Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 30, 2026 — Bitcoin's market capitalization has collapsed three positions to 12th in global asset rankings. According to data from 8marketcap, the valuation now stands at $1.64 trillion. This latest crypto news highlights a severe liquidity drain. Cointelegraph reports the cryptocurrency exited the top 10 amid a large-scale sell-off. Market structure suggests institutional capitulation is accelerating.

8marketcap data confirms Bitcoin's market cap fell to 12th place globally. The asset now trails traditional giants like Apple and Saudi Aramco. Cointelegraph attributes the drop to a "large-scale sell-off." On-chain data indicates significant exchange inflows over the past week. This signals profit-taking by long-term holders. The sell-off illustrates Bitcoin's inherent price volatility. Market analysts note the decline mirrors past capitulation events.

Historically, Bitcoin has weathered similar ranking drops. In 2022, it briefly fell outside the top 15 assets. The current exit from the top 10 marks a critical psychological threshold. Underlying this trend is a shift in institutional liquidity cycles. Large-scale sell-offs often precede consolidation phases. In contrast, retail sentiment remains heavily skewed toward fear. Related developments include recent futures liquidations exceeding $200 million in single hours, as detailed in our analysis of massive liquidation events. , Bitcoin's price has shown resilience, holding above key levels despite extreme fear.

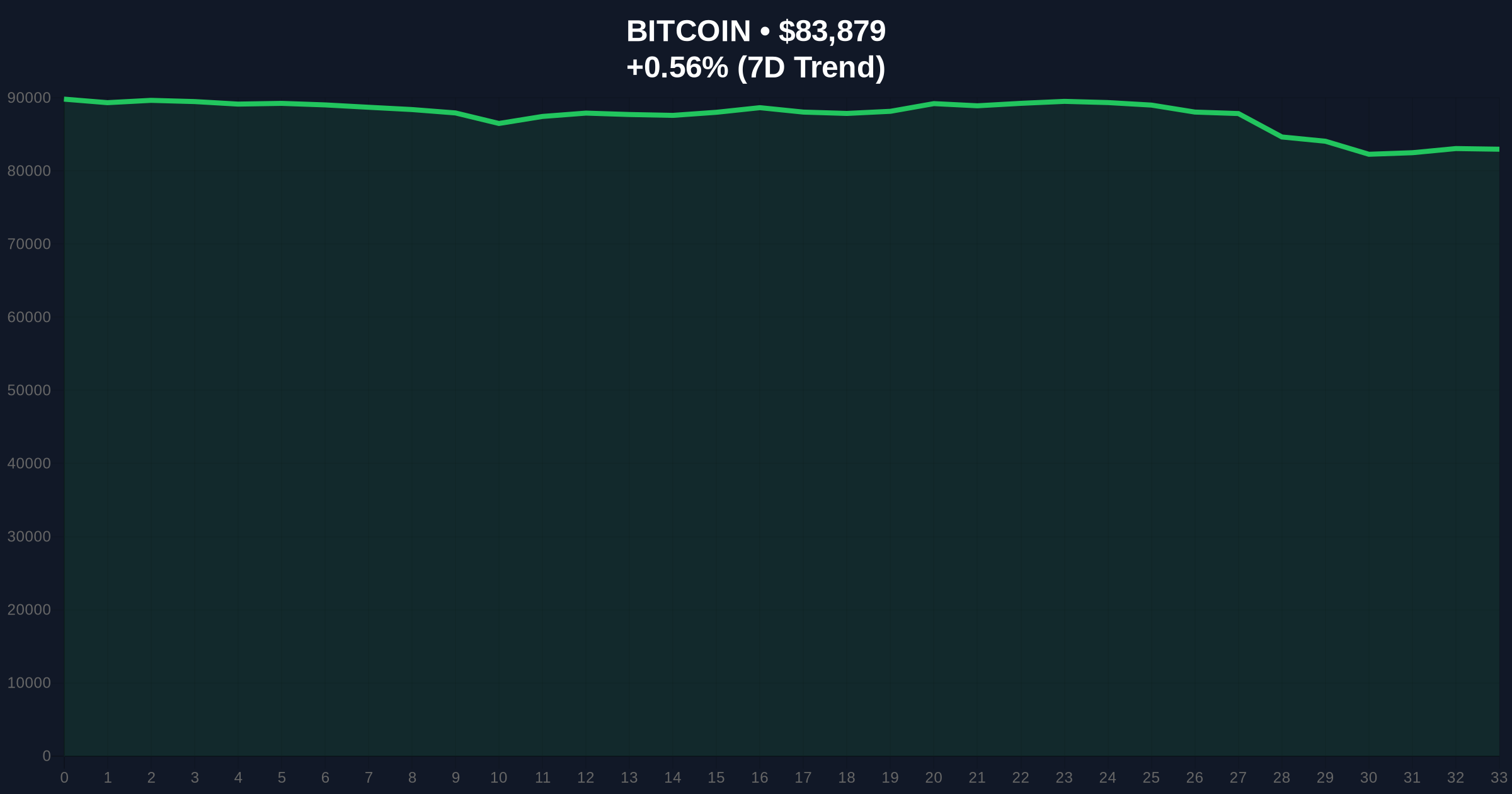

Bitcoin currently trades at $83,840. The 24-hour trend shows a minor gain of 0.51%. Technical analysis reveals a critical Fair Value Gap (FVG) between $85,000 and $88,000. This zone acts as a resistance Order Block. Market structure suggests a retest of the Fibonacci 0.618 support at $82,000 is imminent. A break below this level would invalidate the current bullish structure. The Relative Strength Index (RSI) hovers near oversold territory at 32. This indicates potential for a short-term bounce. Volume Profile analysis shows declining activity on rallies. Consequently, the path of least resistance remains downward.

| Metric | Value |

|---|---|

| Bitcoin Market Cap | $1.64 trillion |

| Global Asset Ranking | 12th |

| Current Price | $83,840 |

| 24-Hour Change | +0.51% |

| Crypto Fear & Greed Index | Extreme Fear (16/100) |

This ranking drop matters for institutional allocation models. A fall outside the top 10 reduces Bitcoin's visibility in global portfolios. Real-world evidence shows pension funds and ETFs monitor these rankings closely. The sell-off reflects a liquidity grab by sophisticated players. Retail market structure is now vulnerable to further downside. Historical cycles suggest such events often mark local bottoms. However, sustained pressure could trigger a deeper correction. The Federal Reserve's monetary policy, as outlined on FederalReserve.gov, continues to influence macro liquidity, exacerbating crypto volatility.

Market structure indicates a classic liquidity squeeze. The exit from the top 10 global assets is a psychological blow, but technical support at $82k remains . On-chain metrics show long-term holders are distributing, not capitulating en masse. This suggests a controlled unwind rather than a panic.

CoinMarketBuzz Intelligence Desk synthesized this institutional sentiment.

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on Bitcoin's ability to reclaim a top-10 ranking. Market analysts project a consolidation phase through Q2 2026. Long-term, adoption of scaling solutions like EIP-4844 could bolster network utility. This event Bitcoin's volatility in the 5-year horizon. Portfolio managers must adjust risk parameters accordingly.