Loading News...

Loading News...

VADODARA, February 10, 2026 — S&P Global Ratings assigned a preliminary BBB- rating to Ledn's Issuer Trust 2026-1 product. This represents the highest credit rating ever given to a cryptocurrency company. Market structure suggests this event attempts to inject confidence during a period of extreme fear. The latest crypto news highlights a critical juncture for institutional adoption.

S&P Global's rating places Ledn's product one notch above junk bond status. According to the official S&P Global report, a BBB- rating indicates adequate capacity to meet financial commitments. However, adverse economic conditions could weaken this capacity. The rating aligns with sovereign debt from Kazakhstan, Hungary, and Morocco.

In contrast, DeFi lending firm Sky and MicroStrategy received B- ratings last year. That is five notches lower. This disparity raises immediate questions about S&P's methodology for crypto-native versus traditional firms. The rating specifically applies to Ledn's Issuer Trust 2026-1, a structured Bitcoin lending product.

Historically, credit ratings for crypto firms have been scarce and low-grade. The 2021-2022 lending crisis saw multiple platforms collapse with zero formal ratings. Consequently, this BBB- rating appears as a potential normalization signal. Underlying this trend is a push for regulatory clarity, as seen in recent U.S. legislative developments.

Market analysts note the timing coincides with a global Extreme Fear sentiment. The Crypto Fear & Greed Index sits at 9 out of 100. This creates a contradictory backdrop: a positive institutional development amid pervasive retail panic. , the expansion of traditional finance into crypto, like Interactive Brokers' crypto futures, parallels this rating event.

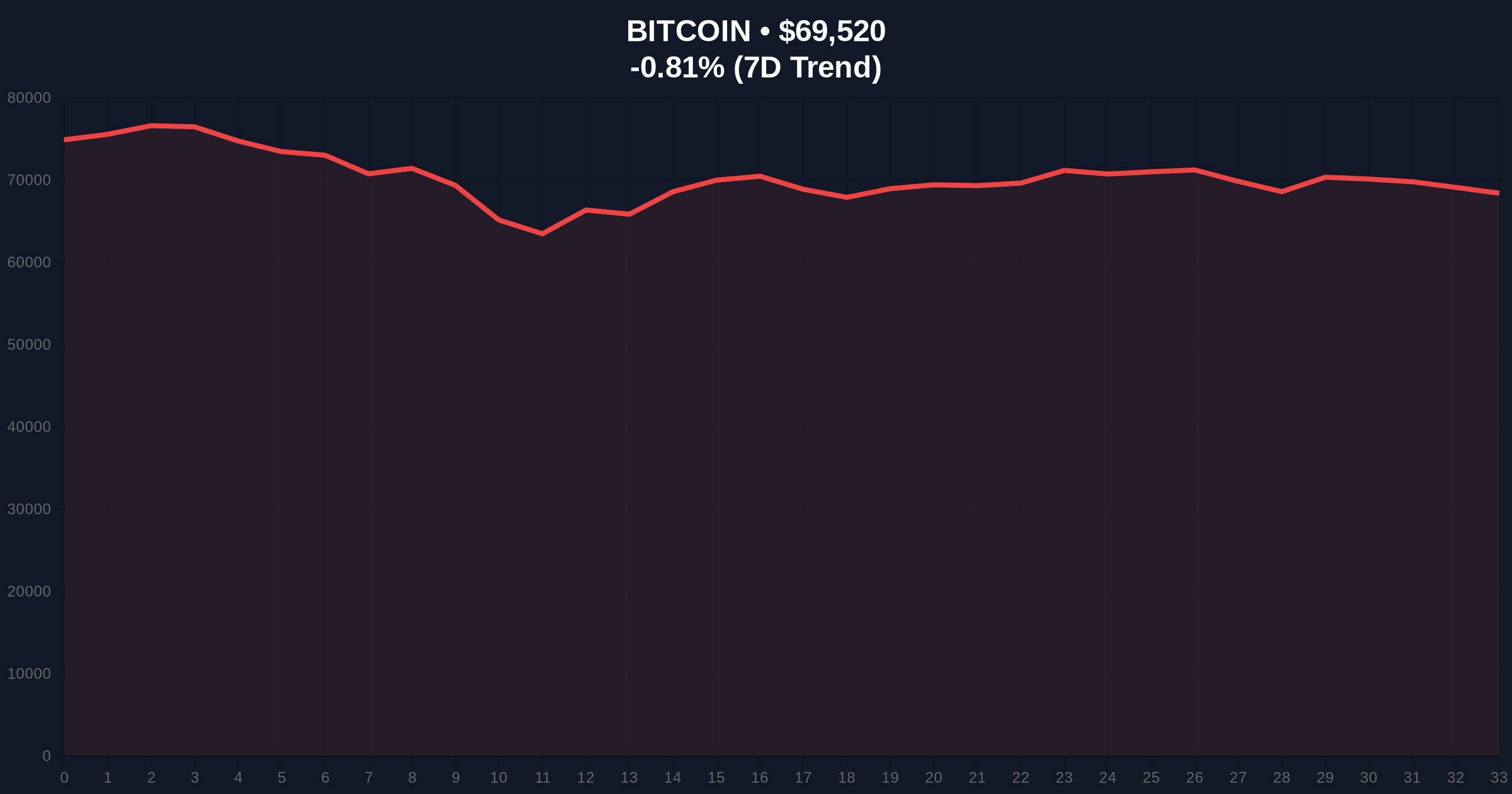

Bitcoin currently trades at $69,393, down 0.99% in 24 hours. On-chain data indicates weak accumulation near this level. The Volume Profile shows a significant Fair Value Gap (FVG) between $71,200 and $72,800. This gap represents a liquidity void that price may need to fill.

Critical support resides at the Fibonacci 0.618 retracement level of $68,500 from the 2025 all-time high. A break below this invalidates the current bullish market structure. Resistance clusters at the 50-day moving average near $71,500. The RSI sits at 42, indicating neutral momentum with a bearish bias.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Indicates peak negative sentiment |

| Bitcoin Current Price | $69,393 | Down 0.99% in 24h |

| S&P Rating for Ledn | BBB- (Preliminary) | Highest ever for a crypto firm |

| Comparative Sovereign Rating | Kazakhstan, Hungary, Morocco | BBB- equivalent |

| Previous Crypto Ratings (2025) | Sky & MicroStrategy: B- | Five notches lower than BBB- |

This rating matters for institutional liquidity cycles. A BBB- rating could allow pension funds and insurers to allocate capital to Ledn's product. Their mandates often prohibit investments below investment-grade. However, the preliminary nature and specific trust structure limit broad applicability.

Real-world evidence suggests caution. The rating does not assess Bitcoin's volatility or Ledn's operational risks holistically. It evaluates a specific, collateralized debt obligation. Market structure reveals this as a potential liquidity grab to stabilize sentiment during extreme fear. The parallel with rising security threats in crypto persistent ecosystem risks.

"The BBB- rating is a technical milestone for crypto credit markets. However, it remains a preliminary assessment of a single product. It does not constitute a blanket endorsement of Bitcoin lending or Ledn's overall creditworthiness. Investors must scrutinize the underlying collateral composition and loan-to-value ratios, which are not fully disclosed in the public summary." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on whether this rating catalyzes similar actions for other firms. If it does, crypto debt markets could see increased capital inflow. Over a 5-year horizon, this could normalize crypto within traditional finance portfolios. However, failure to hold support would signal that credit ratings alone cannot override macro fear and Bitcoin's inherent volatility.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.