Loading News...

Loading News...

VADODARA, February 10, 2026 — Michael Saylor, founder of MicroStrategy (MSTR), projects Bitcoin will outperform the S&P 500 by two to three times over the next four to eight years. This latest crypto news emerges as the Crypto Fear & Greed Index hits 9/100, signaling extreme market pessimism. According to his CNBC Squawk Box interview, Saylor reaffirmed MicroStrategy's no-sell policy. The company will continue quarterly Bitcoin purchases despite recent volatility.

Market structure suggests a deliberate accumulation phase. MicroStrategy recently purchased an additional 1,142 BTC for $90 million. The average price was $78,815. Saylor explicitly stated the company will not sell holdings during the recent downturn. He emphasized Bitcoin's volatility as part of its long-term appeal. Investors with a multi-year horizon should focus on performance, not short-term fluctuations. This strategy mirrors institutional dollar-cost averaging. However, on-chain data indicates retail selling pressure contradicts this bullish accumulation.

Historically, extreme fear sentiment often precedes major liquidity grabs. The current 9/100 Fear & Greed score mirrors December 2022 levels. Bitcoin subsequently rallied over 300% in the following 15 months. In contrast, Saylor's 2-3x outperformance projection requires Bitcoin to significantly outpace traditional equity indices. The S&P 500 has delivered approximately 10% annualized returns over the past decade. Bitcoin would need to sustain 20-30% annual gains to meet Saylor's target. Market analysts question whether post-halving cycles can maintain this momentum. Related developments include a dormant Bitcoin whale moving 2,043 BTC after seven years, adding to current volatility.

