Loading News...

Loading News...

VADODARA, February 10, 2026 — Nobel Prize-winning economist Paul Krugman declared Bitcoin a systemic failure and predicted the cryptocurrency industry's impending "Fimbulwinter." This latest crypto news arrives as real-time market data from the Crypto Fear & Greed Index registers Extreme Fear at a score of 9/100. According to Wu Blockchain, Krugman's interview with Bloomberg dismissed Bitcoin's fundamentals, framing its 17-year existence as a proof of concept for illicit finance rather than legitimate payment technology. Market structure suggests such high-profile bearish narratives often coincide with local sentiment bottoms.

Paul Krugman, a professor at the City University of New York, delivered his critique in a Bloomberg interview. He invoked "Fimbulwinter," a Norse mythological term for the harsh winter preceding the world's end. Krugman asserted Bitcoin lacks fundamental value. He claimed its primary use cases involve sanctions evasion and illicit activities. The economist highlighted Bitcoin's age, noting it is only slightly younger than the first iPhone. He concluded it failed to establish itself as a legitimate payment method after 17 years. This narrative directly challenges the institutional adoption thesis driving recent capital inflows.

Historically, extreme bearish pronouncements from traditional finance figures often mark contrarian inflection points. The 2018 "Bitcoin is dead" cycle preceded a 300% rally. In contrast, the 2022 post-FTX collapse saw similar rhetoric before the 2023 recovery. Underlying this trend is a persistent disconnect between macroeconomic criticism and on-chain network resilience. Krugman's focus on payment utility ignores Bitcoin's evolution into a collateral and settlement layer. This mirrors past cycles where critics targeted outdated use cases while the asset's monetary properties strengthened.

Related developments in regulatory and market structure provide context. The recent dismantling of the CFTC's Chicago office signals shifting enforcement priorities. Simultaneously, entities like MoonPay and Deel are testing new stablecoin payroll systems, as covered in our analysis of the MoonPay-Deel stablecoin payroll launch. These structural developments contradict Krugman's "end of the industry" thesis.

