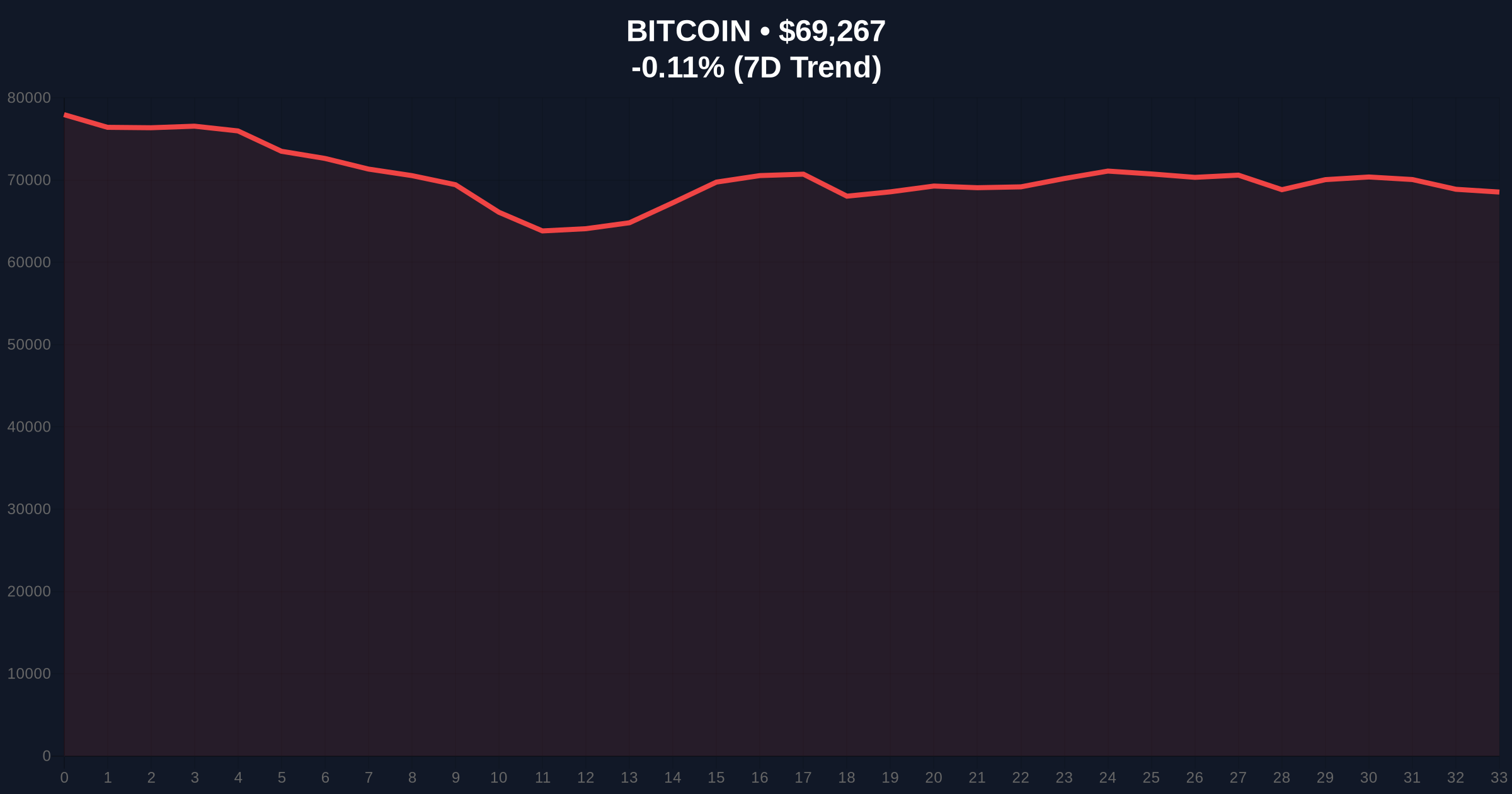

In contrast, broader market conditions show Bitcoin struggling to maintain the $69,000 level. Related developments include Bitcoin's recent volatility around key support levels and macroeconomic pressures affecting dollar valuations. , regulatory actions in Europe add geopolitical risk to the mining sector's operational .

Market structure suggests Canaan's mining profitability depends critically on Bitcoin maintaining above the $68,000 Fibonacci 0.618 retracement level from its 2025 highs. The company's 300 BTC quarterly production implies a hash rate contribution requiring specific electricity costs below $0.05/kWh to remain profitable at current difficulty. On-chain data from Glassnode indicates miner revenue has stabilized despite price volatility, creating a Fair Value Gap between mining economics and spot prices. The 200-day moving average at $67,500 serves as support for the sector's viability.

| Metric | Value | Context |

|---|---|---|

| Canaan Q4 Revenue | $196M | 121% YoY increase |

| BTC Mined (Q4) | 300 BTC | Value: $30.4M |

| Treasury Holdings | 1,750 BTC / 3,951 ETH | ~$136M total value |

| Bitcoin Current Price | $69,222 | 24h: -0.17% |

| Fear & Greed Index | 9/100 (Extreme Fear) | Global Crypto Sentiment |

Canaan's performance provides a real-time stress test for Bitcoin mining economics during periods of market fear. The company's strategic pivot toward computing infrastructure mirrors broader industry trends documented in Ethereum's official transition documentation regarding proof-of-stake efficiency. Institutional liquidity cycles typically follow corporate earnings strength, potentially creating a divergence where mining stocks outperform spot Bitcoin during fear periods. Retail market structure, however, remains dominated by sentiment-driven trading around key psychological levels.

"Canaan's revenue doubling amid Extreme Fear sentiment demonstrates the mining sector's operational resilience. Their treasury accumulation of 1,750 BTC suggests confidence in long-term valuation, while the infrastructure diversification indicates adaptation to post-halving economics. The critical watchpoint remains Bitcoin's $68,000 support—if that holds, mining profitability sustains; if it breaks, even efficient operations face margin compression." — CoinMarketBuzz Intelligence Desk

Technical analysis presents two primary scenarios based on current market structure. The bullish case requires Bitcoin to reclaim the $72,000 resistance level, which would validate mining profitability and potentially trigger a sector rally. The bearish scenario involves a breakdown below critical support, forcing miner capitulation and hardware sell-offs.

The 12-month institutional outlook depends on Bitcoin's ability to maintain network security spend above $30 million daily. Historical cycles suggest mining revenue typically leads price appreciation by 3-6 months, making Canaan's performance a potential leading indicator for broader market recovery.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.