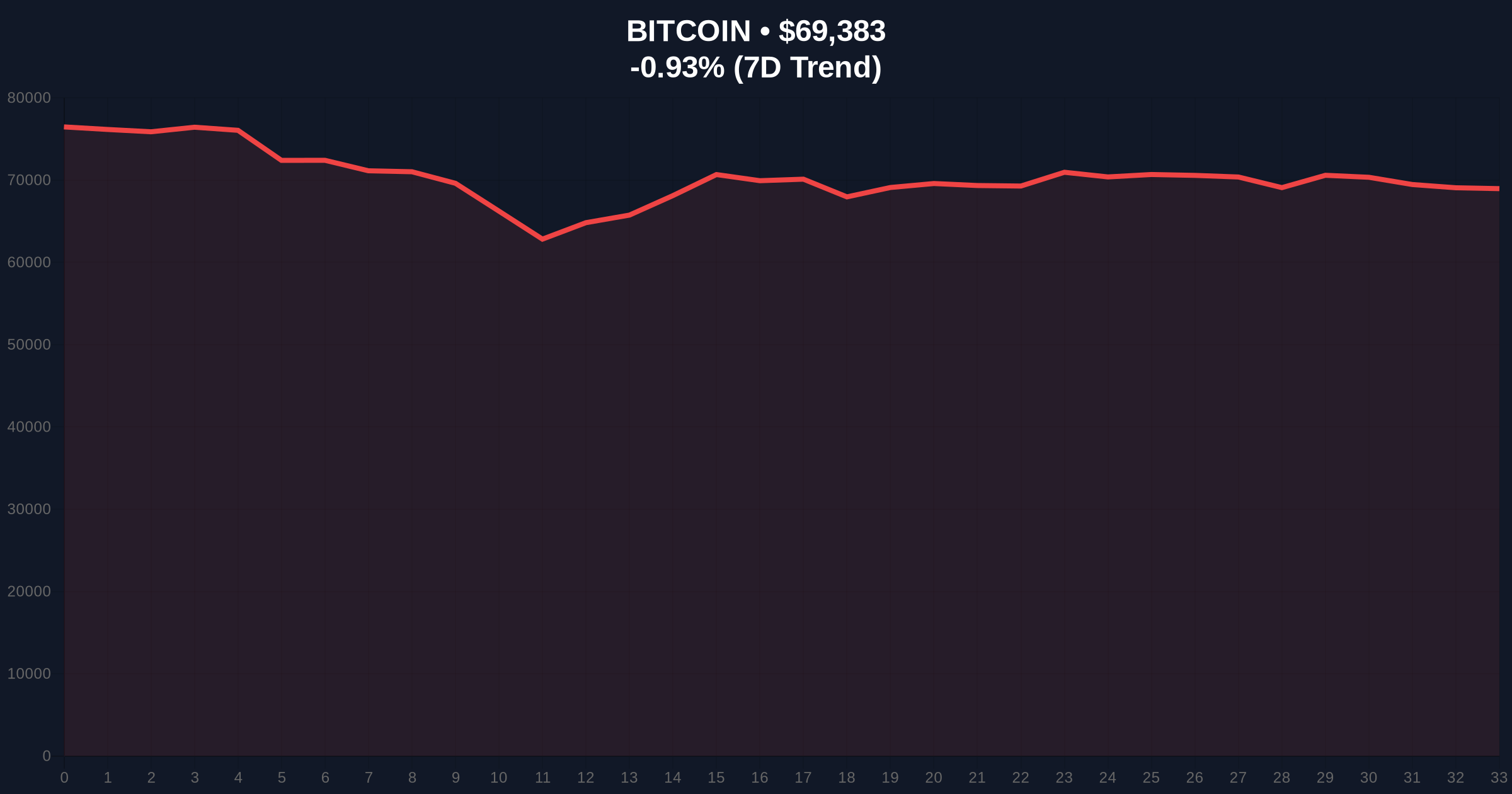

Bitcoin currently trades at $69,368, down 0.95% in 24 hours. The price sits below MicroStrategy's latest average purchase price of $78,815. This creates an immediate unrealized loss on their recent acquisition. Critical support resides at the $67,200 Fibonacci 0.618 retracement level from the 2024-2025 rally. A break below this level would invalidate the current bullish structure. Resistance clusters around the $72,500 volume profile point of control. The 200-day moving average at $65,100 provides secondary support. Order block analysis shows significant liquidity pools between $66,000 and $68,000. These levels must hold to prevent a cascade toward $62,000.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | Contrarian buy signal historically |

| Bitcoin Current Price | $69,368 | Below MSTR purchase avg. of $78,815 |

| 24-Hour Trend | -0.95% | Minor correction within range |

| MicroStrategy Recent Purchase | 1,142 BTC for $90M | Institutional accumulation continues |

| S&P 500 10-Year Annualized Return | ~10% | Bitcoin needs 20-30% for 2-3x outperformance |

MicroStrategy's strategy represents a public beta test for Bitcoin as a corporate treasury asset. The company now holds over 1% of Bitcoin's total circulating supply. This concentration creates systemic risk if forced liquidations occur. However, their quarterly buying program provides consistent institutional demand. This demand potentially offsets retail outflows during fear periods. The divergence between extreme fear sentiment and institutional accumulation suggests a market structure shift. Retail capitulation often fuels institutional accumulation at discounted prices. This dynamic mirrors 2018-2019 accumulation patterns before the 2020-2021 bull market.

"Saylor's projection hinges on Bitcoin maintaining its scarcity premium against traditional inflation hedges. The Federal Reserve's monetary policy, detailed on FederalReserve.gov, will directly impact this calculus. If real yields remain elevated, capital may rotate from crypto back to treasuries, challenging the outperformance narrative." — CoinMarketBuzz Intelligence Desk

Two primary technical scenarios emerge from current market structure. The bullish scenario requires holding the $67,200 Fibonacci support. A rebound toward $75,000 would then target the yearly volume-weighted average price. The bearish scenario involves a breakdown below $67,200. This would likely trigger a liquidation cascade toward the $62,000 fair value gap. Institutional outlook over the next 12 months remains cautiously optimistic. However, macroeconomic headwinds could delay Saylor's 4-8 year outperformance timeline.

The 12-month institutional outlook depends on Bitcoin's network fundamentals. Hash rate stability and adoption metrics must improve to justify outperformance. Historical cycles suggest extreme fear periods typically resolve within 3-6 months. This aligns with potential Q2 2026 momentum shift if macroeconomic conditions stabilize.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.