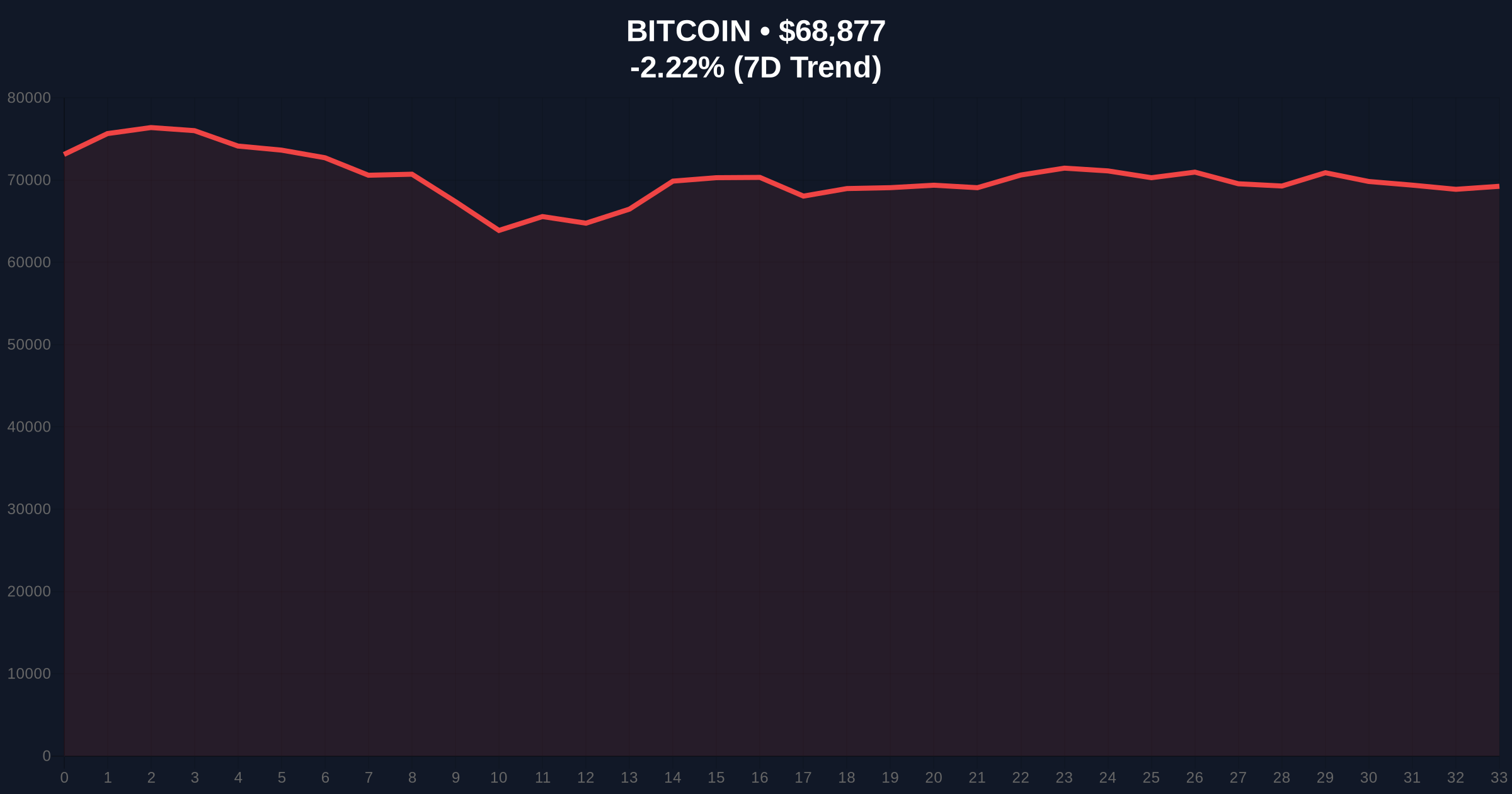

Bitcoin currently trades at $68,873, down 2.23% in 24 hours. The price action reveals a critical Fair Value Gap (FVG) between $70,200 and $71,500. This FVG acts as immediate resistance. On-chain data from Glassnode indicates whale accumulation near the $67,000 support level. The 200-day moving average provides dynamic support at $66,500. A break below this triggers a test of the Fibonacci 0.618 retracement level at $65,200. This level represents the final major Order Block before a potential structural breakdown. The RSI sits at 38, indicating oversold conditions but not extreme capitulation.

| Metric | Value | Interpretation |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Maximum retail capitulation signal |

| Bitcoin Current Price | $68,873 | -2.23% 24h change |

| 200-Day Moving Average | $66,500 | Critical dynamic support |

| Fibonacci 0.618 Support | $65,200 | Major bearish invalidation level |

| Fair Value Gap Resistance | $70,200 - $71,500 | Immediate liquidity zone |

Krugman's comments matter because they amplify existing market fear. This creates a potential Liquidity Grab opportunity for institutional players. Extreme Fear readings historically precede sharp reversals when combined with strong technical support. The narrative that Bitcoin lacks fundamentals contradicts measurable on-chain metrics. According to Ethereum.org's documentation on blockchain economics, network security and decentralization provide inherent value that traditional finance models often miss. Krugman's payment-focused critique ignores Bitcoin's role as digital gold and institutional balance sheet asset. Market structure suggests sentiment extremes often misprice underlying network strength.

"High-profile bearish narratives during Extreme Fear periods typically signal maximum pain capitulation. The data shows whale accumulation increasing at these levels, contradicting the 'end of industry' thesis. We monitor the $65,200 Fibonacci level as the line in the sand for medium-term structure." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains bifurcated. If Bitcoin holds the $65,200 support, institutional accumulation likely accelerates, targeting new all-time highs in late 2026. A break below triggers a prolonged consolidation phase. The 5-year horizon depends on Bitcoin's ability to maintain its security budget post-halving, a technical detail Krugman's analysis completely overlooks.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.